Blog /

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Stephen Tapp, our Chief Economist, looks at Canada’s headline inflation for August, which fell for the second straight month. Core inflation and services measures have also finally started to slow.

Amy Orfanakos

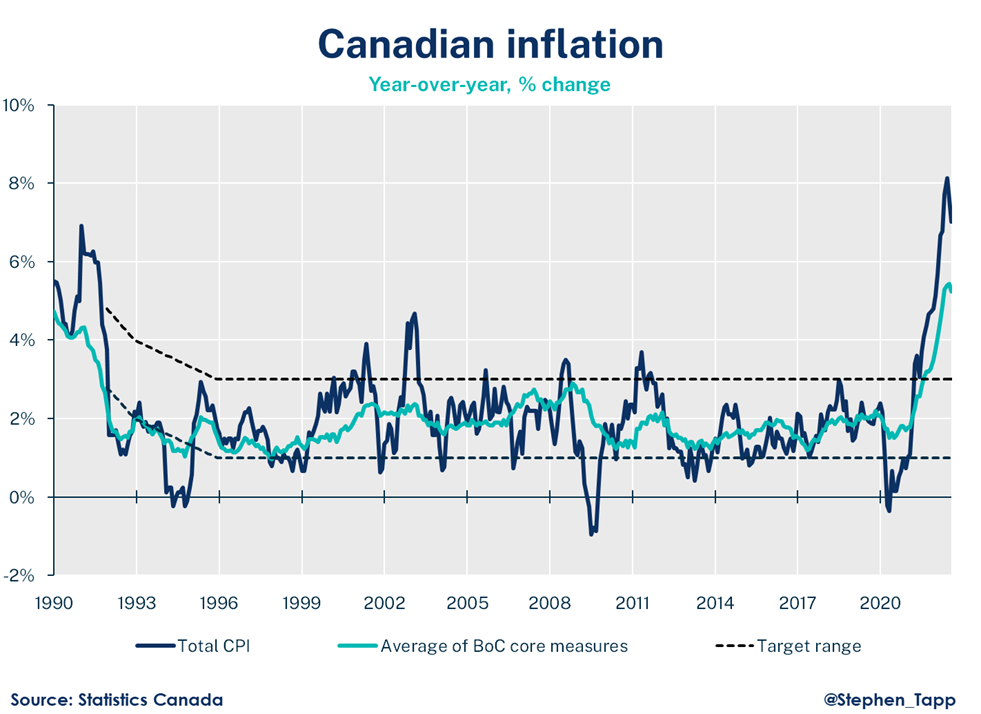

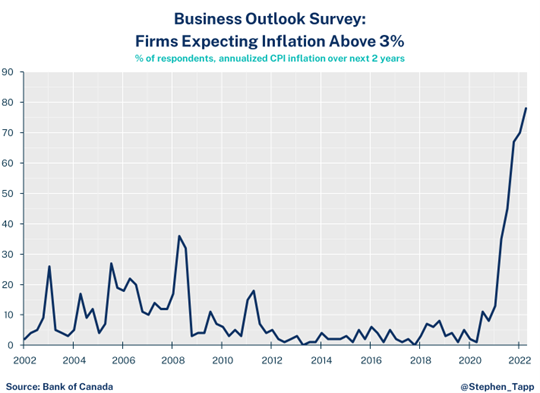

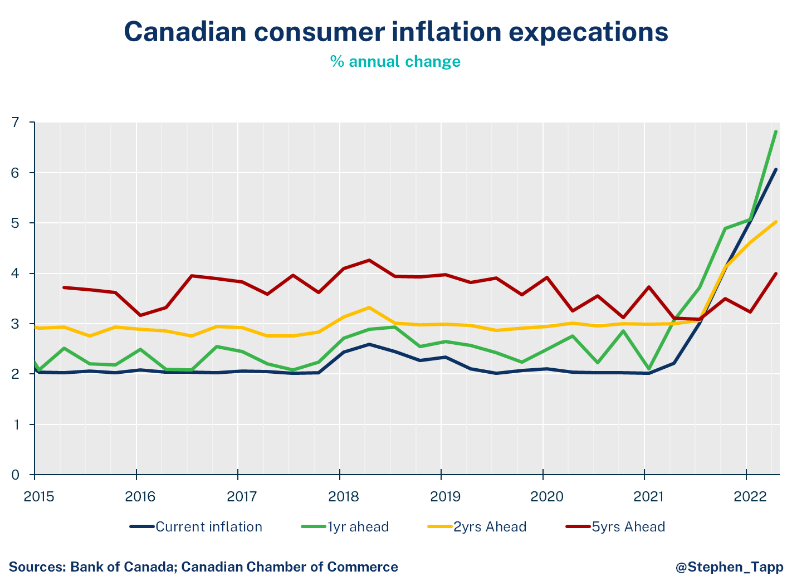

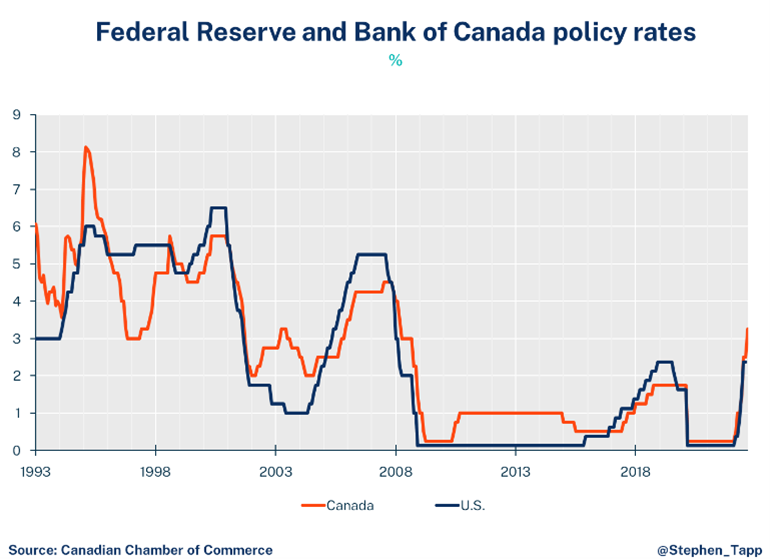

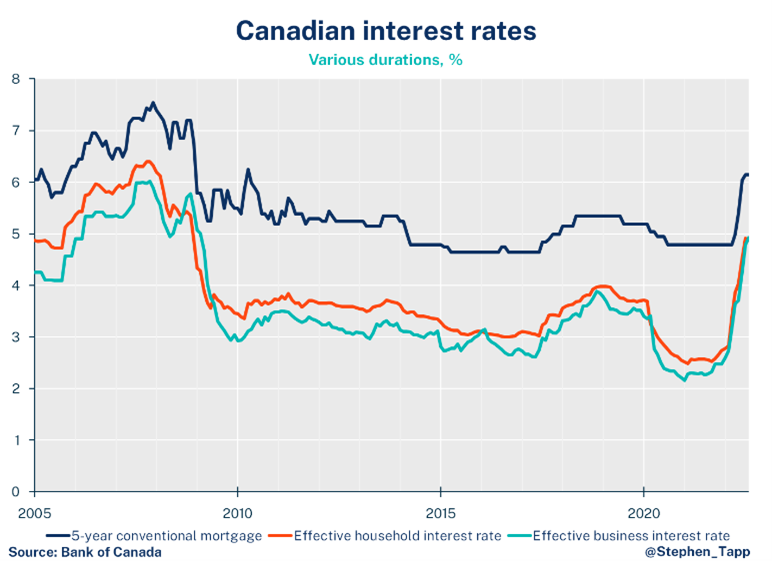

Canada’s headline inflation fell for the second straight month — this time by more than markets expected — but more importantly, core inflation and services measures finally started to slow. Today’s positive inflation developments, alongside slowing growth, weakening labour market data over the past three months, and rapidly tightening financial conditions, could tip the scale for the Bank of Canada to deliver a more restrained 25-basis point rate hike in October, which would still move their policy rate up to 3.50%.

Stephen Tapp, Chief Economist, Canadian Chamber of Commerce

Key Takeaways

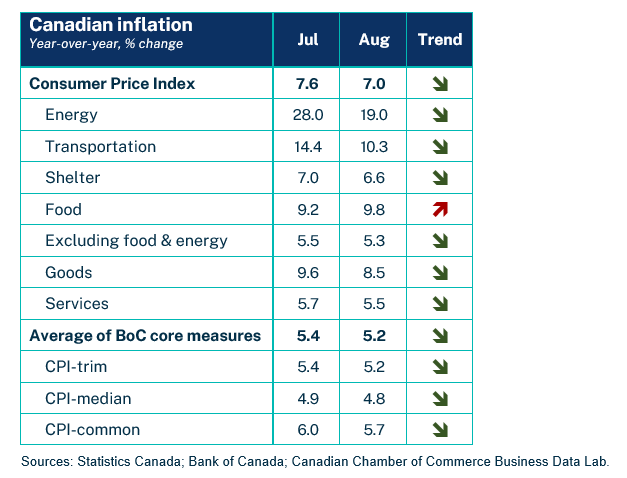

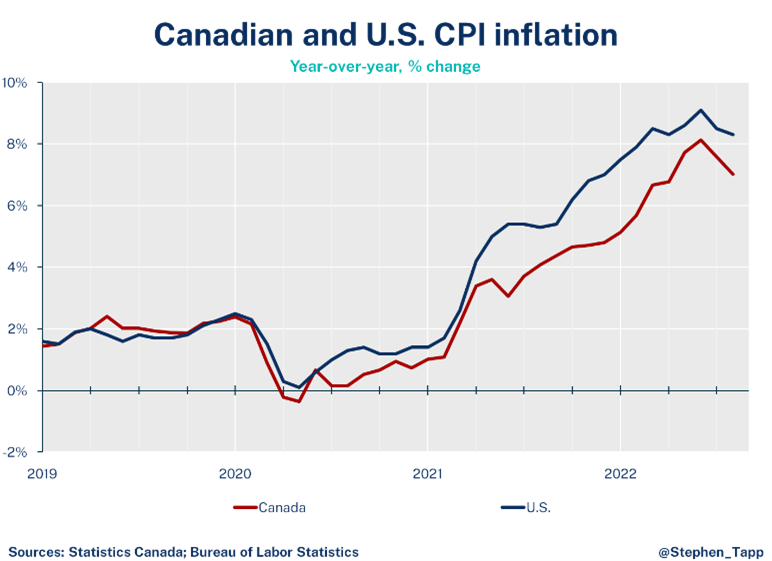

- Canada’s headline Consumer Price Index (CPI) inflation slowed for the second straight month — to 7.0% year-over-year, down from its peak of over 8% in July. The slowdown in headline inflation exceeded market expectations (7.3%).

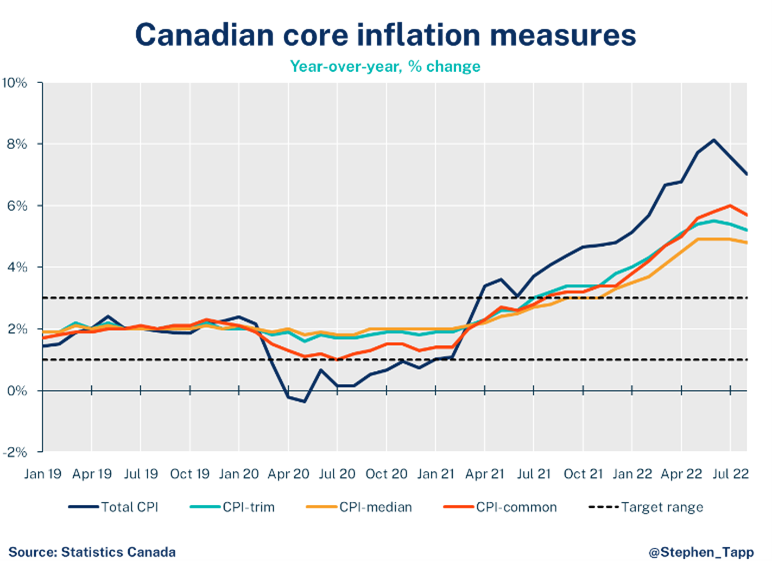

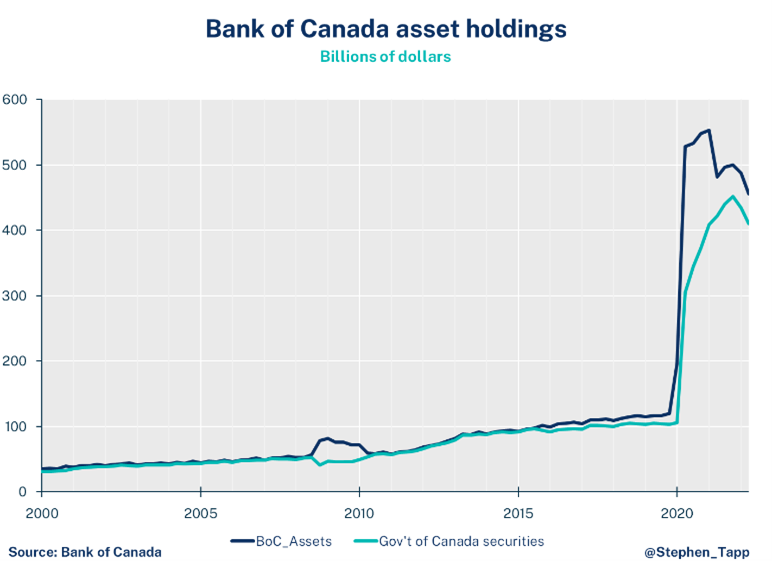

- The Bank of Canada’s “core inflation” measures declined by an average of 0.2 percentage points to 5.2%, as all three measures improved. This is great news for the central bank, providing the first tangible sign that underlying price pressures may have finally turned the corner, after six months of aggressively tightening interest rates.

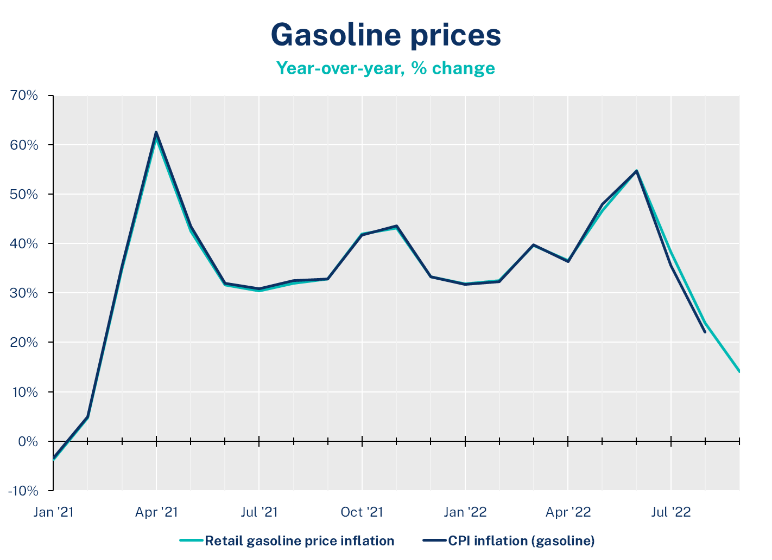

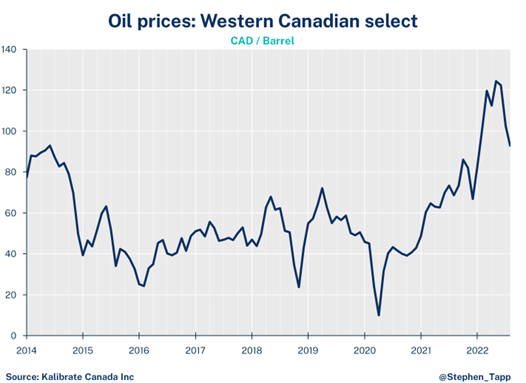

- In August, energy price growth slowed (to 19% from 28%). Gasoline prices have been a key driver of headline inflation and a major issue for consumers. They peaked in mid-June at $2.14 per litre, and have since dropped back to $1.57, as global oil production has increased, and domestic refiners’ margins have fallen from elevated levels. Consumers will notice such an improvement (from 55% year-over-year price gains in June, down to 14% thus far in September), could push down the headline inflation figure again next month.

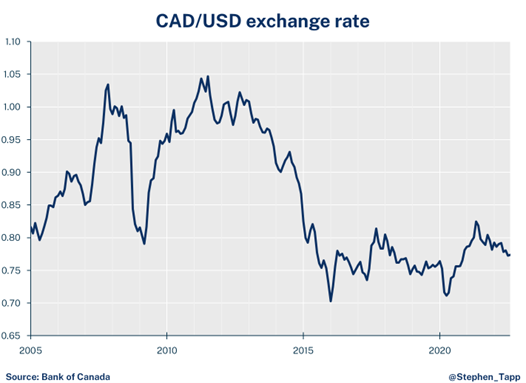

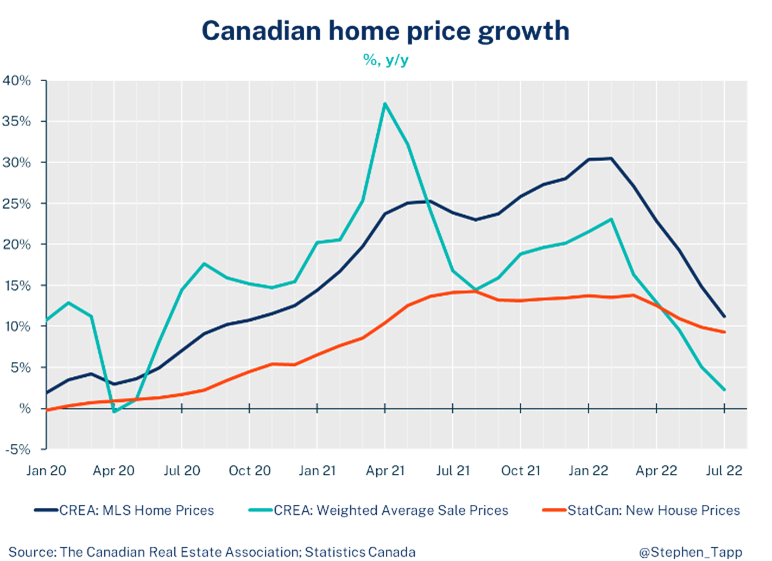

- Prices gains are also starting to slow for transportation (+10%, with car prices up 7%) and shelter costs (6.6%, reflecting the cooling of Canada’s over-heated housing markets, as interest rates rise to rein in inflation).

- Food prices are the only major category that kept rising (up 10%). As grocery shoppers can attest, prices are up painfully across the board — 11% year-over-year, the fastest pace since 1981!

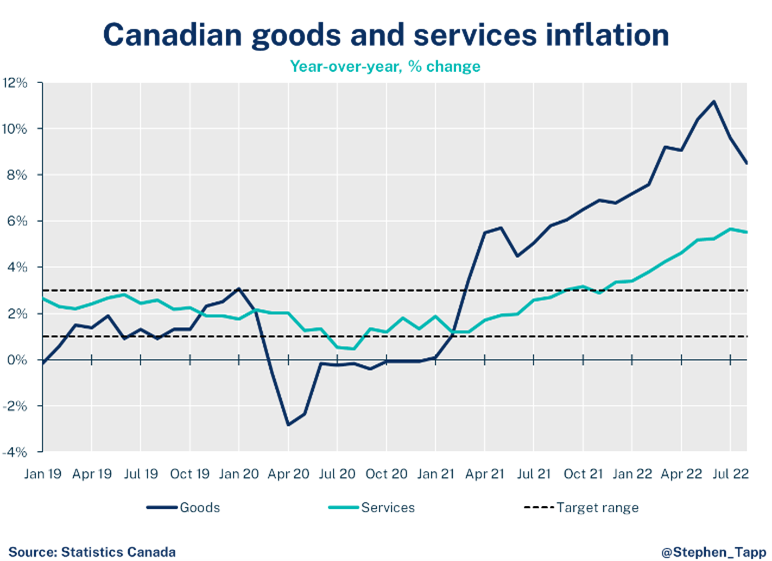

- Price increases for goods continue to slow (to 8.5% from 9.6%), which is expected, but the more significant move is the slowdown in services inflation (to 5.5%, from 5.7%).

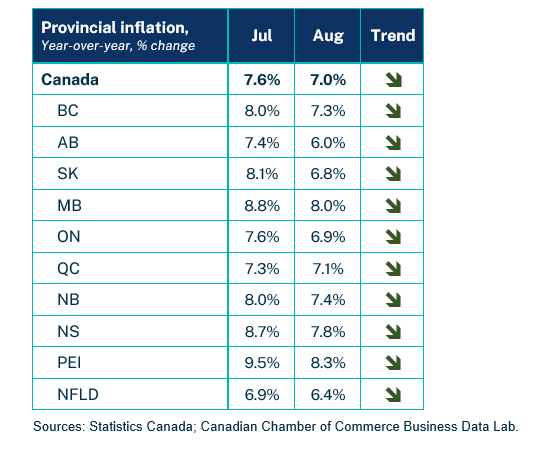

- The inflation rate fell in all 10 provinces. It is highest in Prince Edward Island (8.3%) and lowest in Alberta (6.0%).

- In the months ahead, momentum in inflation should decelerate further due to slower global growth, a deflating domestic housing market, and positive “base effects” (i.e., comparing 2022 inflation readings with price levels that had rebounded in Spring 2021.)

- That said, there’s still a long way to go before inflation returns to pre-pandemic levels of 2%. The Bank of Canada’s July Monetary Policy Report forecast CPI inflation of 7.2% in 2022, 4.6% in 2023, and 2.3% in 2024.

- With this positive development for inflation, alongside weakening labour market data over the past three months, slowing growth, and rapidly tightening financial conditions, today’s data could tip the scale for the Bank of Canada to deliver a more restrained 25-basis point rate hike in October, which would take their policy rate up to 3.50%.

Summary Tables

Inflation Charts

For more economic analysis and insights, visit our Business Data Lab.

Other Blogs

Jun 27, 2025

April 2025 GDP: The shoe drops as the economy shows trade impacts.

Jun 24, 2025

May 2025 CPI: Inflation holds steady, giving the Bank of Canada some space to breathe.

Jun 19, 2025