Blog /

Canadian GDP 2022Q3: The headline is much better than the details

Our Chief Economist, Stephen Tapp, digs into the details of today’s surprise headline for Canadian GDP of almost 3%, which reveals that the fundamentals are quite weak.

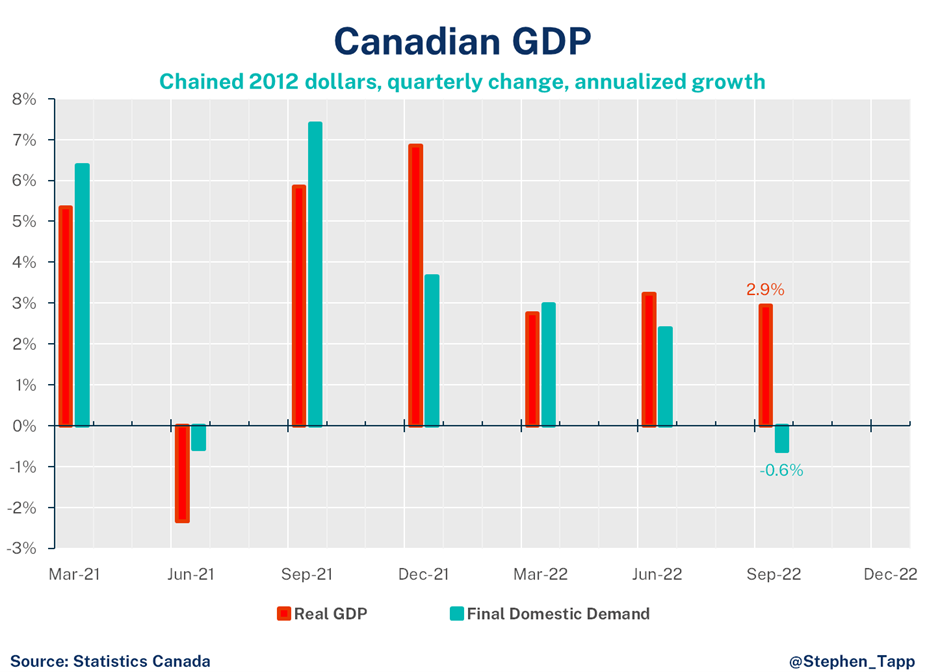

Today’s surprise headline for Canadian real GDP of almost 3% was much better than expected, however digging into the details reveals that the fundamentals are quite weak. Economic growth is still widely expected to slow in the fourth quarter and into the first half of next year, as the cumulative impact of rising interest rates and the slowing global economy take a toll.

Stephen Tapp, Chief Economist, Canadian Chamber of Commerce

Key Takeaways

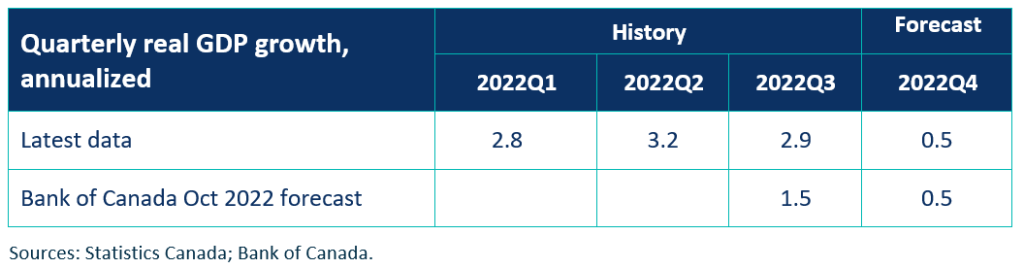

- Canada’s real gross domestic product (GDP) increased 2.9% in the third quarter of 2022 — a much better headline than expected by the Bank of Canada (1.5%) or the consensus market call (roughly 1%).

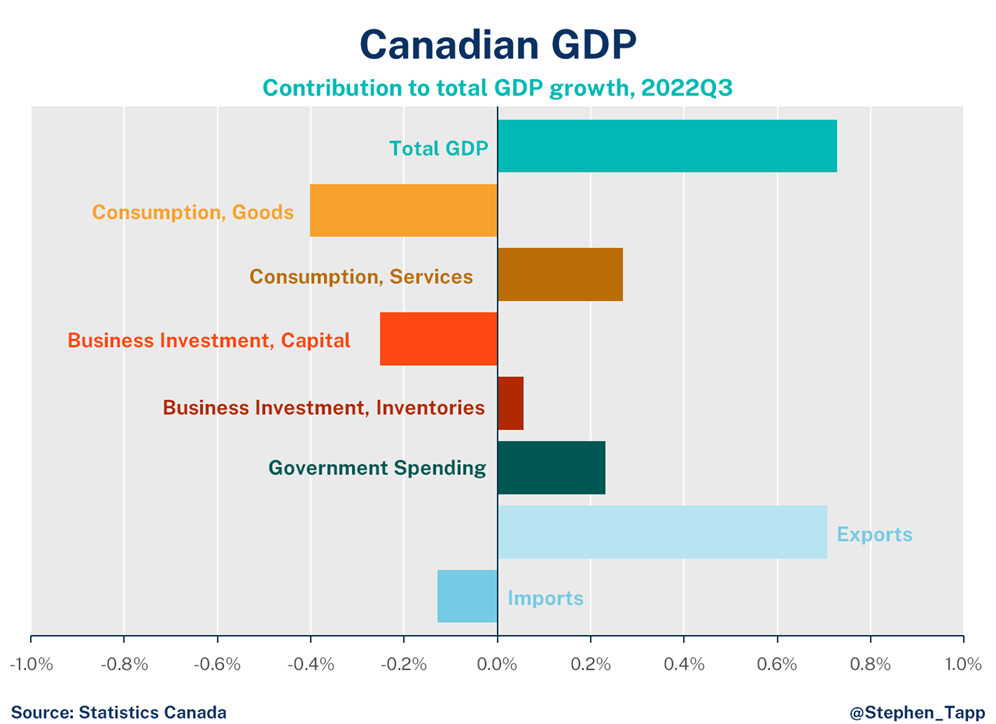

- That said, the details for the third quarter were much worse than the headline result, as final domestic demand fell (-0.6%).

- With the sharp rise in interest rates and faltering consumer confidence, consumer spending was down (-1.0%). This was due to falling goods spending (-1.7%), while services continued to recover (albeit at a slower pace than last quarter +0.9%, down from 4.2%). The household saving rate increased from 5.1% to 5.7%.

- Higher interest rates are also slowing the housing market, where investment fell for the second straight quarter (-15%).

- Business investment was weak once again this quarter (-5%).

- Businesses accumulated inventories, which added to growth. The stock-to-sales ratio rose to its highest level since 2020Q2, which doesn’t bode well for production in Q4.

- Trade saved the quarter: Net trade was by far the largest driver of growth in the third quarter. Exports rose (8.6%) led by oil and agriculture (including wheat, as this year’s harvest has impressed).

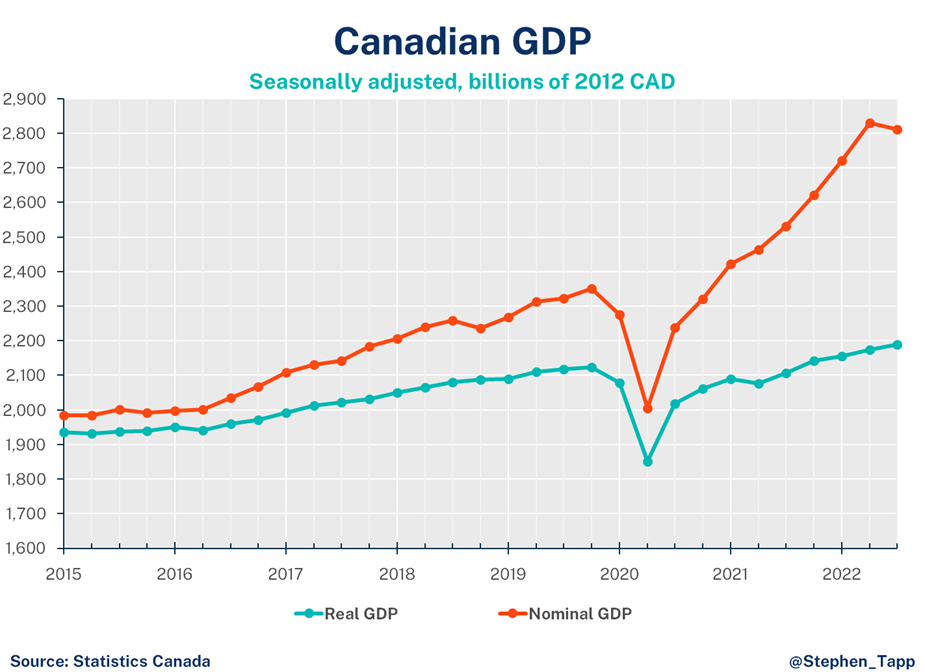

- Nominal GDP, which has been doing very well due to rising prices, fell (-0.7%). The GDP deflator was down -1.4%. Canada’s terms of trade took a big hit (-6.3%), and as energy prices fell, this pushed down real gross national income (-1.4%), its first decline since 2020Q2.

- Today’s release includes monthly details for GDP by industry, which shows 0.1% growth for September. StatCan’s flash estimate is for unchanged growth in October. Assuming no further changes in the fourth quarter, puts growth on track to slow materially to only 0.6%.

- Slowdown ahead: The weakness in key GDP components, such as consumption and housing, is expected to continue going forward. The Q3 inventory build-up won’t help business production in Q4, while investment intentions have also been shaky. We shouldn’t expect net trade to provide another boost to growth like in Q3. And nominal GDP finally fell as energy prices dropped. All told, we expect growth to slow at the end of the year and into 2023.

- The Bank of Canada’s October forecast acknowledged that two quarters of slightly negative growth was just as likely as two quarters with small positive growth. In other words, the Bank recently put ~50-50 odds on the likelihood of Canada’s economy experiencing the common definition of a “technical recession” in the short-term.

Summary Table

For more great #cdnecon content, visit our Business Data Lab.