Blog /

The end is near: Bank of Canada lowers interest rate to lower-end of the neutral range

The Bank of Canada lowered its interest rate to 2.25%.

An interest rate of two and a quarter percent isn’t free candy in this environment. The Bank of Canada’s decision to lower rates signals persistent economic concern as tariffs continue to be layered. Though it’s still unclear how the balance of risks between inflation and growth play out, the policy rate needs to be lower as excess capacity in the economy remains wide. As we wait for the Federal Budget next week, it’s unlikely the stimulus being signaled will alter the course of monetary policy this year.

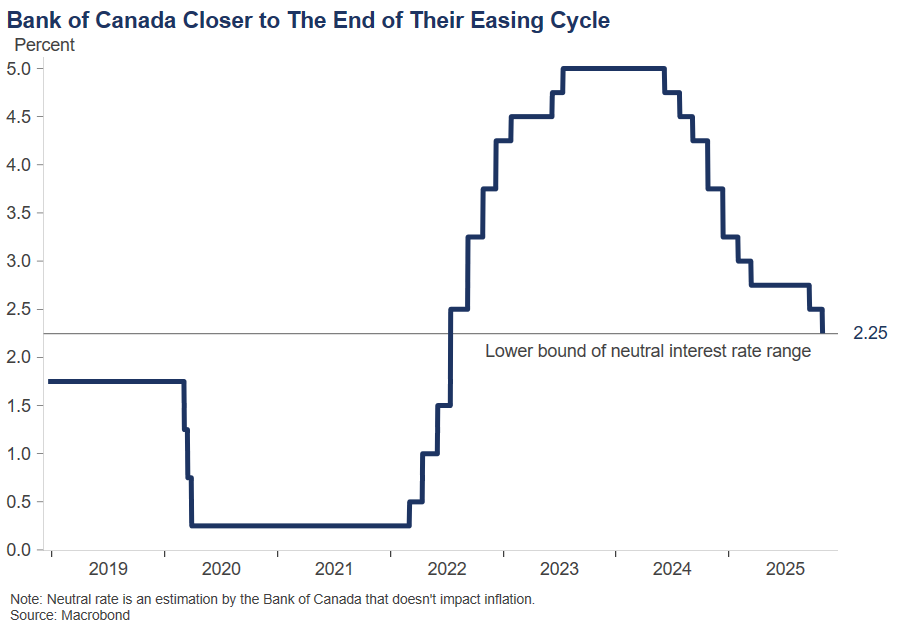

The Bank of Canada lowered its policy interest rate by 25 basis point to 2.25%. Interest rates have been reduced 100 basis points this year as the Bank tries to provide support to consumers and businesses during the uncertainty from U.S. tariffs.

Despite the Canadian economy showing significant wear in trade-exposed sectors, governing council noted in their decision that the policy interest rate is at “about the right level” to support growth and control inflation. These could be famous last words in the coming months. But it’s clear that we are nearing the end of the easing cycle in Canada. We’ll get a better sense of how uniform this belief is among governing council members in the summary of deliberations. The Bank stressed once again that the balance of risks between inflation and growth are to the downside.

The Bank released their October Monetary Policy Report (MPR) alongside their decision, reverting back to publishing a baseline forecast for the first time since January.

Economic outlook to remain weak

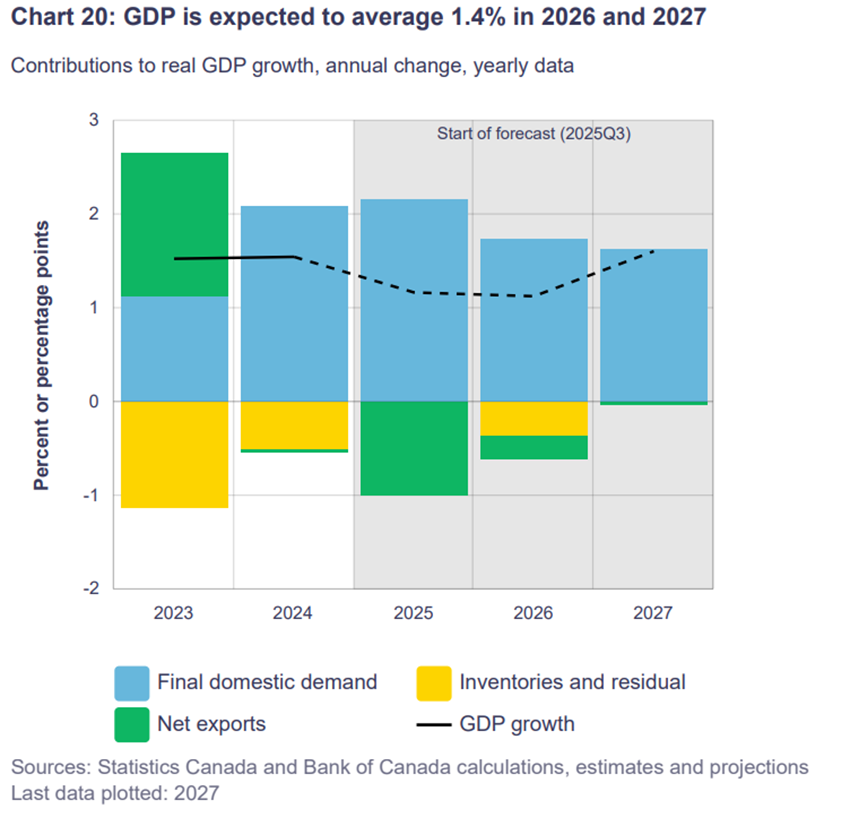

The Canadian economy is expected to grow 1.2% in 2025 (compared to 1.8% expected in January’s MPR). The second half of the year will be sluggish, only expanding 0.75%, with Q3 expected to grow about 0.5%, avoiding a technical recession.

Exports to U.S. continue to face high tariffs, with export growth to other markets partially offsetting some of the decline with the U.S. Domestic demand remains a bright spot for the Canadian economy, even when accounting for population. As population growth slows, the Bank expects this resilience will fade in 2026. The labour market is weak with the MPR noting that excess capacity will be absorbed only “gradually” over the forecast horizon.

The global economy is forecasted to grow 3.2%, up 0.1% from January’s report. This reflects upward revisions to growth in Europe. U.S. growth in 2025 is now 2.1%, down 0.5% from January. This could be further downside risk to Canada’s exports, even though trade with other markets have risen to offset the hit from less exports to the U.S.

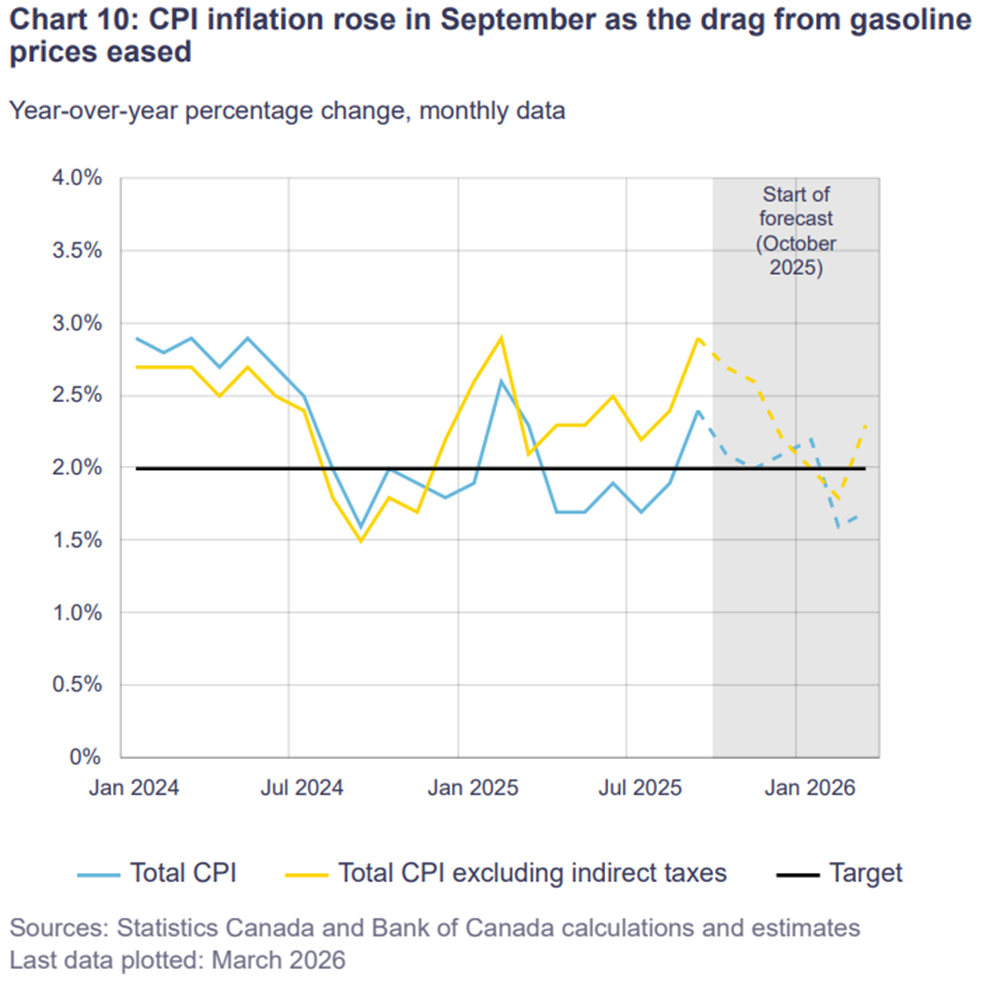

Inflation to grow near 2% target

Despite inflation rising to 2.4% in September, Governor Macklem signaled that the breadth and momentum of inflation point to subdued growth. A weaker economic backdrop will also keep price pressures subdued. As a result, inflation is expected to be lower over the forecast horizon compared to January’s MPR, averaging 2%.

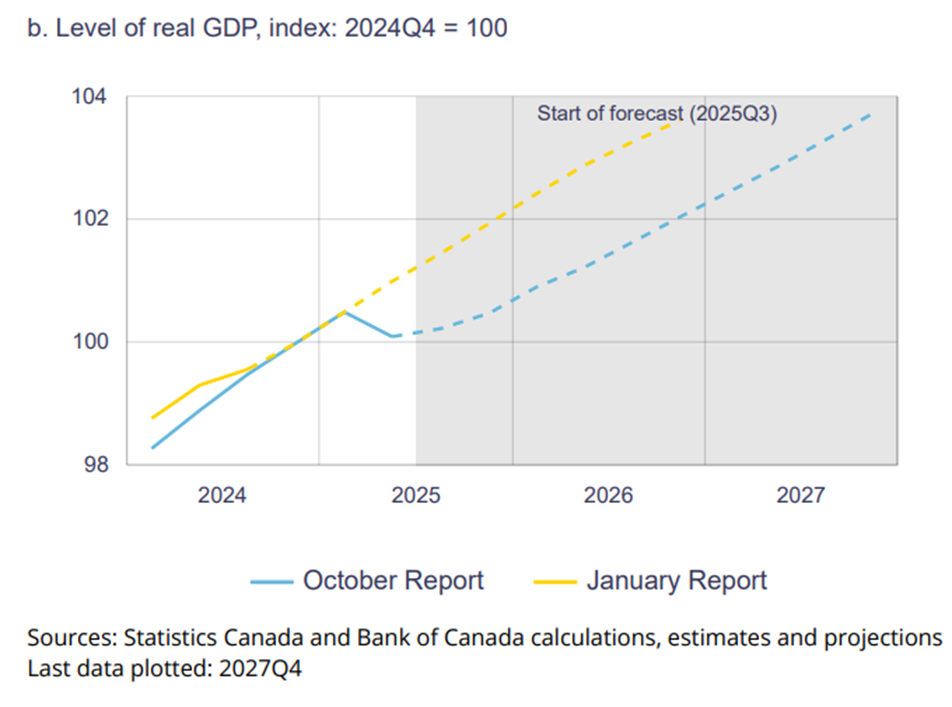

Economy is permanently smaller due to structural impacts from trade war

Governor Macklem made clear once again that the Bank is limited in supporting economic growth in this environment. The economy faces a structural shock from tariffs, which the Bank estimates has made the Canadian economy 1.5% smaller compared to January’s forecast by the end of 2026. The reasons for this lower path are equally put on weaker demand and lost capacity. Potential growth is also expected to be lower due to the trade shock and slower population estimates in the coming year.

Implications

The Bank of Canada was right to lower interest rates. We’ve been of the belief that rates should be near the bottom of the neutral range (2.25-3.25%) to support growth while balancing inflation risks. Further rates cuts aren’t out of the question but upcoming data will determine whether more support is needed. That said, we’re near the end of the easing cycle for the Bank of Canada.

The BDL’s nowcast expects the third quarter to grow 1.6%, though monthly GDP is suggesting 0.8% for the quarter. Markets have priced in no rate moves in the coming meetings. As Budget 2025 gets tabled on November 4, the role of fiscal policy will come into the spotlight. Government spending lags consumption as the second largest contributor to the forecast.