Blog /

September 2022 Labour Force Survey: The “cooling-off period” continues

Our Chief Economist, Stephen Tapp, digs into the September 2022 Labour Force Survey results and looks beneath the headlines, which shows emerging signs of an underlying “cooling-off” period.

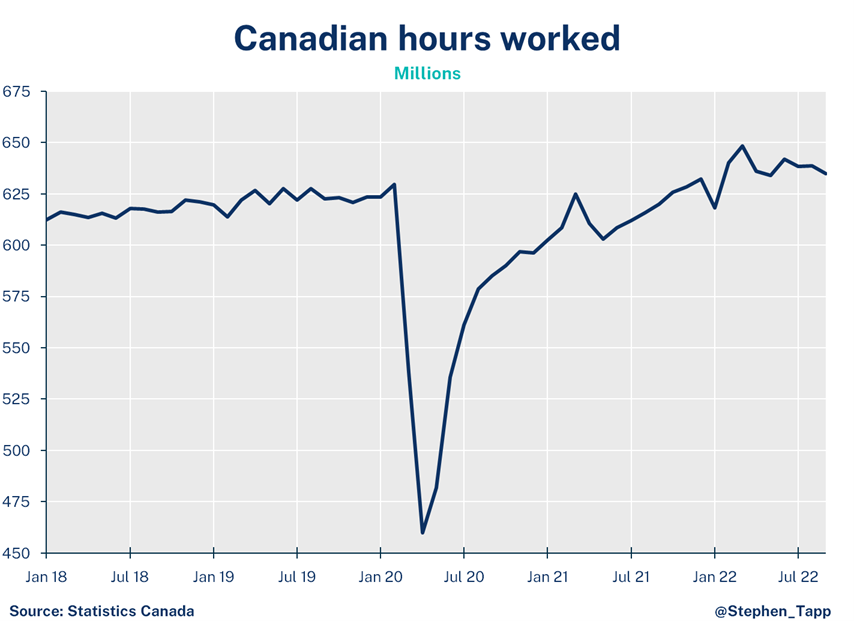

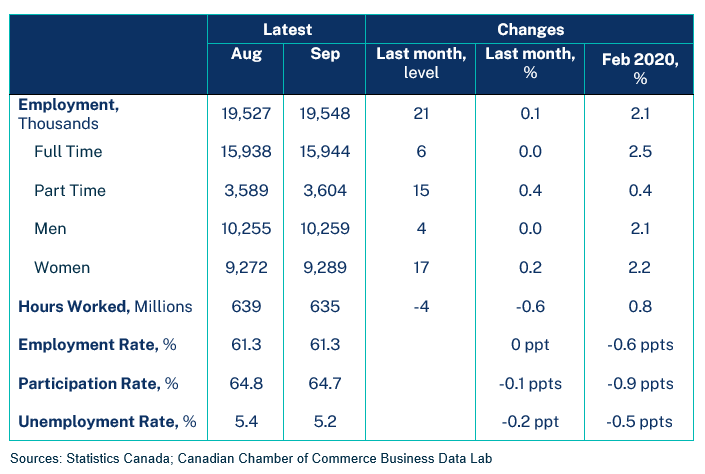

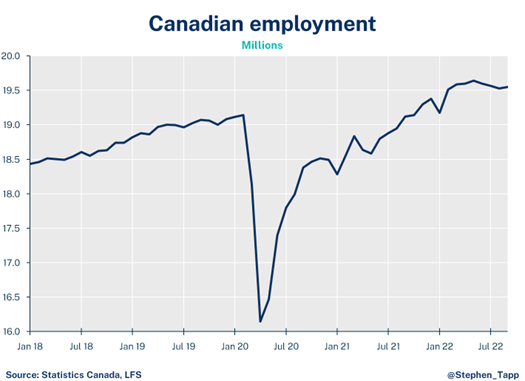

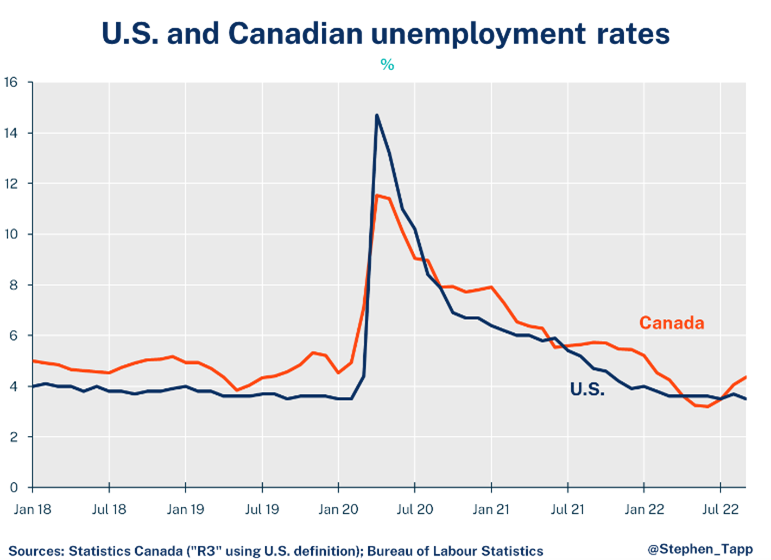

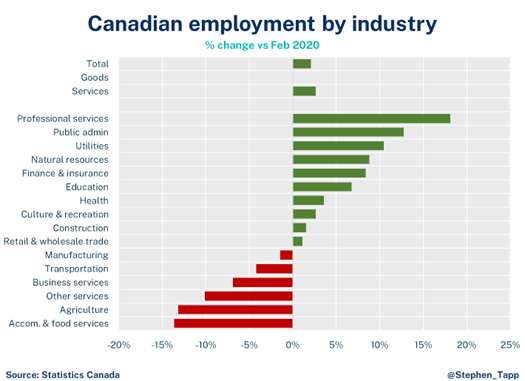

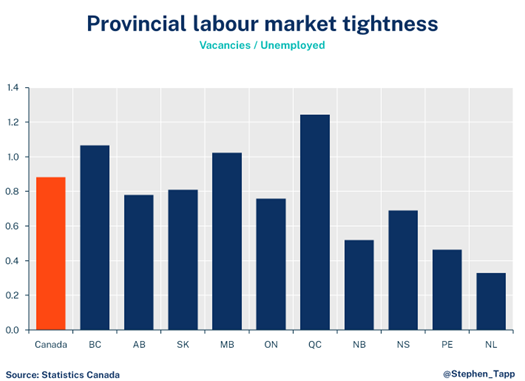

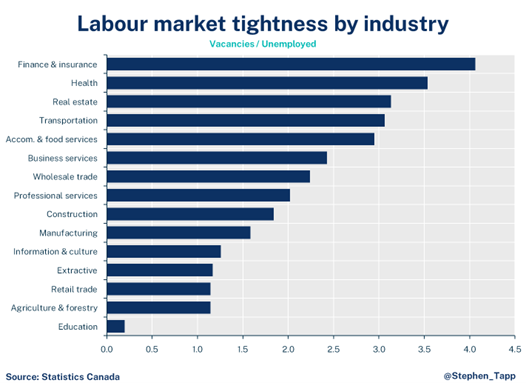

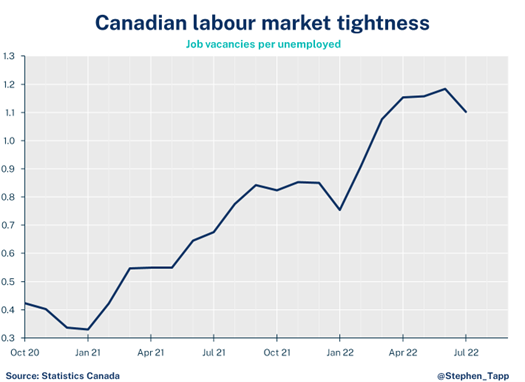

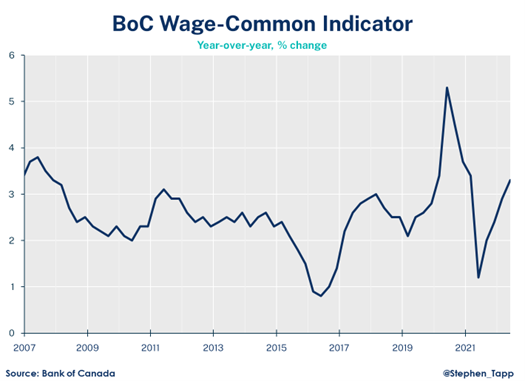

At first glance, it looked like we finally received good news from Canada’s Labour Force Survey for September: after three months of declines, employment was up by 21,000 jobs, while the unemployment rate dropped back to 5.2% after unexpectedly spiking to 5.4% last month. Digging beneath the headlines, however, shows emerging signs of an underlying “cooling-off” period. First, hours worked are down over 1% since June. Second, labour force participation has sagged over the course of this year, and third, it’s the public-sector, not the private sector, that continues to push up employment. That said, Canada’s labour market remains historically tight. It’s remains difficult for businesses to fill the nearly one million vacant positions they’re seeking. And, though, wage growth exceeded 5% for the fourth month in a row, this still isn’t enough to boost workers’ purchasing power, as it’s below the highest rates of inflation seen in a generation.

Stephen Tapp, Chief Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

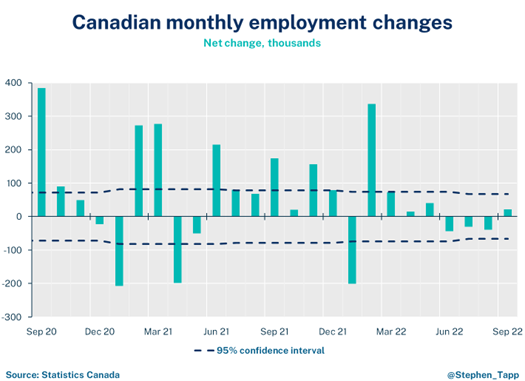

- Canadian employment was up slightly, with 21K net new jobs added in September. This reverses a three-month consecutive trend of falling employment.

- Still, total hours worked fell 0.6% and are off by an aggregate of 1.1% since June, although they remain up 2.4% year-over-year.

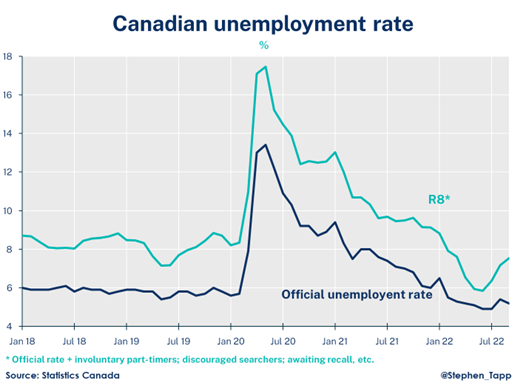

- The unemployment rate fell to 5.2% (from 5.4%), however, this is mostly because fewer people are looking for work.

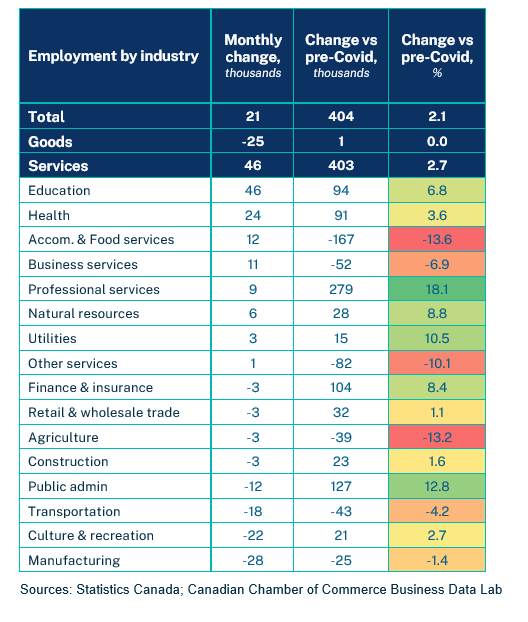

- Public-sector employment (+35k) continues to lead the recovery, while private-sector jobs were only up by 9k; self-employment continued its weak performance throughout the pandemic (-22k).

- Job gains in education (46k) and health care (24k) were offset by losses in manufacturing (-28k); information, culture, and recreation (-22k); transportation and warehousing (-18k) and public administration (-12k).

- Even acknowledging the recent cooling off, Canada’s labour market remains tight. With employers looking to fill nearly a million job vacancies, and inflation near generational highs, wage growth was above 5% year-over-year for the fourth straight month. Wage growth is strongest in professional services (+9.1% yr/yr) and accommodation and food services (+8.7%), industries where labour demand is currently very high.

- Canada’s aging population is proving to be a major challenge for labour supply. Retirements show no signs of slowing. Of the 5.2 million Canadians aged 55-64, almost 1 million are retired.

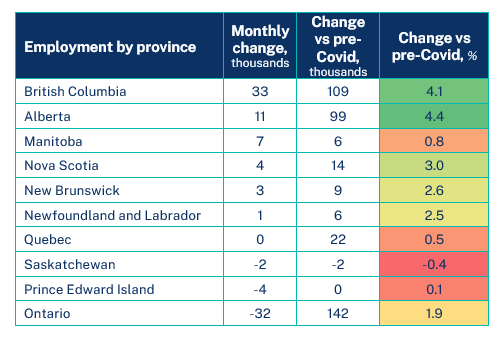

- Provincial employment increased in British Columbia, Manitoba, Nova Scotia and New Brunswick, but was down in Ontario and PEI. Moves in other provinces didn’t exceed the survey margin of error.

- In September, more than one quarter of workers were either fully remote (16%) or hybrid (9%).

SUMMARY TABLES

For more economic analysis and insights, visit our Business Data Lab.