Blog /

Goods Exporters Are Having a Hard Time: Key Findings from Business Insights Quarterly (Q1 2025)

As 2025 progresses, Canadian businesses — especially goods exporters — face mounting headwinds.

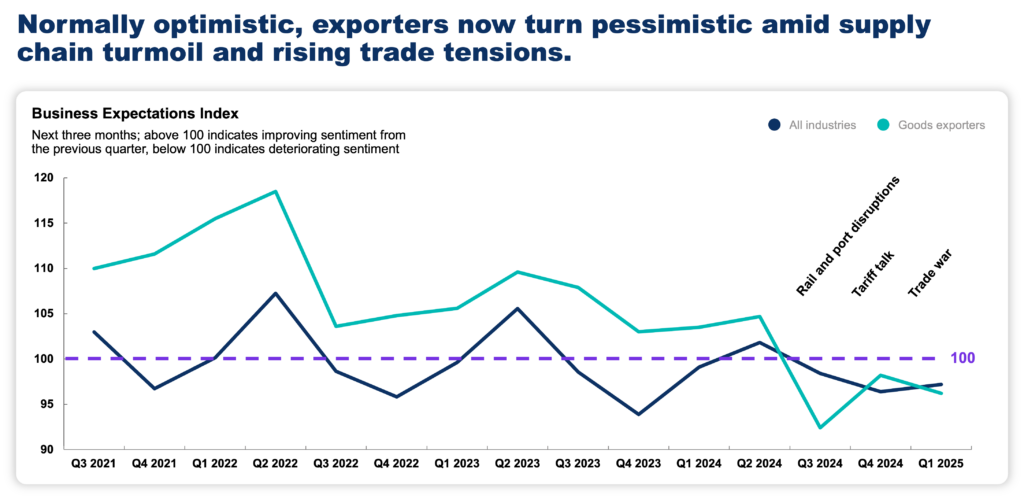

As 2025 progresses, Canadian businesses — especially goods exporters — face mounting headwinds. Given the current economic and trade environment, it comes as no surprise that in the latest Business Insights Quarterly, business sentiment remains weak for the third consecutive quarter, with exporters now trailing other businesses in optimism.

Business Outlook

Since Q3 2021, goods exporters have been more optimistic than the average — that changed in Q3 2024, when the rail and port disruptions hit, and Q4 2024, when trade policy uncertainty surged amid U.S. tariff threats. Though business optimism for goods exporters remains subdued, it has yet to show a clear recovery.

By Region

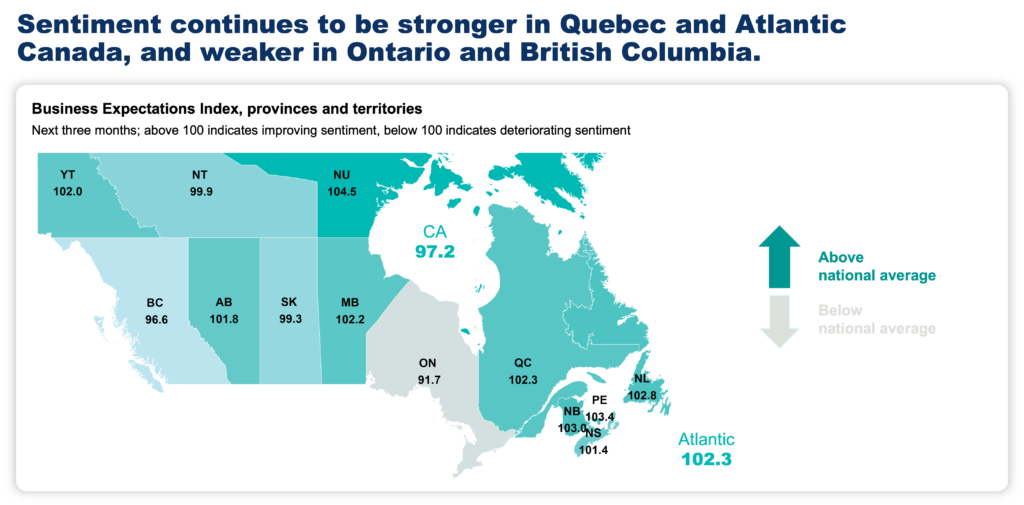

Ontario — Canada’s manufacturing and automaking hub — is the least optimistic province. Among major Canadian cities, business sentiment is weakest in Southwestern Ontario, particularly in Oshawa, London, and Hamilton, where trade-exposed industries are under strain.

9,785 business responses in January and February 2025.

By Business Size

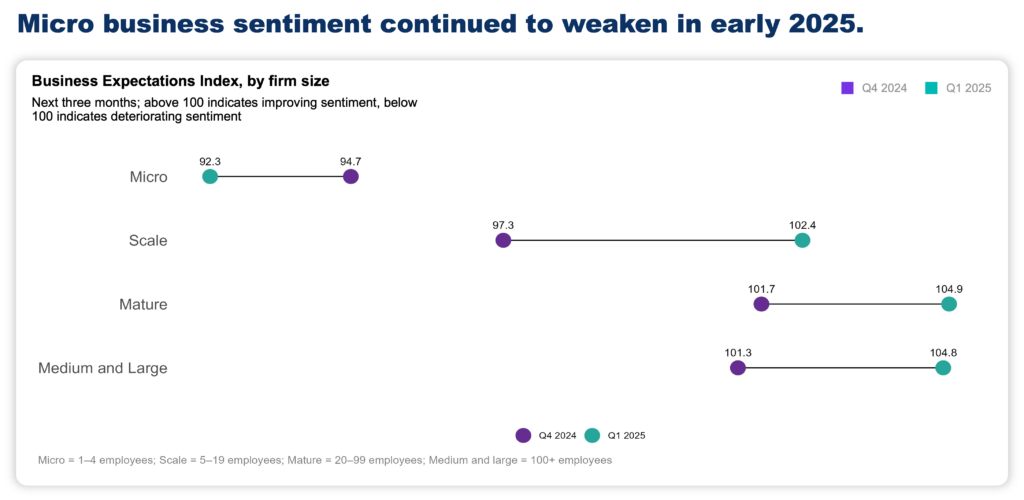

Among the four business sizes — micro (1–4 employees), scale (5–19 employees), mature (20–99 employees), and medium and large (100+ employees) — micro businesses remain the most pessimistic, with sentiment declining further from Q4 2024 to Q1 2025, while other business sizes remain steady.

9,785 business responses in January and February 2025.

Some good news: Despite current economic uncertainties, almost three-quarters (73%) of businesses maintain a positive outlook for the year ahead.

Business Obstacles

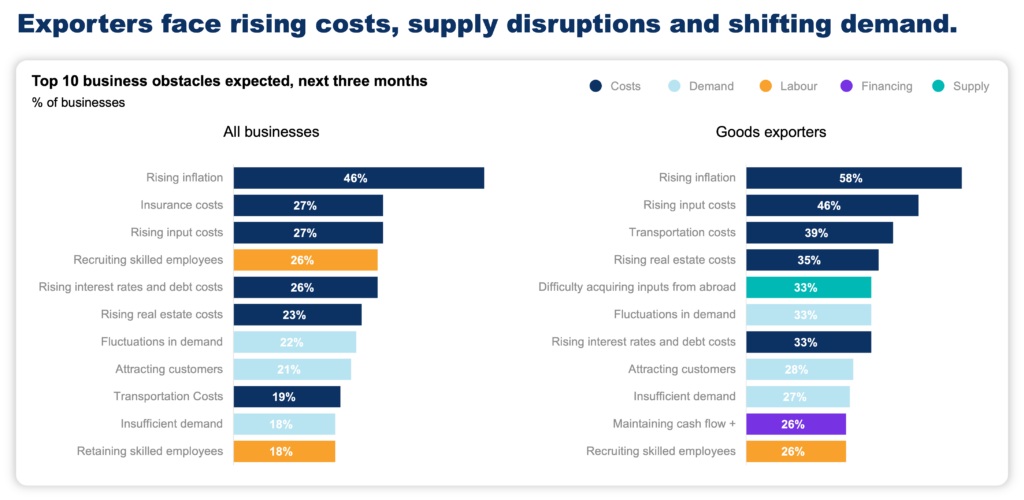

Rising inflation topped the list of business obstacles expected in the next three months for all businesses and for goods exporters.

By Obstacle Category

Cost pressures remain the top challenge, but concerns over consumer demand have intensified.

9,785 business responses in January and February 2025.

- Consumer demand overtook labour shortages as a top concern in Q4 2024, and this trend has continued into Q1 2025. This shift signals concerns about weakening consumer confidence and slowing spending amid rising trade uncertainty.

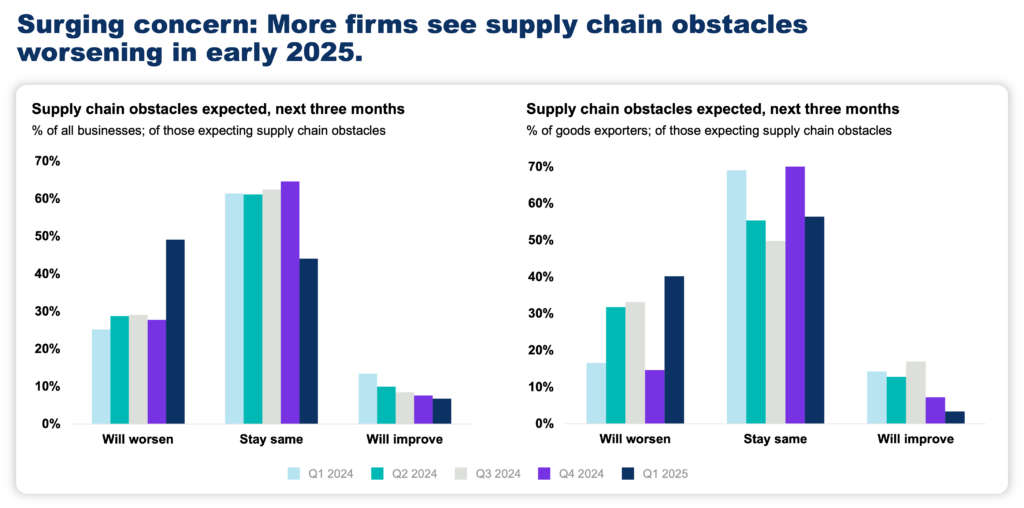

- More firms expect supply chain challenges to persist or worsen, with a 21% quarterly increase in businesses anticipating further disruptions — the sharpest jump in years.

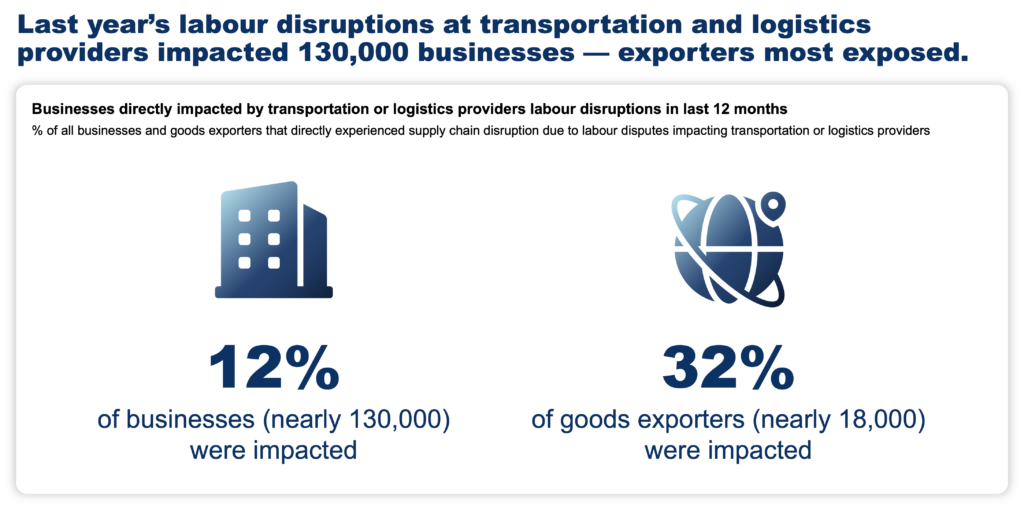

- Labour disruptions have left a lasting impact: Last year’s rail and port strikes affected nearly 130,000 businesses, disproportionately harming exporters who rely on trade-enabling infrastructure.

Pricing and Inflation

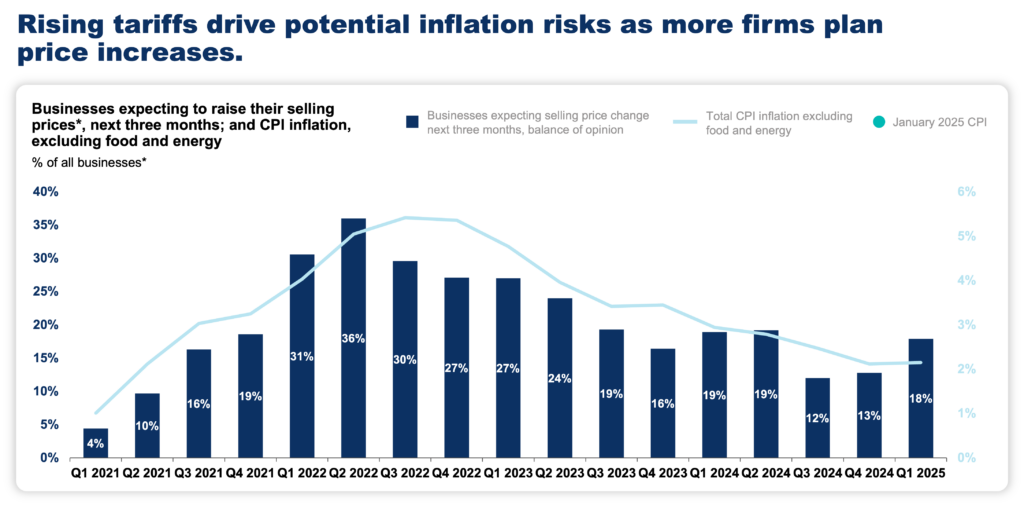

Despite inflation declining through 2024, concerns are resurfacing in early 2025, as more firms plan to raise prices for the first time in over a year. This shift coincides with new tariff measures that threaten to drive up costs, signaling a potential inflationary rebound in the short term.

Source: BDL analysis using on Statistics Canada’s Canadian Survey on Business Conditions and CPI data.

Supply Chains

Around 40% of goods exporters expect supply chain obstacles to worsen in the short term, while over half think they’ll stay the same.

Compared to last quarter, more goods exporters think supply chain woes will drag on for longer than six months:

- 40% expect difficulty acquiring inputs from within Canada (up from 31%).

- 57% expect difficulty acquiring inputs form abroad (up from 49%).

- 47% expect maintaining inventory levels (up from 31%).

Labour Disruptions

The last time Canada had as many work stoppages as it did in 2024 was almost 40 years ago. Last year’s labour disruptions at rail and ports impacted nearly 18,000 goods exporters, adding pressure to supply chains that have yet to recover.

9,785 business responses in January and February 2025.