Blog /

November 2023 CPI: Too early to declare victory over inflation as we remain above the target band

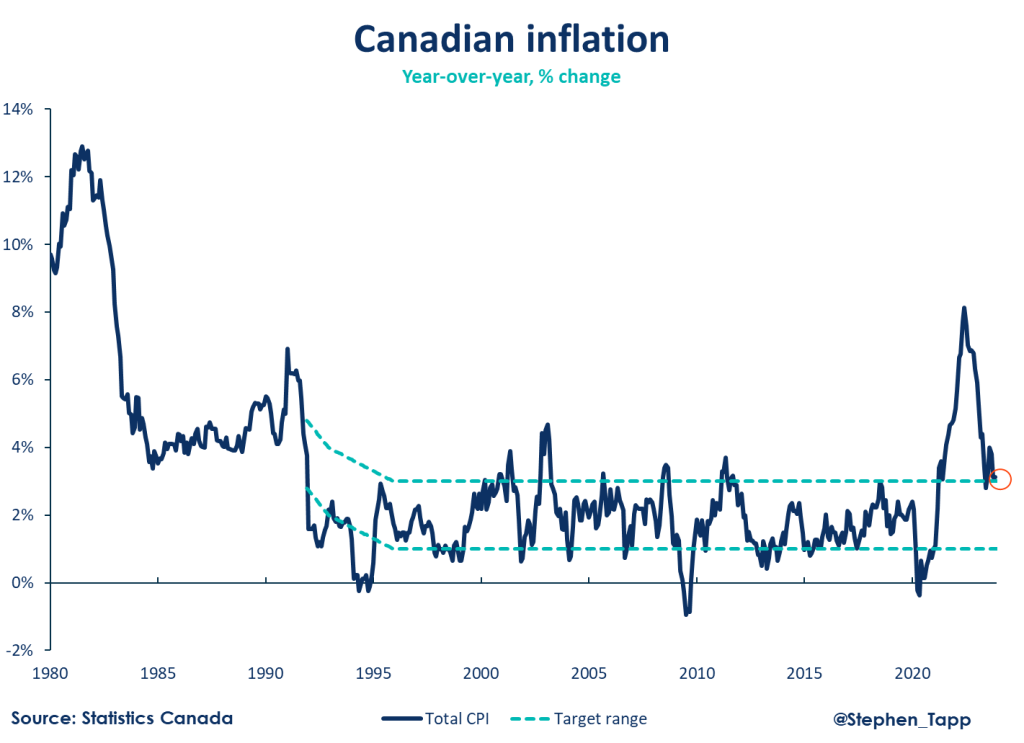

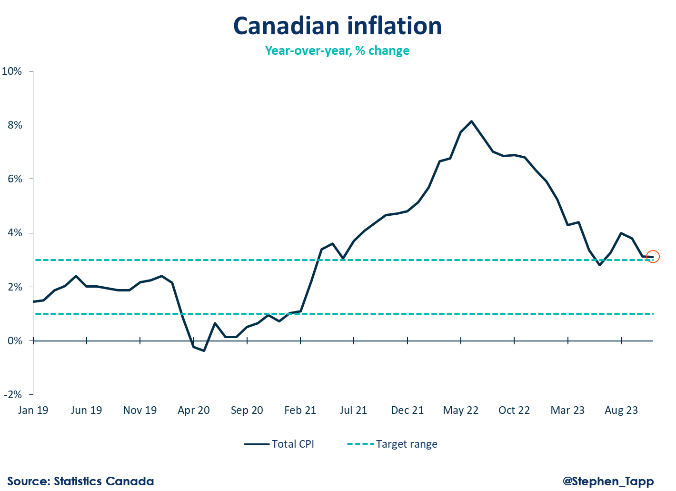

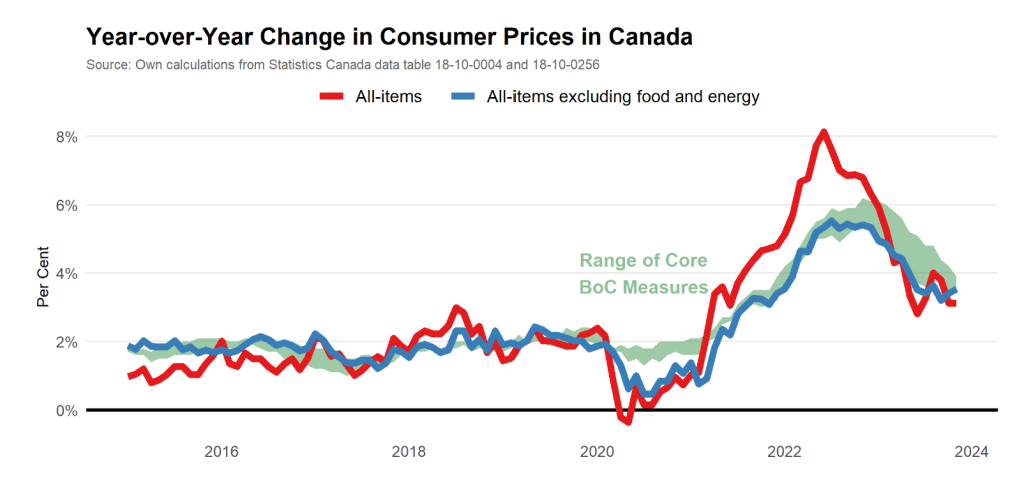

Headline inflation in Canada was unchanged in November, staying at 3.1%, which was higher than the market was expecting (2.9%) and still remains slightly above the top of the Bank of Canada’s inflation control target band.

Amy Orfanakos

Headline inflation in Canada was unchanged in November, staying at 3.1%, which was higher than the market was expecting (2.9%) and still remains slightly above the top of the Bank of Canada’s inflation control target band.

While this was not the Christmas present that the market or the BoC was expecting, if you dig beneath the headline annual numbers, there has been some underlying progress on core inflation in recent months; the three-month moving average of the Bank’s preferred core measures fell from 2.9% to 2.5% in November, as food price inflation thankfully continues to decelerate.

That said, rising rents and elevated wage pressure remain problematic. Given the more optimistic outlook south of the border, we expect the U.S. Federal Reserve to start the easing cycle in 2024 while the Bank of Canada, and most other central banks, sit back, hold the line and nervously wait for more durable progress on the inflation front.

Marwa Abdou, Senior Research Director, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headline

- Headline inflation held steady and above market consensus at 3.1% on a year-over-year (y-o-y) basis. Matching last month’s increase, November’s read was up 0.1% month-over-month (m-o-m) which continued to keep us outside the Bank of Canada’s target range (1-3%).

- We remain above June’s 27-month low of 2.8% when the effects of lower energy prices from a year prior when Russia invaded Ukraine had peaked.

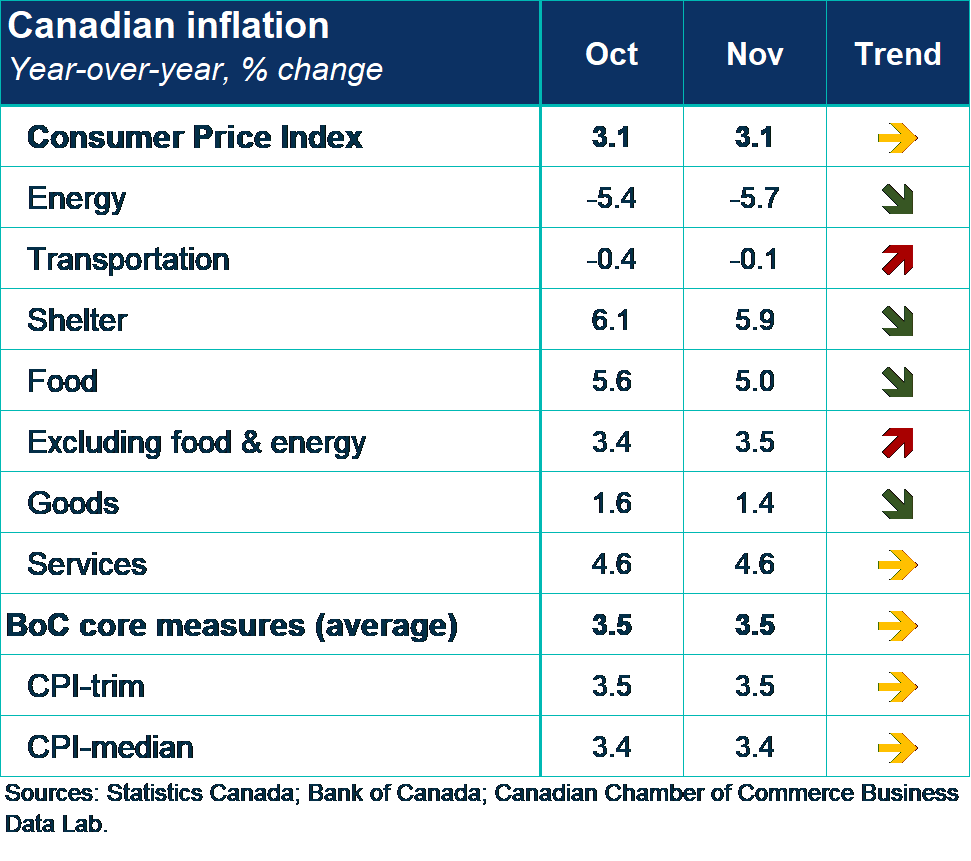

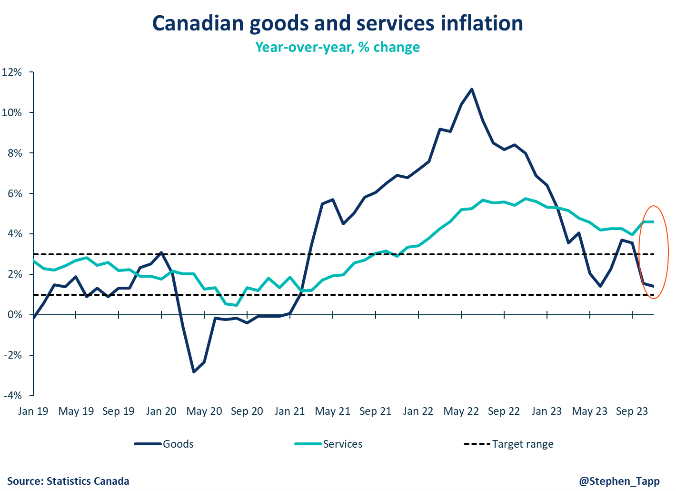

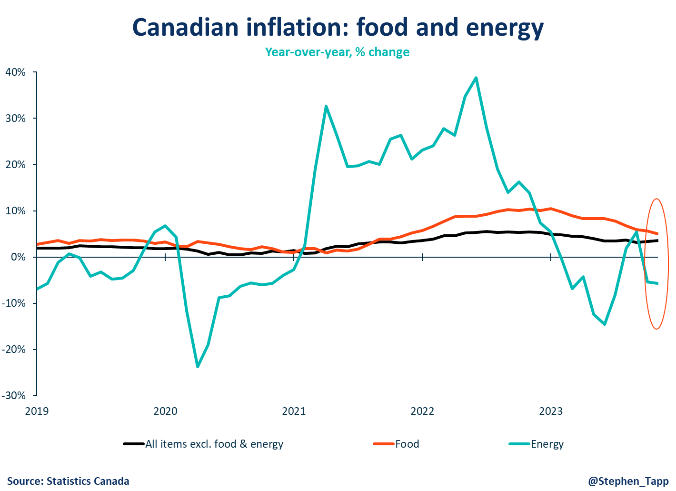

- Unfortunately, excluding food and energy, prices rose 3.5% in November, compared with a 3.4% rise in October.

- While headline inflation remained stuck and the BoC’s core measures didn’t improve on a year-over-year basis, there was one silver lining. There was some progress as the BoC’s closely watched 3-month average of their preferred core measures fell from 2.9% to 2.5%, as food prices decelerated.

CPI Components

- Grocery prices, which had been consistently running hot for most of 2023, continued their fifth consecutive month of y-o-y deceleration.

- Food prices increased in November (+4.7%) but at a slower pace compared with October (+5.4%) with broad-based slowdowns across components including non-alcoholic beverages (-0.6%), fresh vegetables (+2.5%) and other food preparations (+6.4%) making the biggest dents.

- Energy prices fell to a larger extent below year-ago levels in (-5.7%) because of lowered fuel oil prices. The temporary suspension of federal carbon levy on fuel oil contributed to the decline. Prices fell a whopping 23.6% at the national level in November (following October’s downtick of 12.6%).

- Y-o-y services’ prices remained elevated in November and unchanged from October (+4.6%).

- Canadians are also continuing to feel relentless heat from higher prices for mortgage interest costs (+29.8%) and rent (+7.4%), which were the largest contributors to last month’s y-o-y increase.

- Prices pressures also came by way of prices for travel tours which accelerated +26.1% y-o-y compared with October (+11.3%). This was due to “events held in destination cities in the United States during November” as cited by the report.

Provincial Inflation and Regional Notes

- On an annual basis, prices rose at a slower pace in November than October in six provinces – all Atlantic provinces (Newfoundland & Labrador, PEI, Nova Scotia, and New Brunswick), Manitoba and Quebec.

SENTIMENT, OUTLOOK & IMPLICATIONS

Bank of Canada

- As the BoC held its interest rates steady this month at 5% for the fourth consecutive month, this latest report only solidifies that this will unlikely change anytime soon.

- Now more than a year and a half after beginning its aggressive campaign to cool the economy, and with former Governor Tiff Macklem remarks last week, it is “still too soon for the institution to consider rate cuts”.

SUMMARY TABLES

Table 1: Canadian Inflation – CPI Components and BoC Core Measures

Table 2: Provincial Inflation

CPI CHARTS

Other Blogs

Jul 11, 2025

Labour Force Survey June 2025: Canada’s job market remains surprisingly resilient

Jul 03, 2025

Merchandise Trade May 2025: Headline rebound masks underlying softness

Jun 27, 2025