Blog /

Q2 2023 GDP: A cause for pause as Canada’s economy unexpectedly stalls.

With this last piece of domestic data before the Bank of Canada’s policy announcement next week, the GDP report is positive news on a few fronts.

Amy Orfanakos

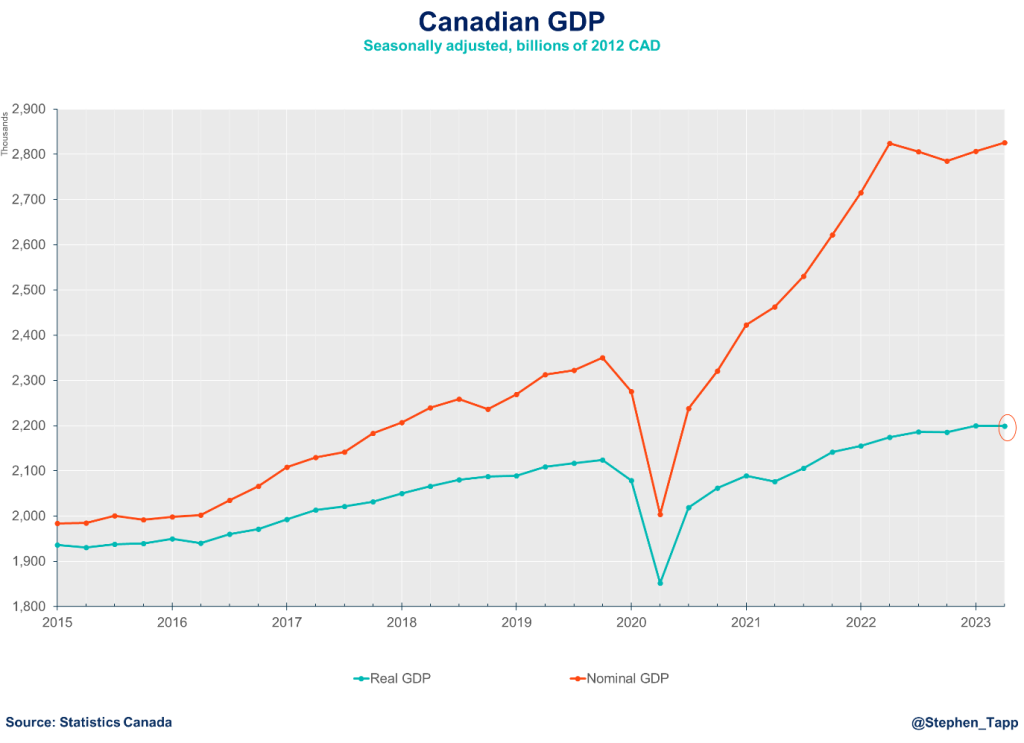

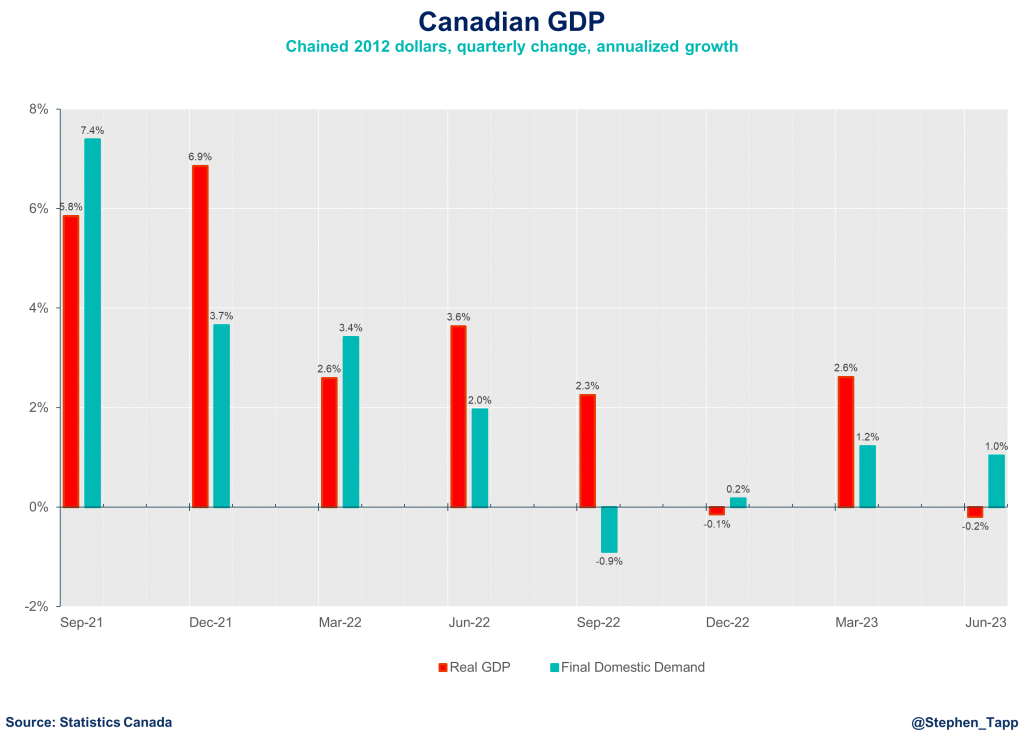

With this last piece of domestic data before the Bank of Canada’s policy announcement next week, the GDP report is positive news on a few fronts. With a surprise contraction of 0.2% in real GDP in the second quarter, the economy has clearly slowed in response to monetary tightening. Given the recent inflation report, where July saw inflation exceed 3% after a period of steady cooling — drifting further from the BoC’s 2% target — this is the positive news many had hoped for and increases the likelihood of the Bank holding rates steady.

Marwa Abdou, Senior Research Director, Canadian Chamber of Commerce.

KEY TAKEAWAYS

Headline

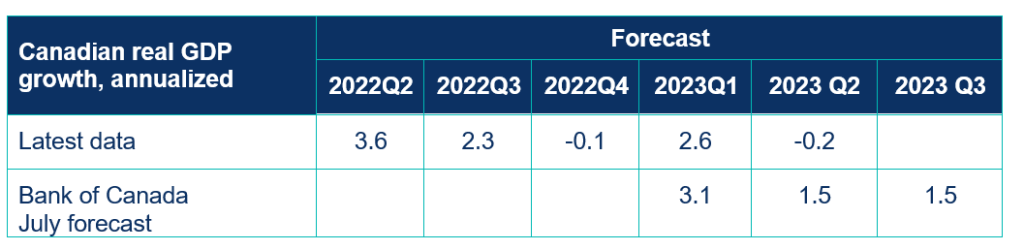

- Canada’s real gross domestic product (GDP) growth significantly under-performed expectations with a surprise contraction of 0.2% in the second quarter. This result was much weaker the Bank of Canada’s forecast of a 1.5% gain, and the 1.2% consensus call.

- Moreover, growth for Q1 was revised down to 2.6% from 3.1%.

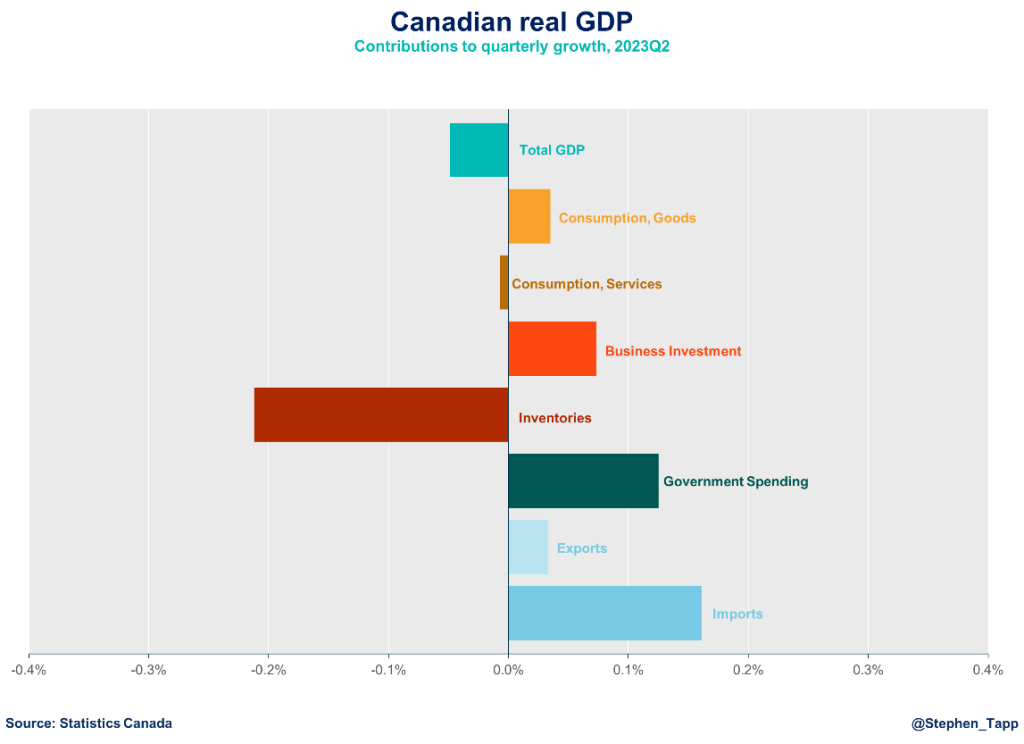

- There are now clear signs that higher interest rates are weighing on the economy, as consumers are finally starting to pinch their wallets — consistent with the earlier warnings from our Local Spending Tracker. The slowdown was attributable to household spending (0.1% down from 1.2% last quarter), continued declines in housing investment (-2.1%, for the fifth quarterly decrease!), smaller inventory accumulation, as well as slower export growth (+0.1% following 2.5% increase in Q1 2023). Increased business investment in engineering structures (+3.3%) and higher government spending on wages (+2.2%) were among the few components that aided the economy’s growth.

Movers and Shakers

- There was a very modest increase in spending on goods (+0.1%), but the real surprise was the weakness in household spending on services, which was flat in Q2, after a 1.1% increase in Q1.

- The report also noted that “while aggregate household expenditures edged up in the second quarter, spending per capita fell 0.7%. In fact, per capita household spending declined in three of the last four quarters.” – again in line with the insights from our spending tracker.

SENTIMENT, OUTLOOK & IMPLICATIONS

Outlook Ahead/Recession Pulse

- This represents a clear miss for the second quarter forecast by the consensus market call and the BoC. The only “good news” is that this release should finally cement the case for the Bank of Canada to hold on interest rates next week.

- The advanced estimate for July suggests GDP was unchanged on the month. A variety of special, albeit temporary factors —on-going forest fires and a major port strike in July — will hurt activity in the third quarter. All in all, it’s entirely possible that Canada’s economy’s is already in a mild recession.

SUMMARY TABLES

CHARTS

Other Blogs

Economic Commentary

Jul 03, 2025

Merchandise Trade May 2025: Headline rebound masks underlying softness

Economic Commentary

Jun 27, 2025

April 2025 GDP: The shoe drops as the economy shows trade impacts.

Economic Commentary

Jun 24, 2025