Blog /

The Bank of Canada shifts from “whether to hike” to “how long to hold”.

Today the Bank of Canada maintained its policy rate at 5% for the fourth straight decision. This move was unanimously expected by economists and markets, however, we did learn something today — the Bank dropped its hiking bias and shifted to neutral holding pattern for now.

Amy Orfanakos

KEY TAKEAWAYS

- Today the Bank of Canada maintained its policy rate at 5% for the fourth straight decision. This move was unanimously expected by economists and markets, however, we did learn something today — the Bank dropped its hiking bias and shifted to neutral holding pattern for now. This is a first sign that we’re now walking slowly down a new path towards eventual interest rate cuts, rather than more hikes.

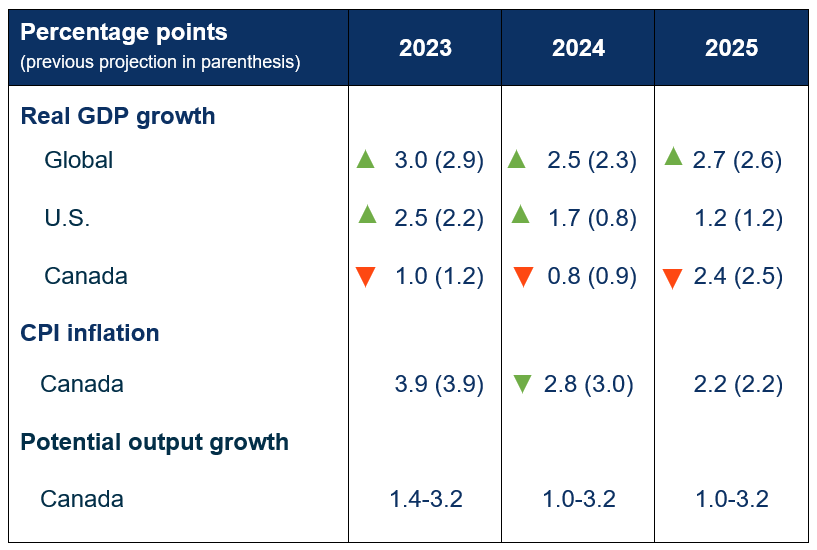

- Global growth: The Bank’s outlook for the global economy is slightly better than in October. This is primarily due to the U.S. economy out-performing expectation. Here, the Bank significantly revised up its forecast U.S. real GDP growth in 2024 to 1.7% from 0.8%.

- Canada’s economy: The Bank’s forecast for Canadian real GDP was largely unchanged, but the Bank now views the economy as operating slightly below its potential (i.e., in “modest excess supply”). Near-term growth is expected to remain essentially flat, with a pickup in the second half of 2024. Once again, the Bank does not expect negative GDP growth, but make no mistake, Canada’s economy is weak, especially when viewed in per capita terms, given that output and employment aren’t keeping pace with strong population growth.

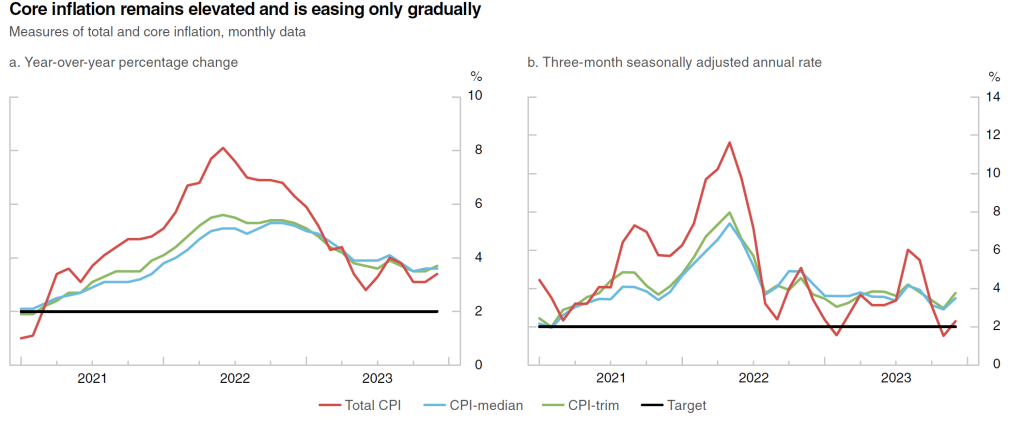

- Inflation: The Bank expects Canada’s headline inflation remaining around 3% for the first half of this year, and easing to around 2.5% in the second half, before returning to the 2% target in 2025. For the annual inflation forecast the picture is slightly improved and revised down by 0.2 percentage points this year, owing to lower oil and gasoline prices.

- When will interest rates come down? The core problem: “Governing Council wants to see further and sustained easing in core inflation”, which is still running around 3.5%. The other problematic parts of the inflation picture include shorter-run inflation expectations, still elevated wage growth, as well as the risk that future rate cuts could re-inflate Canada’s already-unaffordable housing market. Financial markets are currently factoring in a better-than-even chance (60%) that the Bank of Canada will cut its policy rate by 0.25% in April. I think this could prove too optimistic, and am leaning towards rate cuts beginning in the summer — unless short-run core inflation quickly and durably falls back into target range (i.e., is under 3% for three consecutive months).

Bank of Canada projections

Other Blogs

Economic Commentary

Jun 27, 2025

April 2025 GDP: The shoe drops as the economy shows trade impacts.

Economic Commentary

Jun 24, 2025

May 2025 CPI: Inflation holds steady, giving the Bank of Canada some space to breathe.

Report

Jun 19, 2025