“Canada’s economy is picking up steam as we wrap up the year, and we’re expecting growth in the fourth quarter close to 2%. Manufacturing is bouncing back, and oil and gas exports are on the rise, ahead of potential tariffs. If this momentum holds, it could influence the Bank of Canada to slow the pace of rate cuts in the new year. That said, we remain pessimistic about the challenges ahead, with tariffs, reduced immigration targets, and increased uncertainty clouding the outlook for businesses. With lower rates needed, it’s encouraging to see the economy on solid ground before we head into the holidays.”

Headlines

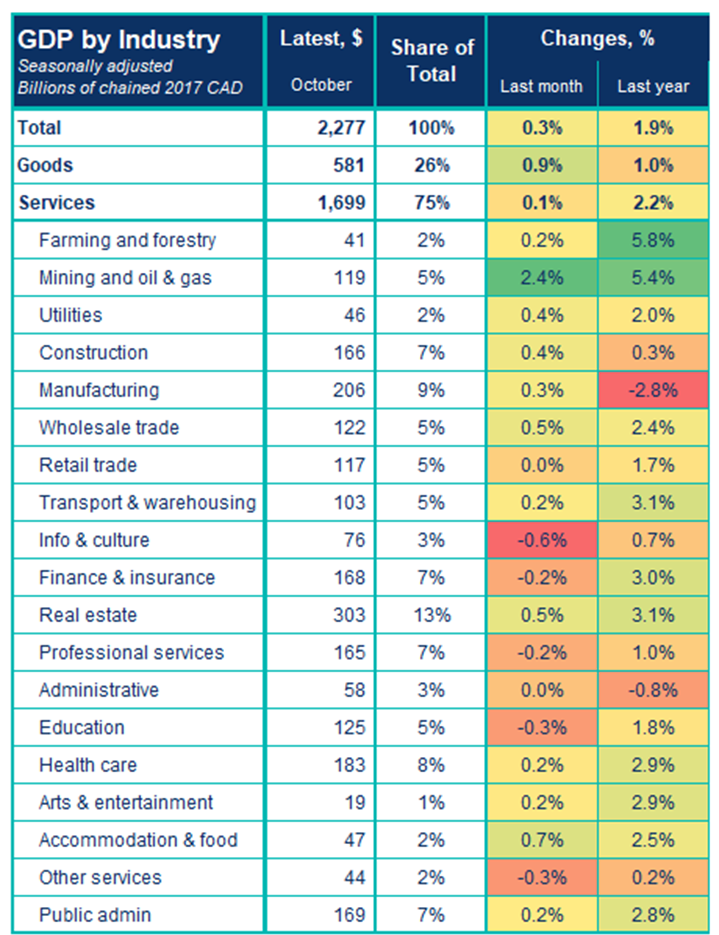

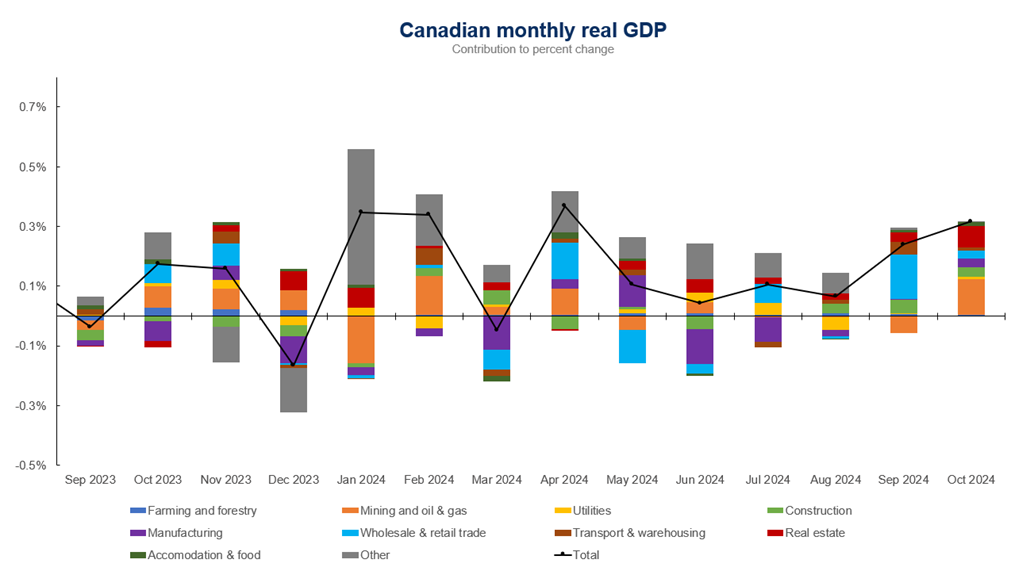

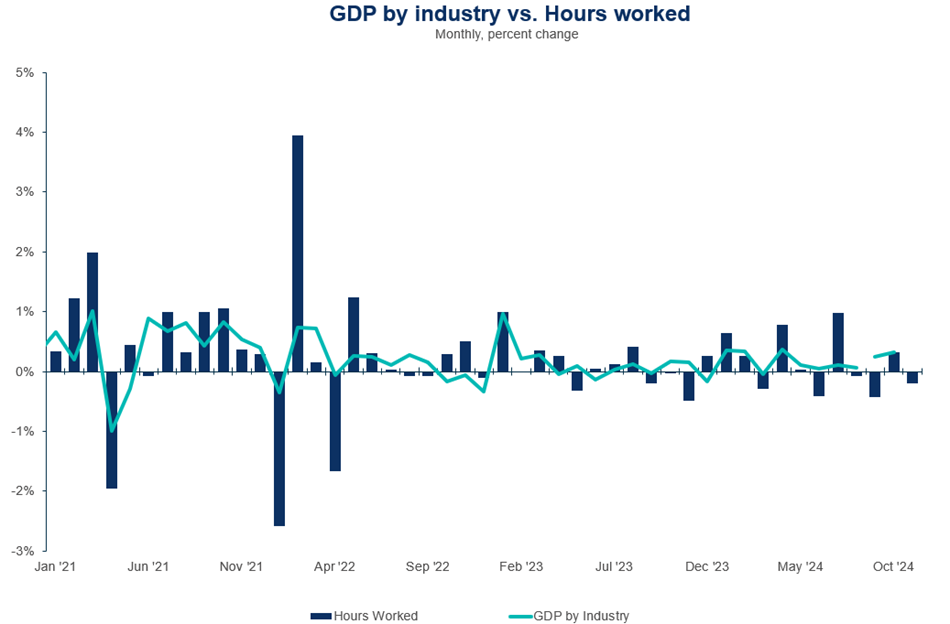

Real gross domestic product grew 0.3% in October, well above expectations of 0.1%. Upward revisions to September lifted its previous growth from 0.1% to 0.2%. Most sectors posted growth (12 of 20 sectors), with goods sectors leading growth this month (+0.9%), following four months of declining growth. The services sectors edged up 0.1%.

Movers and shakers

- Mining, Oil, and Gas Extraction: The sector grew by 2.4% in October, rebounding from months of sluggish performance due to maintenance at key facilities. Oil sands extraction surged by 5.2%, with some operations achieving record production levels. Mining operations also supported GDP growth, as several sites recovered from earlier operational challenges.

- Real Estate: The real estate sector was the second-largest contributor to October GDP, expanding by 0.5%. Increased home sales drove higher demand for real estate agents during the month. As interest rates ease, home sales activity is expected to continue rising.

- Manufacturing: The sector posted a modest 0.3% increase in October, supported by growth in non-durable goods after four consecutive months of decline. Petroleum and coal product manufacturing jumped by 3.8% as refineries resumed operations and ramped up production for export. However, durable goods manufacturing contracted, with machinery and equipment manufacturing leading the decline. While the sector has been relatively stagnant over the past year, October saw capacity utilization rates rise to their highest levels since June 2023. Higher sales and inventory drawdowns contributed to the month’s growth.

- Transportation and Warehousing: The sector grew by 0.2% in October, despite ongoing challenges from labor strikes and volatility. Gains in air transportation and pipeline operations offset declines in rail (-1.8%) and water transportation (-3.4%). Strikes at the Port of Montreal and eastern U.S. ports weighed on the subsector’s performance.

Outlook and implications

- The advanced estimate for real GDP in November suggests a slight contraction of 0.1%, putting fourth-quarter growth on track for an annualized 1.7%. This aligns closely with the Bank of Canada’s October forecast of 2% in their Monetary Policy Report.

- While the economy carried strong momentum into the fourth quarter, it appears to be losing steam. Hours worked, as reported in the Labour Force Survey, declined by 0.2% in November. The Canada Post strike is also expected to weigh on growth.

- The outlook for the Canadian economy remains uncertain. Export activity may see a temporary boost as businesses front-load shipments to avoid U.S. tariffs, but weak consumption demand leaves little to drive growth forward in the remaining months of 2024. The Bank of Canada is likely to lower its policy interest rate again in January, reflecting persistent economic slack. While the holiday GST rebate offers some relief for households, it’s far from enough to offset the broader challenges in the new year.

Summary table and charts

Source: Statistics Canada.

Sources: Statistics Canada; Canadian Chamber of Commerce Business Data Lab.