Blog /

LFS March 2024: Unemployment rate hits two-year high

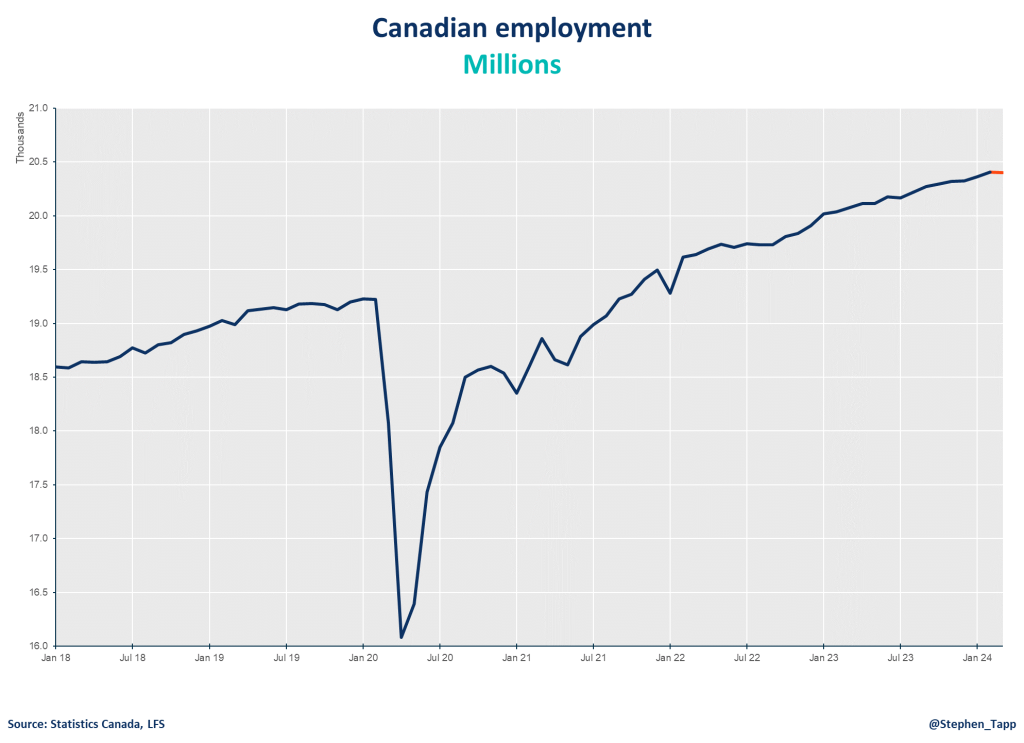

Following decent growth in January and February, Canadian employment saw little change in March 2024.

Marwa Abdou

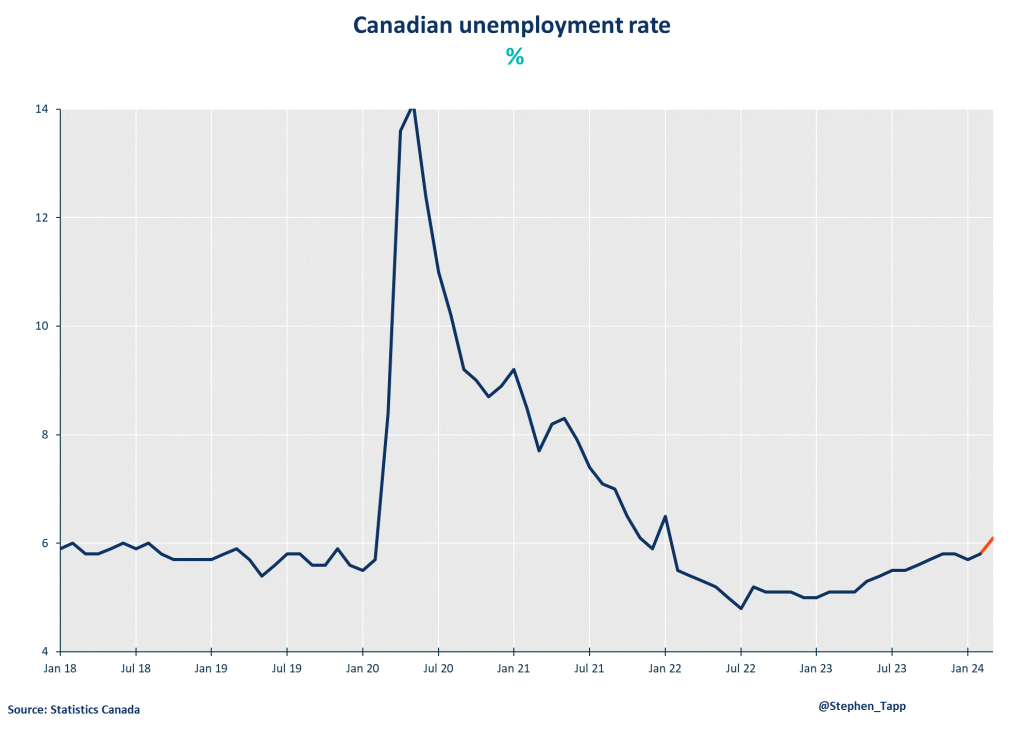

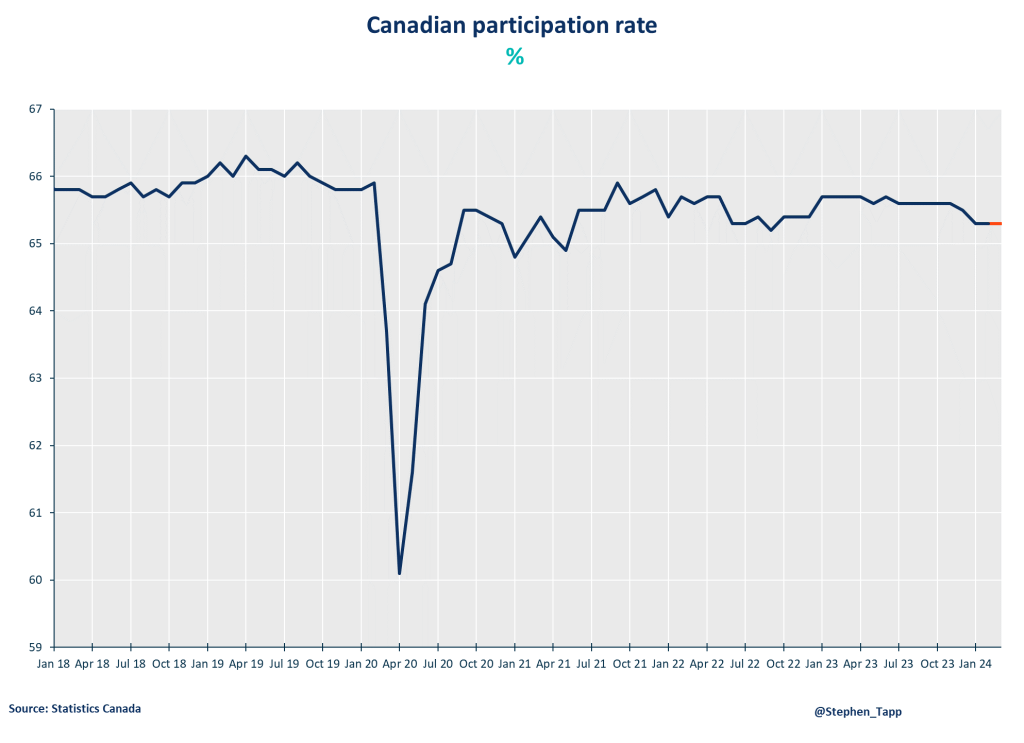

Though job growth came to a grinding halt in March, the main headline was the unemployment rate breaking the 6% threshold for the first time in more than two years. These numbers signal that population growth continues to run ahead of labour demand. As the Bank of Canada continues to assess how much the economy is weakening under high interest rates, this report signals growing slack in the labour market, which might just test patience in terms of rate cuts.

Marwa Abdou, Senior Research Director, Canadian Chamber of Commerce

KEY TAKEAWAYS

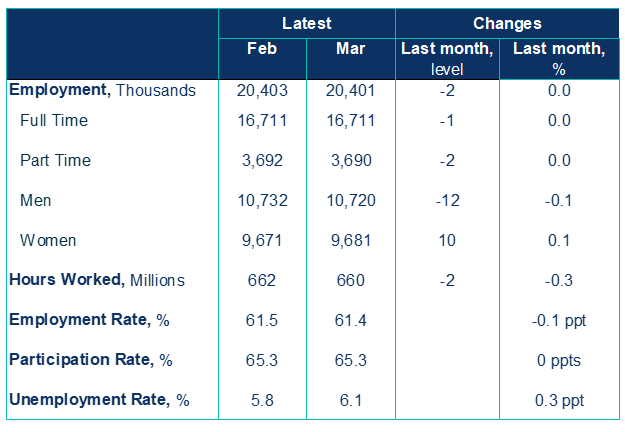

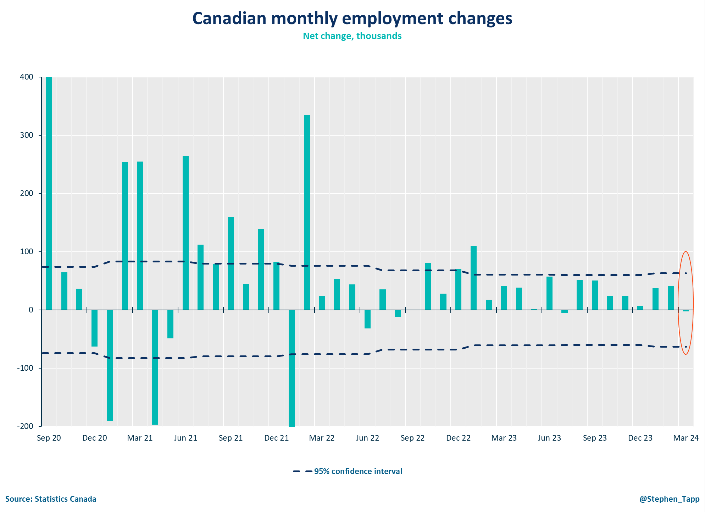

- Following decent growth in January and February, Canadian employment saw little change in March (-2,200; -0.0%).

- The unemployment rate surpassed market expectations, edging up 0.3 percentage points to 6.1% from 5.8% in February. This is the rate’s largest increase since summer 2022, the first time above the 6% threshold since Jan 2022 during COVID lockdowns and brings the cumulative increase over the past year to 1.0 ppts.

- The rise in unemployment was driven by the increase of 60K (+4.8%) of job seekers or on temporary layoffs. Unemployment was particularly up among youth where the unemployment rate rose 1.0 ppts in the month to 12.6% – the highest since September 2016 excluding the pandemic. Over the last year, the unemployment rate also increased more for core-aged Black Canadians by 3.9 ppts to 10.8%.

- Total hours worked were virtually unchanged in March, but rose 0.7% for the first quarter, which suggests decent headline GDP growth to start the year.

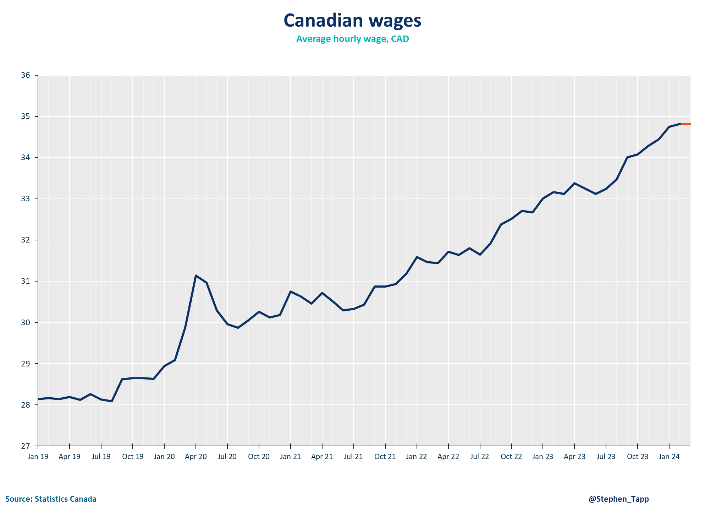

- Average hourly wages rose 5.1% (+$1.69 to $34.81) year-over-year, following an increase of 5.0% in February.

- Youth labour market conditions (aged 15 to 24) have weakened — particularly for females — over the past year as their participation rate fell 3.0 ppts to 62.7%.

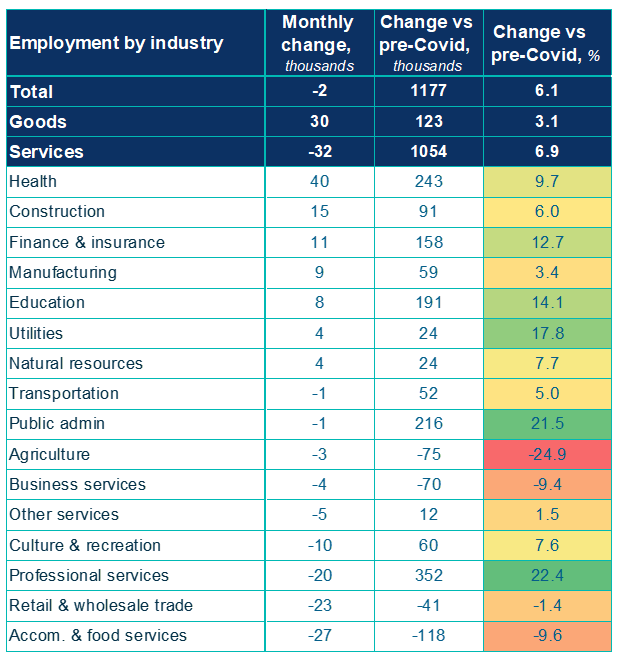

- Employment declines were seen in three industries led by accommodation and food services (-27K; -2.4%), wholesale and retail trade (-23K; -0.8%) as well as professional services (-20K; +1.0%). There were increases in health care and social assistance (+40K; +1.5%) and construction (+15K, +1.0%).

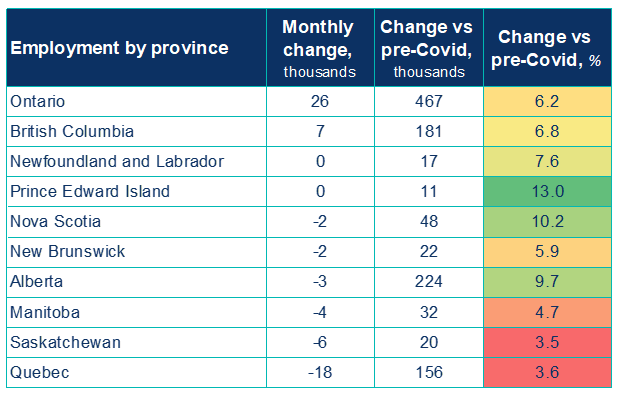

- Regionally, provincial employment declines occurred in Quebec (-18K; -0.4%), Saskatchewan (-6K; -1.0%) and Manitoba (-4.3K; -0.6%). This while Ontario posted its second increase this quarter (+26K, +0.3%).

SUMMARY TABLES

CHARTS

Other Blogs

Economic Commentary

Jul 03, 2025

Merchandise Trade May 2025: Headline rebound masks underlying softness

Economic Commentary

Jun 27, 2025

April 2025 GDP: The shoe drops as the economy shows trade impacts.

Economic Commentary

Jun 24, 2025