Blog /

LFS January 2024: A warmer start to the year than anticipated but winter is still coming

Following a flat streak in the last quarter of 2023, Canada’s labour market kicked off the new year a little better than expected.

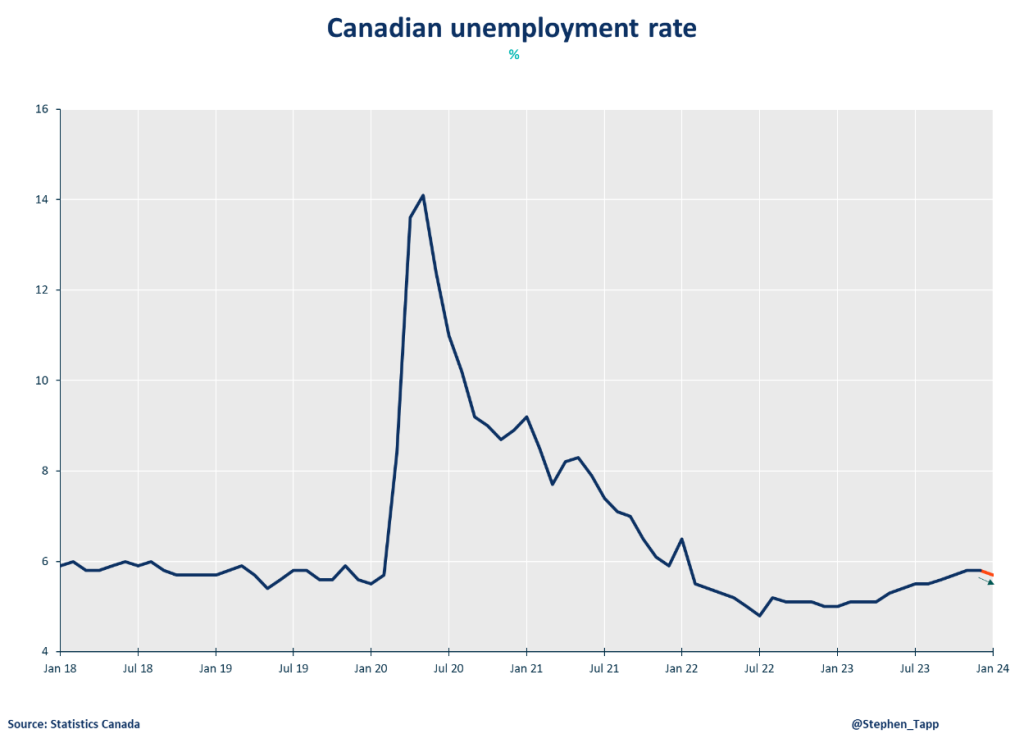

Marwa Abdou

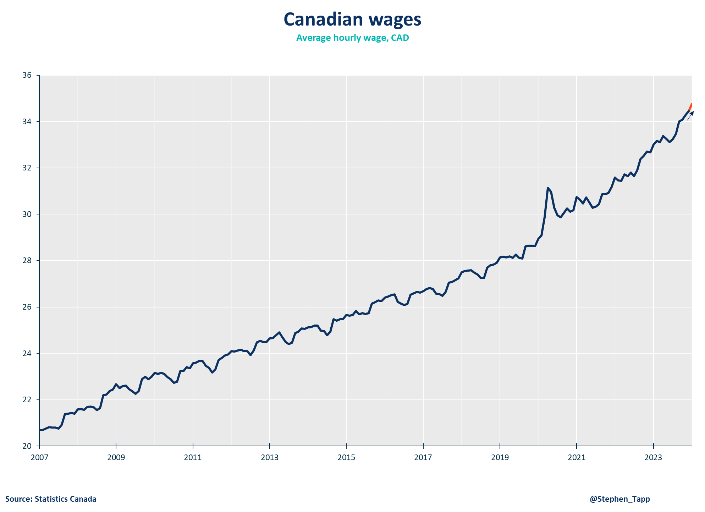

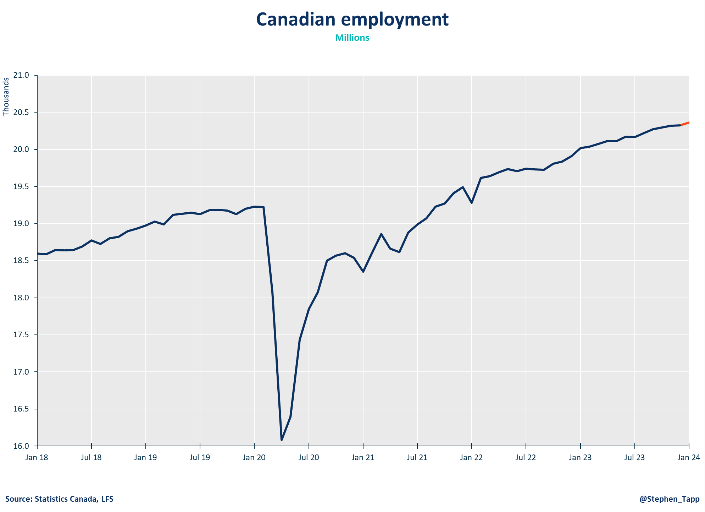

Following a flat streak in the last quarter of 2023, Canada’s labour market kicked off the new year a little better than expected. January saw the unemployment rate at 5.7%, surpassing expectations of 5.9%, with a 37K job increase. While this marks the first decline in over a year (since December 2022), the growth was primarily in part-time and public sector roles. As immigration rates from last year’s historic pace moderate, labour supply will continue to be dominant driver. Despite robust wage growth at 5.3% year-over-year, which is higher than ideal, this trend is expected to moderate in response to the ongoing impact of interest rate adjustments rippling through the economy, even if on a delayed schedule.

Marwa Abdou, Senior Research Director, Canadian Chamber of commerce

KEY TAKEAWAYS

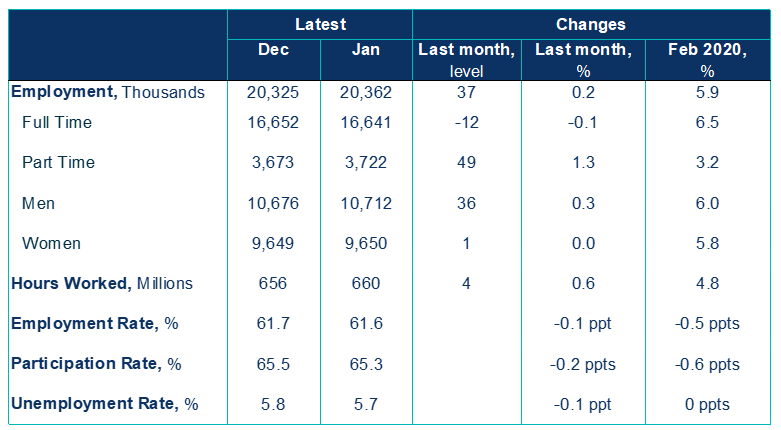

- After three months of little change, Canadian employment increased by 37K in January (exceeding market expectations for 15k).

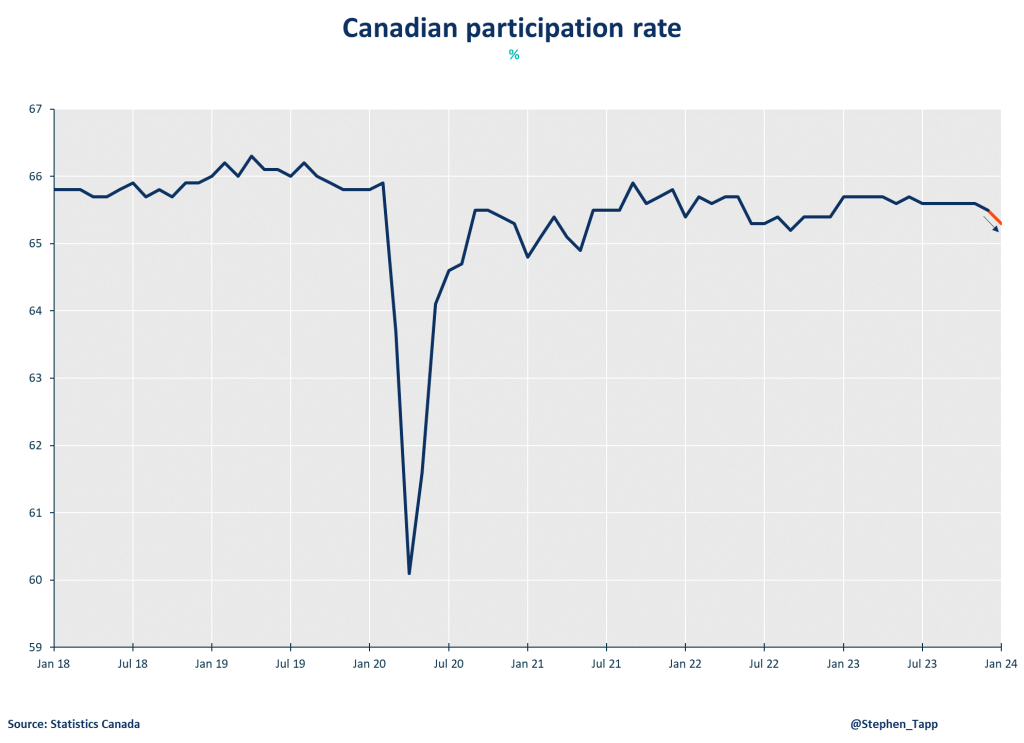

- The unemployment rate edged down 0.1 percentage points to 5.7% – the first decline since December 2022. However, this was driven by a drop in labour force participation. The employment rate continues to decline (down 0.1 ppts to 61.6%) because job growth (+0.2%) is not keeping pace with rapid population growth (+0.4%.)

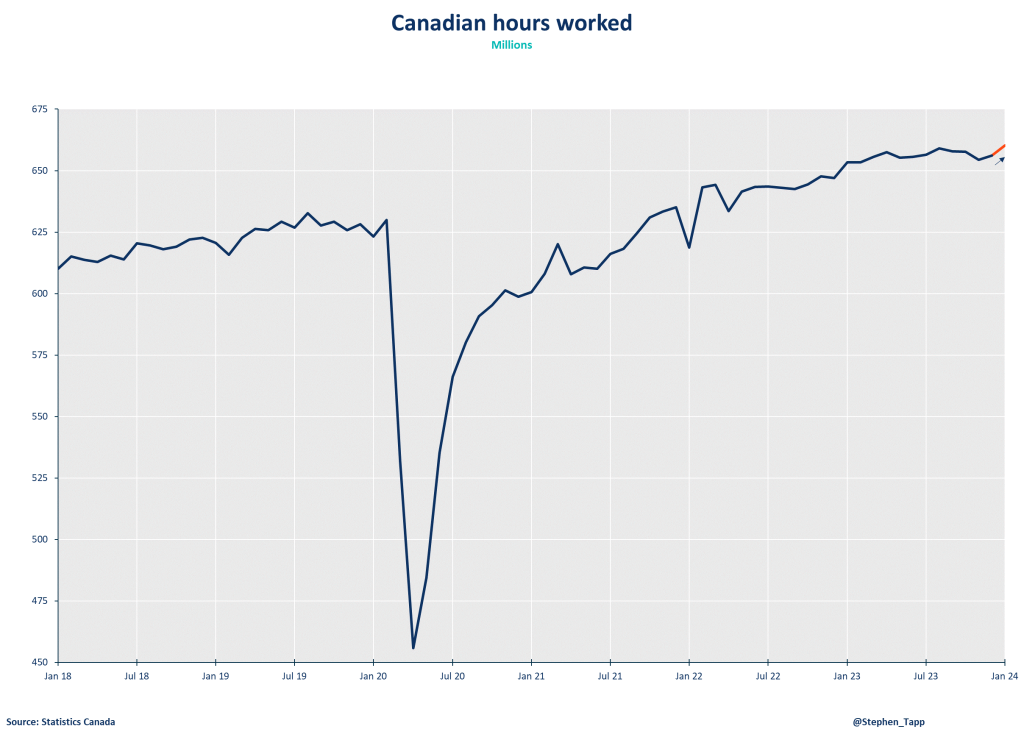

- The good news is that total hours worked rose 0.6% on the month, which should bode well for GDP growth staying the positive territory in Q1 2024.

- Average hourly wages rose 5.3% (+$1.74 to $34.75) following an increase of 5.4% in December 2023, with faster growth in the upper end of the distribution.

- Youth labour market conditions (aged 15 to 24) look to have weakened — particularly for females — over the past year as their participation rate fell 3.0 ppts to 62.7%.

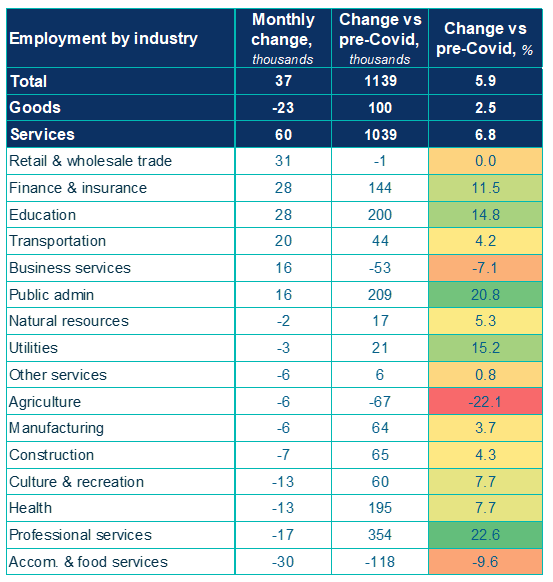

- Employment gains were spread across several industries in the services-producing sector, led by wholesale and retail trade (+31K; +1.1%) as well as finance, insurance, real estate, rental and leasing (+28K; +2.1%). There were also declines in other industries, led by accommodation and food services (-30K; -2.7%).

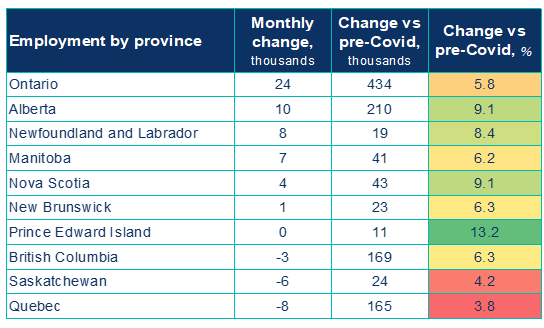

- Regionally, provincial employment increases occurred in Ontario (+24K; +0.3%), Newfoundland and Labrador (+7.5K; +3.2%), Manitoba (+6.9K; +1.0%) and Nova Scotia (+3.7K; +0.7%). Saskatchewan saw a decline (-6.2; -1.0%).

SUMMARY TABLES

CHARTS

Other Blogs

Jul 11, 2025

Labour Force Survey June 2025: Canada’s job market remains surprisingly resilient

Jul 03, 2025

Merchandise Trade May 2025: Headline rebound masks underlying softness

Jun 27, 2025