Blog /

Labour Force Survey for July 2022: Historic and unprecedented low unemployment remains, wage pressures continue to mount

Our Senior Research Director, Marwa Abdou, analyzes July’s Labour Force Survey results and finds the data both unexpected and unprecedented.

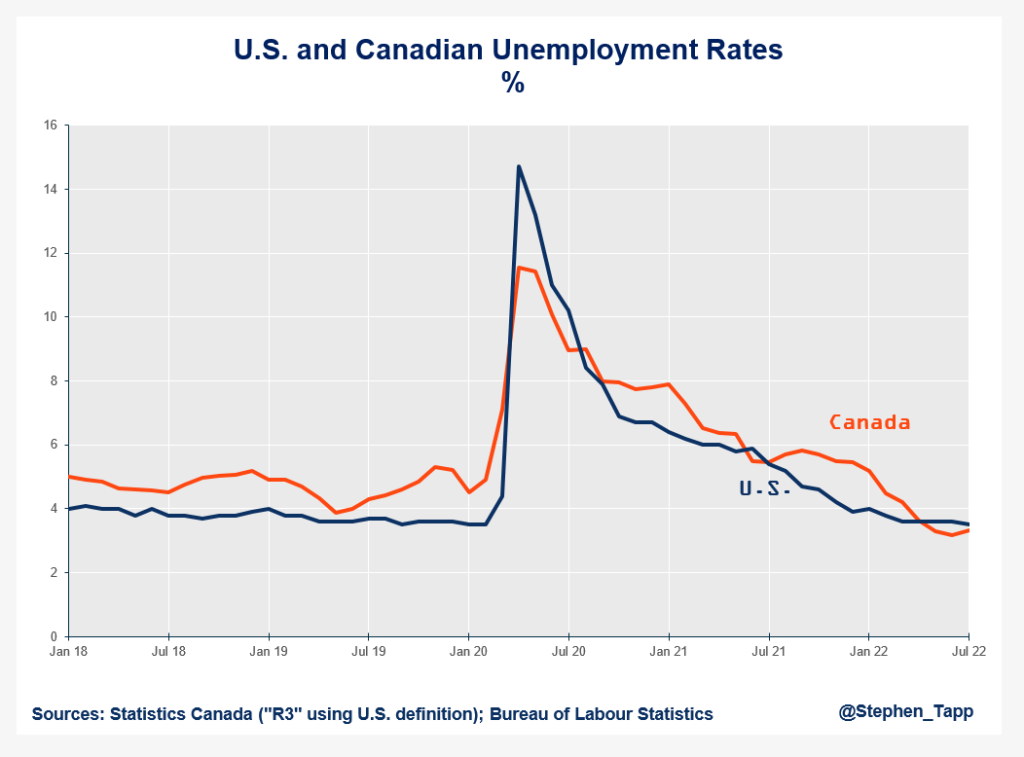

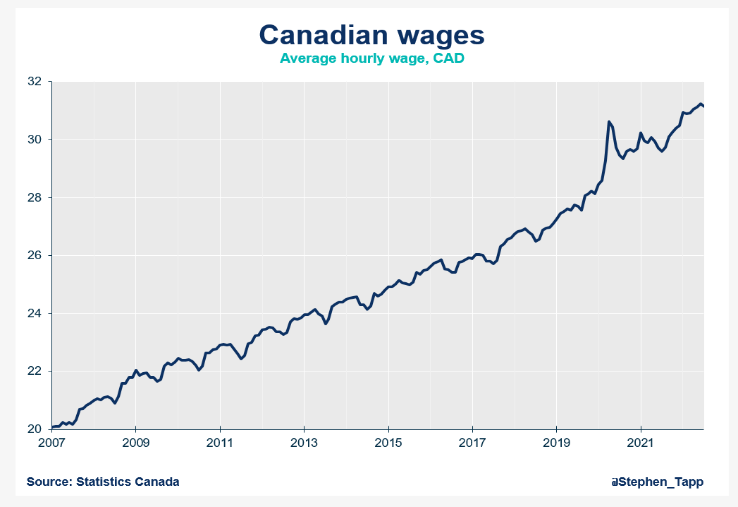

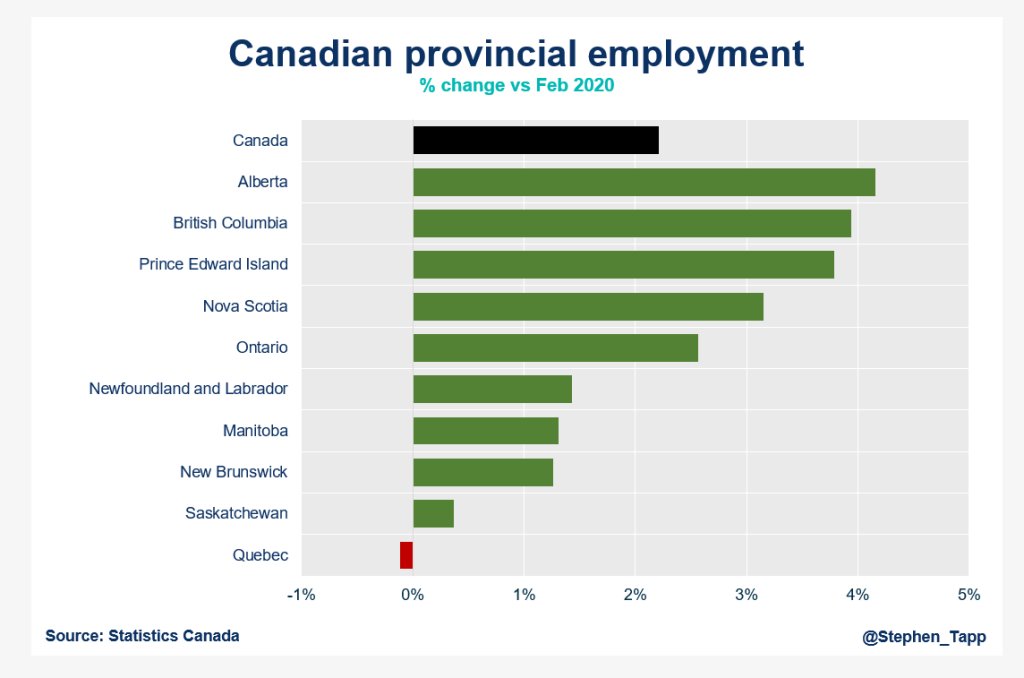

July’s Labour Force data is both unexpected and unprecedented, with Canada’s unemployment rate remaining at a multi-decade low of 4.9% for a second consecutive month. Wage growth also continued at June’s torrid pace, with average hourly wages up 5.2% year-over-year.

While good news for employees and job seekers, for businesses that are already navigating the pressures of inflation and increasing demand, rising compensation and competition for labour in a heated job market will continue to be a challenge.

Marwa Abdou, Senior Research Director, Business Data Lab

Key Takeaways

- The unemployment rate remains at 4.9% for the second consecutive month. This is a record low since the monthly data began in 1976.

- After returning to its pre-pandemic level for the first time in June, July marked the third consecutive decline in long-term unemployment which dropped 23K (-12.2%) to162,000.

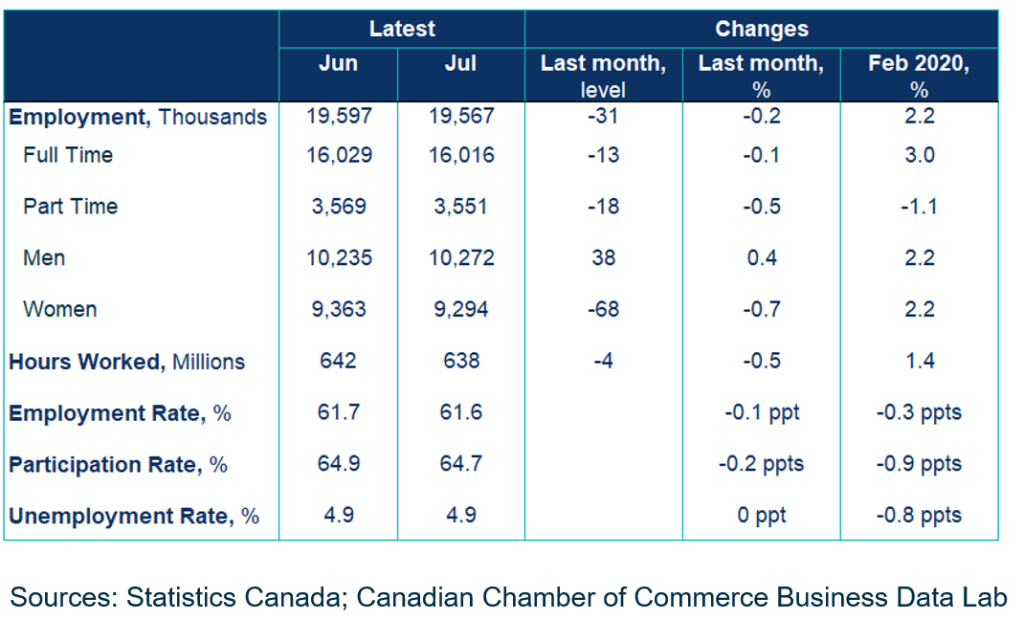

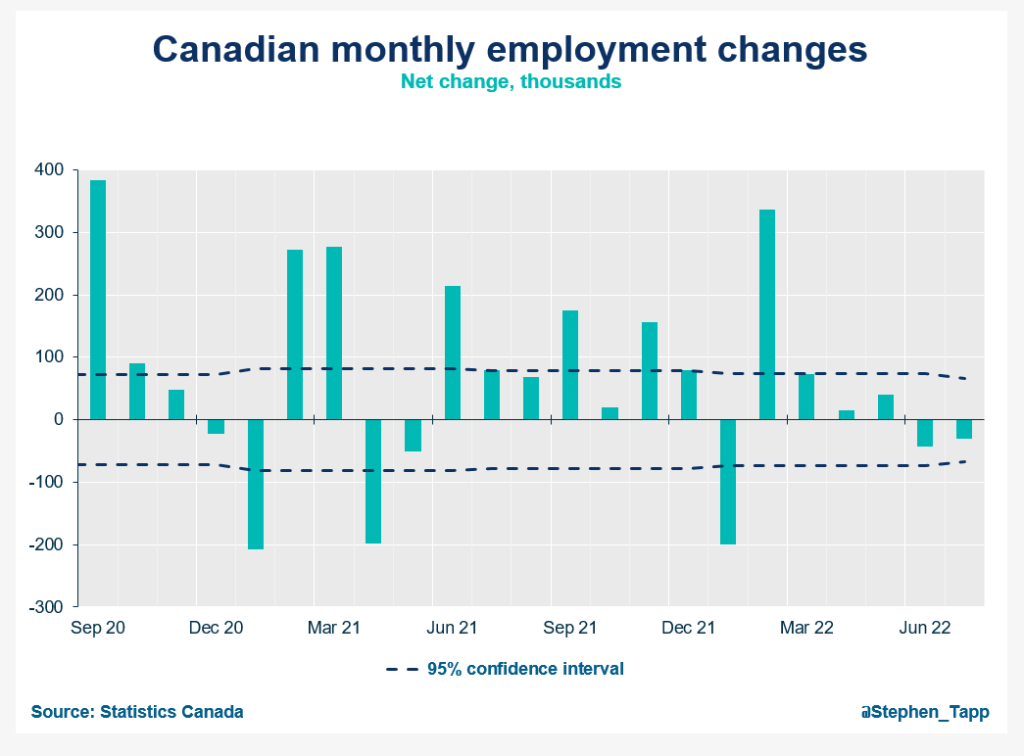

- July experienced a decline of nearly 31K jobs, bringing the total loss of jobs since May to 74K.

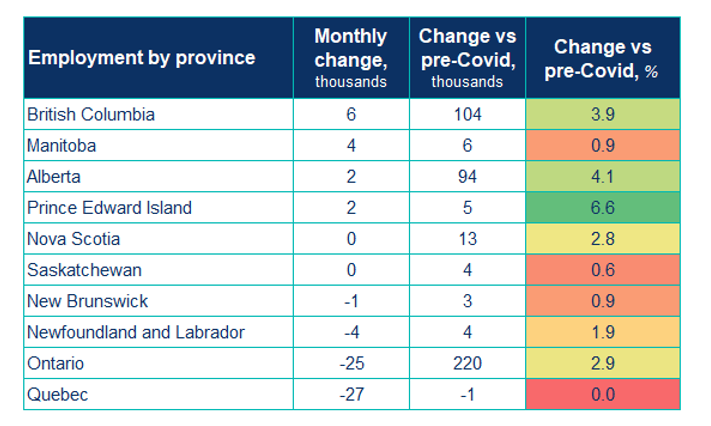

- The decline in jobs appears to be slowing down, but some sectors continue to feel it more acutely than others. Employment among public sector employees fell by 51K (-1.2%) in July, the first decline in the sector in 12 months.

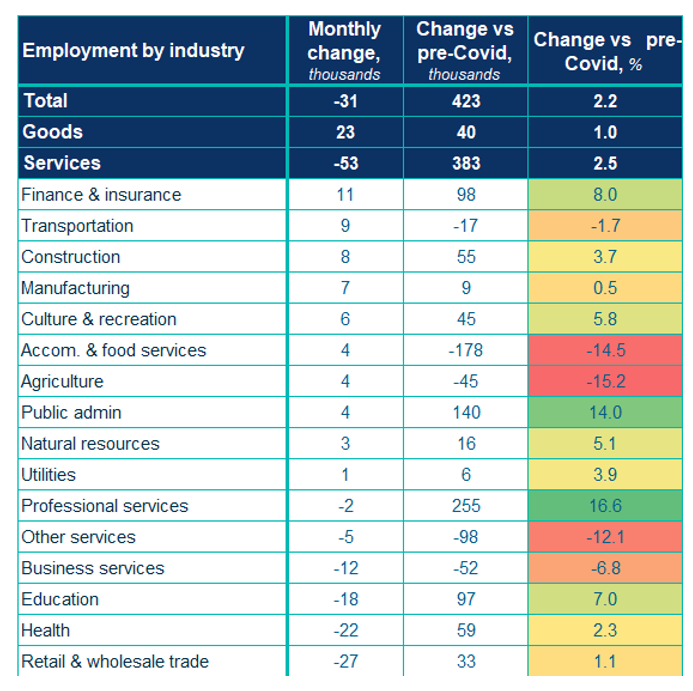

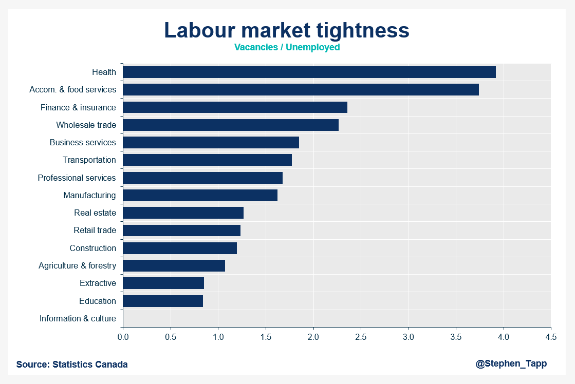

- In the services sector, employment fell by 53K, specifically wholesale and retail trade, health care and social assistance, and educational services. Conversely, there was a gain of net new positions of about 23K in the goods sector.

- Hours worked (on a monthly basis) declined by 0.5%. This is the third decline to hit 1.5% below the Q1 2022 peak in March. Persistent shortage of workers and lags in productivity will demand businesses rethink and retool existing jobs to maintain their bottom line and meet consumer demand.

- Average hourly wages of employees increased by 5.2%, matching the pace of previous months’ wage growth. While this is still below inflation, it increases the chance of a wage-price spiral that would further lift inflation above the Bank of Canada’s target.

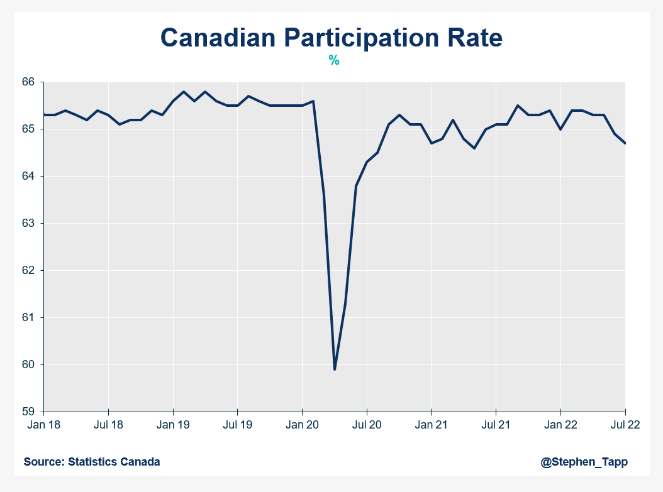

- Labour force participation decreased 0.2 percentage points to 64.7% following a 0.4 percentage point drop in June. The core-age labour force participation rate was 87.9% in July, well below the record high of 88.6% in March 2022.

- The labour market remains exceptionally tight with low unemployment-to-job-vacancy ratio – building up steadily prior to the pandemic. The not-so-great news is we are seeing it affect health care more severely despite increased labour demand in the industry. The good news is, on the whole, there is little warning that there is an increase in the rate at which people are changing jobs or changing employment status.

- All in all, July’s data were well below the consensus projections and will likely have an impact on GDP figures for Q3 2022.

Summary Tables

For more economic analysis and insights, visit our Business Data Lab.