Steady Inflation, anchored by gasoline prices

December 2025 CPI

“Headline inflation edged up to 2.4% in December, remaining within the Bank’s target range. While the overall print is not alarming, a closer look shows year-over-year price increases across most components, excluding gasoline. The acceleration in food prices—largely driven by the 2024 GST/HST tax break—was the largest contributor to the uptick. With inflation holding steady and employment posting modest gains in December, we expect the Bank to hold its policy rate at the upcoming decision.”

Summary

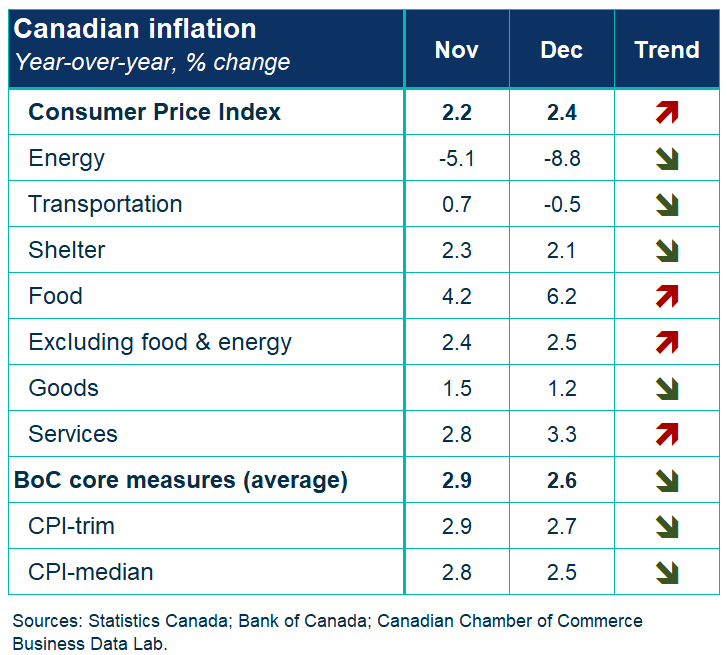

CPI rose 2.4% year over year in December, slightly faster than in November. The increase in headline inflation was largely driven by base-year effects stemming from the 2024 GST/HST tax breaks, which lifted prices for food items and alcoholic beverages. This upward pressure was partially offset by falling gasoline prices.

Adjusting for base effects, food prices rose 6.2% year over year, up from 4.2% in November, making food the largest contributor to December’s inflation. Price increases in alcoholic beverages (3.6%) and shelter costs (2.1%) were the next-largest contributors. However, without the base effects, the increase in food prices is down to 0.3% m/m from 0.8% in November.

Gasoline prices fell 13.8% year over year, providing a meaningful drag on headline inflation. Excluding gasoline, CPI rose 3.0%, accelerating from 2.6% in November.

The Bank of Canada’s core inflation measures showed further improvement. The average of CPI-trim and CPI-median declined to 2.6% from 2.9%, pulling the three-month annualized rate down to 1.7% from 2.3% in November—an encouraging sign that underlying inflationary pressures are easing.

Inflation accelerated across all provinces except British Columbia, with Prince Edward Island recording the fastest year-over-year increase.

Looking beyond the near-term data, inflation remains elevated from a household perspective. Over the past five years, average annual all-items CPI increased by 3.7%, while food and shelter prices rose by 5.4% and 5.0%, respectively—well above the Bank’s target range. Meanwhile, the five-year average of the Bank of Canada’s preferred core measures (trim and median) stands at 3.5% annually, underscoring the cumulative inflation burden facing households despite recent moderation in headline readings.

This CPI result reinforces our read of the situation that the Bank of Canada will hold its policy rate at the upcoming decision. With no clear signs of recovery and expecting uncertainty to intensify in 2026 -amid upcoming CUSMA negotiations and the evolving impact of AI on the labor market – we expect the Bank not to hike interest rates in 2026 as intended earlier.