Blog /

October 2024 CPI: Two is the sweet spot. Sitting at target won’t change the Bank’s need to support growth.

Inflation is back to 2%—a sweet spot that sets the stage for the Bank of Canada to cut rates in...

Andrew DiCapua

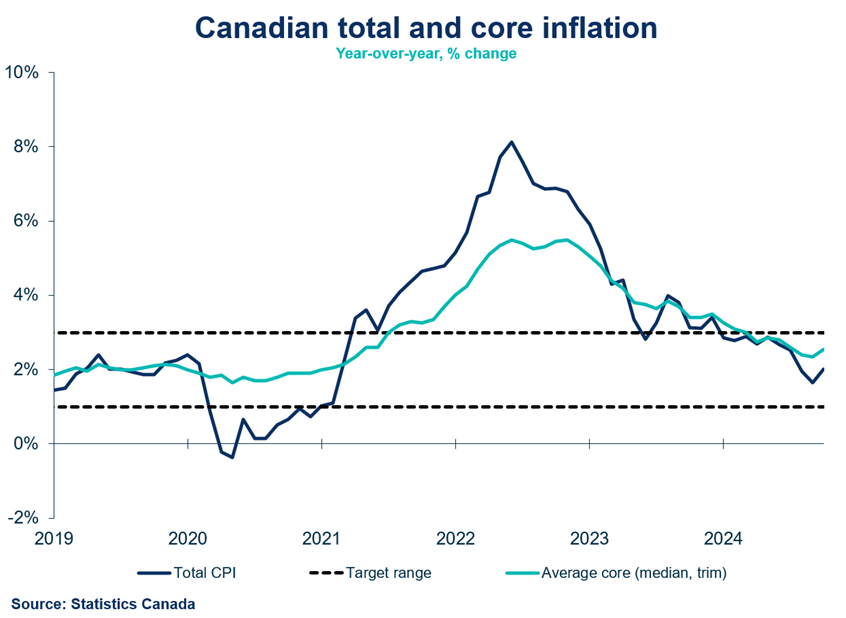

Inflation is back to 2%—a sweet spot that sets the stage for the Bank of Canada to cut rates in December. With upcoming GDP data expected to show weak economic growth, a 0.5% rate cut seems likely. While some sticky inflation pressures are easing, even the Bank’s anticipated uptick in inflation won’t change the narrative. Q3 GDP probably won’t deliver the strength they’re hoping for, which reinforces the need to support businesses and growth.

Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEWAYS

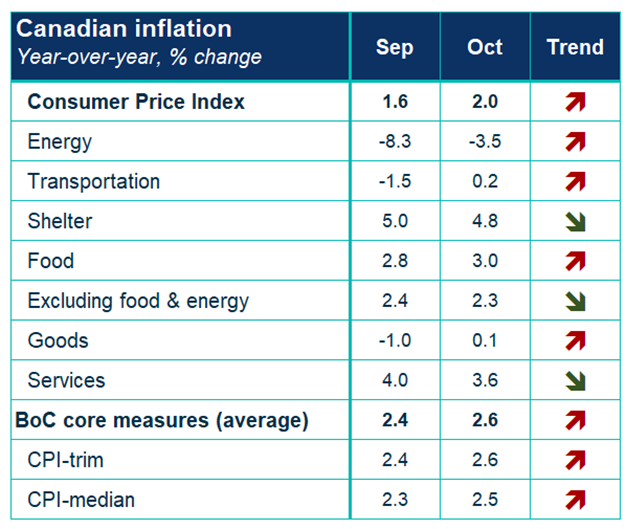

- Canada’s headline inflation accelerated 2% in October, above consensus (1.9%) on a year-over-year basis. This increase was expected as energy prices dropped less in October compared to the previous month. The main takeaway is that price stability remains, and the Bank should be optimizing inflation symmetrically around the two percent target. Monthly seasonally adjusted prices grew 0.3% with clothing and property taxes rising.

- The Bank of Canada’s core measures (Trim and Median) rose slightly to 2.6% year-over-year. Short-run core measures (3-month change annualized) increased 2.75%.

COMPONENTS

- Shelter prices decelerated to 4.8% (previously 5%) from lower rent and mortgage interest costs. Rent prices made some decent progress, growing by 7.3%. Mortgage interest costs continued to slow, with growth of 14.7% in October, the slowest annual growth since November 2022. Property taxes rose 6%, the highest yearly increase since 1992, which kept the overall category from decelerating further.

- Gasoline prices declined 4% in October, down to a lesser extent than in September’s decline of 10.7%. Prices grew on a monthly basis by 0.7%.

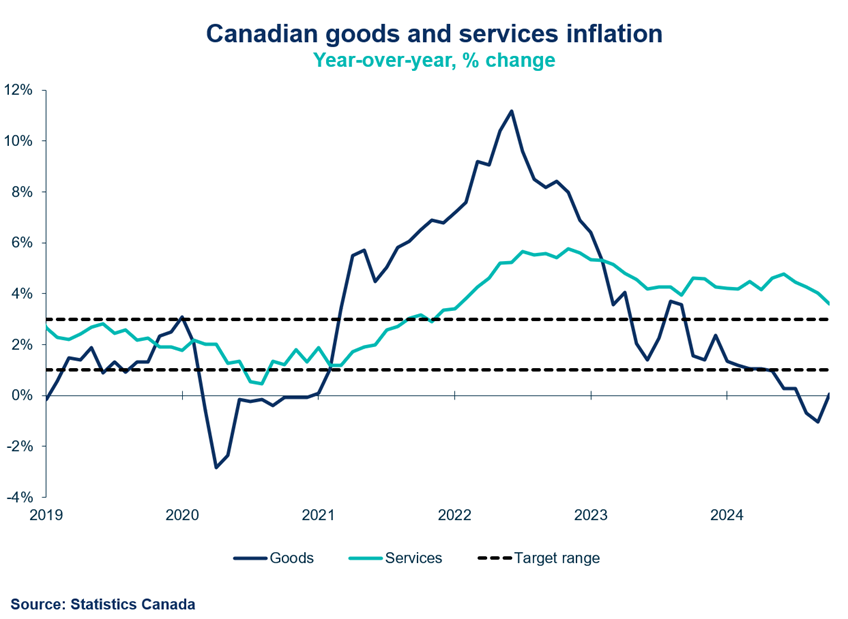

- Goods inflation reversed its decline in October, growing merely 0.1% on an annual basis, with non-durable goods experiencing price growth. Clothing and footwear prices were down for the tenth consecutive month, declining 2.3%, though monthly price growth rose 2% potentially signaling stabilization. Services inflation slowed to 3.6% in October, down from 4%, marking the slowest pace of services price growth since February 2022.

- Food price inflation supported overall price growth in October, edging up to 3%. Grocery store prices continue to put pressure on prices, rising 2.7%. Fresh vegetables and meat were the largest contributors to grocery store inflation. Restaurant prices eased to 3.4% growth.

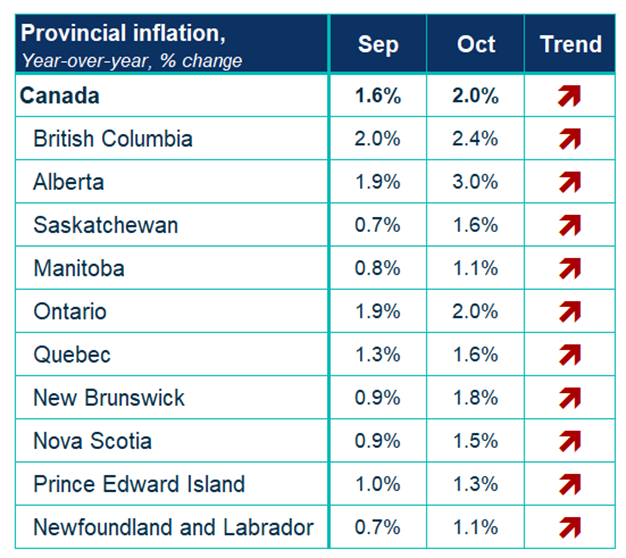

REGIONS

- Inflation accelerated in all provinces in October with New Brunswick and Saskatchewan leading growth in prices.

IMPLICATIONS

- October’s CPI showed an expected uptick, reversing some progress on inflation. The Bank of Canada’s October Monetary Policy Report forecasts inflation to average 2.1% year-over-year this quarter. However, third-quarter GDP is tracking at just over 1% annualized—well below the Bank’s updated projections. Core inflation measures edged up by only 0.1% over recent months, which is no cause for alarm. Encouragingly, there’s progress in curbing sticky areas of inflation, particularly in services. Shelter costs, including mortgage interest rates, are expected to continue their downward trend, while goods inflation could shift direction in the coming months. The Bank remains cautious about balancing inflation targets, aiming to avoid undershooting the 2% benchmark.

- Markets are still pricing in rate cuts at the December meeting, though the probability of a 50-basis-point cut has dropped to 31% following this data. Governor Macklem has reiterated that the economy needs support, especially with headwinds like slowing population growth, softening consumer spending (despite any potential “Taylor Swift effect”), and potential shifts with a new U.S. administration. We believe the Bank must quickly return to a neutral stance. The Canadian economy continues to operate below potential, leaving room for growth without sparking broad-based price pressures.

SUMMARY TABLES

CHARTS

Other Blogs

Economic Commentary

Jun 27, 2025

April 2025 GDP: The shoe drops as the economy shows trade impacts.

Economic Commentary

Jun 24, 2025

May 2025 CPI: Inflation holds steady, giving the Bank of Canada some space to breathe.

Report

Jun 19, 2025