Blog /

May 2024 CPI: Canadians can’t catch a win this week as inflation reverses course in May

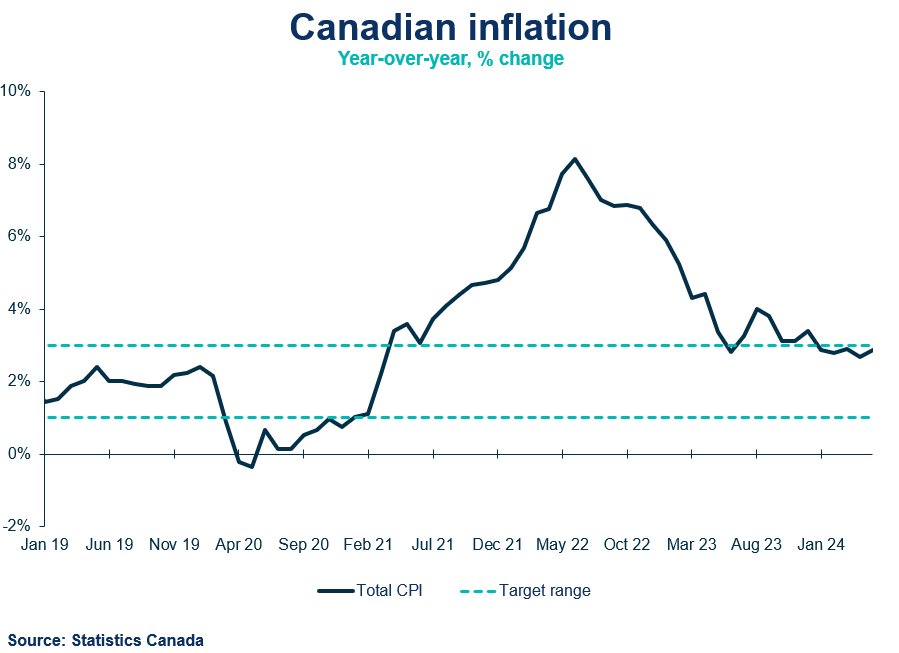

Canada’s headline CPI inflation accelerated 2.9% in May, above consensus (2.6%) on a year-over-year basis.

Not the best news on the Canadian front this morning. Governor Macklem may want to hold off on the soft-landing claim, at least for now as the Bank will likely wait to see how the economy progresses and pause at their next meeting. The increase in services inflation is not helpful, especially as wage growth is elevated. The risk of a strong rebound in the housing market hasn’t materialized yet, but slowing shelter inflation is welcome news. Our consumer spending tracker is showing growth presenting a risk that demand is more robust. Odds of a cut in July are lower and still depend on whether the economy is weaker than the Bank’s recent forecast. Governing Council continues to be heavily data dependent, and this reversal will support their restrictive bias. The Bank will want to take a slow and measured approach, especially with inflation accelerating. This bumpy road on inflation could keep the Bank overly restrictive for the Canadian economy risking any soft-landing.

Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headline

- Canada’s headline CPI inflation accelerated 2.9% in May, above consensus (2.6%) on a year-over-year basis. Despite headline inflation making considerable progress over the past few months, allowing the Bank to lower their policy rate in June, that progress is paused. On a monthly basis, the seasonally adjusted prices grew 0.3% as prices for travel and tourism accelerate.

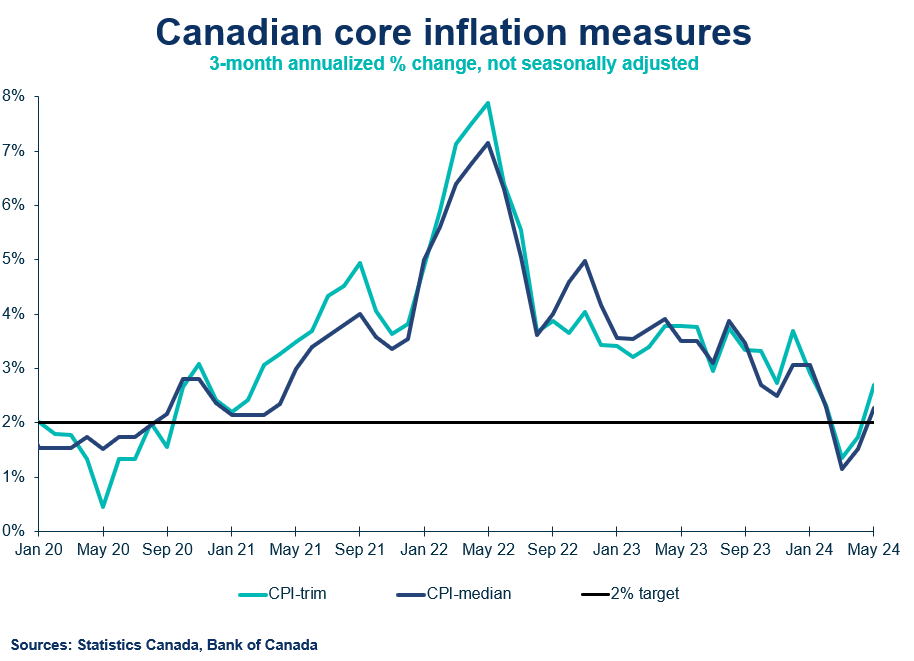

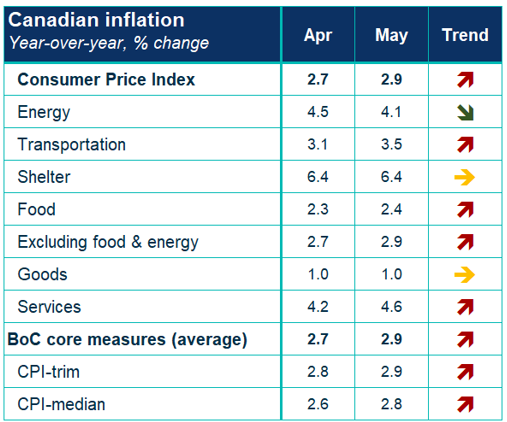

- The Bank of Canada’s core measures (Trim and Median) grew 2.9% year-over-year, up from 2.7% in April, marking the third consecutive month within the target range despite moving higher in May. Short-run core measures (3-month change annualized) increased to 2.5%, its strongest reading since February.

CPI Components

- Shelter prices remain high in but levelled off, growing 6.4%, primarily driven by rent prices accelerating 9% in May. Rent is growing the fastest in Ontario as rental supply is insufficient to keep up with rapid population growth.

- Goods inflation has consistently grown by merely 1%, driven down by durable and semi-durable goods. Services inflation accelerated to 4.6% due to higher seasonal prices for travel tours and air transportation. Wage growth reported in the Labour Force Survey (LFS) remains slightly above 5% and is likely to keep services inflation higher in the context of a still loosening labour market.

- Food price inflation rose in May, growing 2.4%. Grocery prices rose on an annual and monthly basis, partly due to seasonal price changes but posted the largest increase since January 2023. Restaurant food prices continue to slow from 4.3% in April to 4.2% in May.

Provincial and Regional Inflation

- Prices accelerated in six provinces.

SENTIMENT, OUTLOOK AND IMPLICATIONS

- May CPI was consistent with the inflation forecast in the Bank of Canada’s April Monetary Policy Report, which expected 2.9% year-over-year growth. Despite the fact that the Bank’s policy remain overly restrictive and risks further weakening the economy, May’s inflation data will continue to give the Bank breathing room. There is more progress to achieve with bringing inflation down, anchoring inflation expectations, and slowing wage growth. Even though Governing Council recognizes that their policy is restrictive, and the economy is in excess supply, the inflation is too high.

- Markets are lessening their expectations of a rate cut in July with the probably decreasing from 60% down to 40%. The strength of the Canadian economy in the second half of this year is still uncertain with population growth expected to slow and mortgage renewals continuing. Unless there are negative surprises in the next few data points for CPI and GDP, the Bank will likely keep rates at current levels in July.

SUMMARY TABLE

CHARTS