How to Undermine U.S. Manufacturing

Debunking Aluminum Tariff Myths

Canada supplies nearly half of all U.S. primary aluminum — and does it cleaner, cheaper, and more reliably than any other source. That aluminum feeds essential downstream industries in the U.S., from automotive and aerospace to construction and packaging. Yet in March 2025, the U.S. reimposed a 25% tariff on Canadian aluminum, threatening to raise costs, disrupt supply chains, and undercut domestic manufacturers that depend on stable, affordable inputs.

“We can just produce our own aluminum.””

Reality:

- U.S. aluminum smelters are running near full capacity and yet still fall short by 1.2 million tons per year — a gap Canada currently fills.

- U.S. smelters have been closing for decades due to high energy and labour costs. Electricity alone accounts for up to 40% of aluminum production costs and U.S. energy rates are 32% higher than Canada’s. At the same time, U.S. labour rates are 31% higher than in Canada.

- Building new smelters is not a short-term fix. Even with a $500 million Department of Energy grant, Century Aluminum’s planned U.S. facility won’t be operational for at least three years.

- Reshoring would increase production costs by US$350–600 per ton, a ~9% rise that would make U.S. companies spend billions more annually across key sectors.

“We can just import aluminum from somewhere else.”

Reality:

- A switch from Canada doesn’t solve the dependency problem — it just moves it farther away and makes it more expensive.

- Other major exporters like China, Russia, and the Middle East come with risks:

- China: National security, regulatory scrutiny, and ESG concerns.

- Russia: Sanctions and supply chain uncertainty.

- Middle East: Long shipping distances and volatile energy costs.

- Canadian aluminum is shipped overland and hydro-powered, making it low-cost, low-carbon, and logistically efficient.

- Shifting away from Canada would mean longer lead times, higher costs, and less predictable delivery — exactly the kind of friction American manufacturers can’t afford.

- Even if the U.S. ramped up smelting, it would still rely on imported raw materials as U.S. bauxite reserves are negligible.

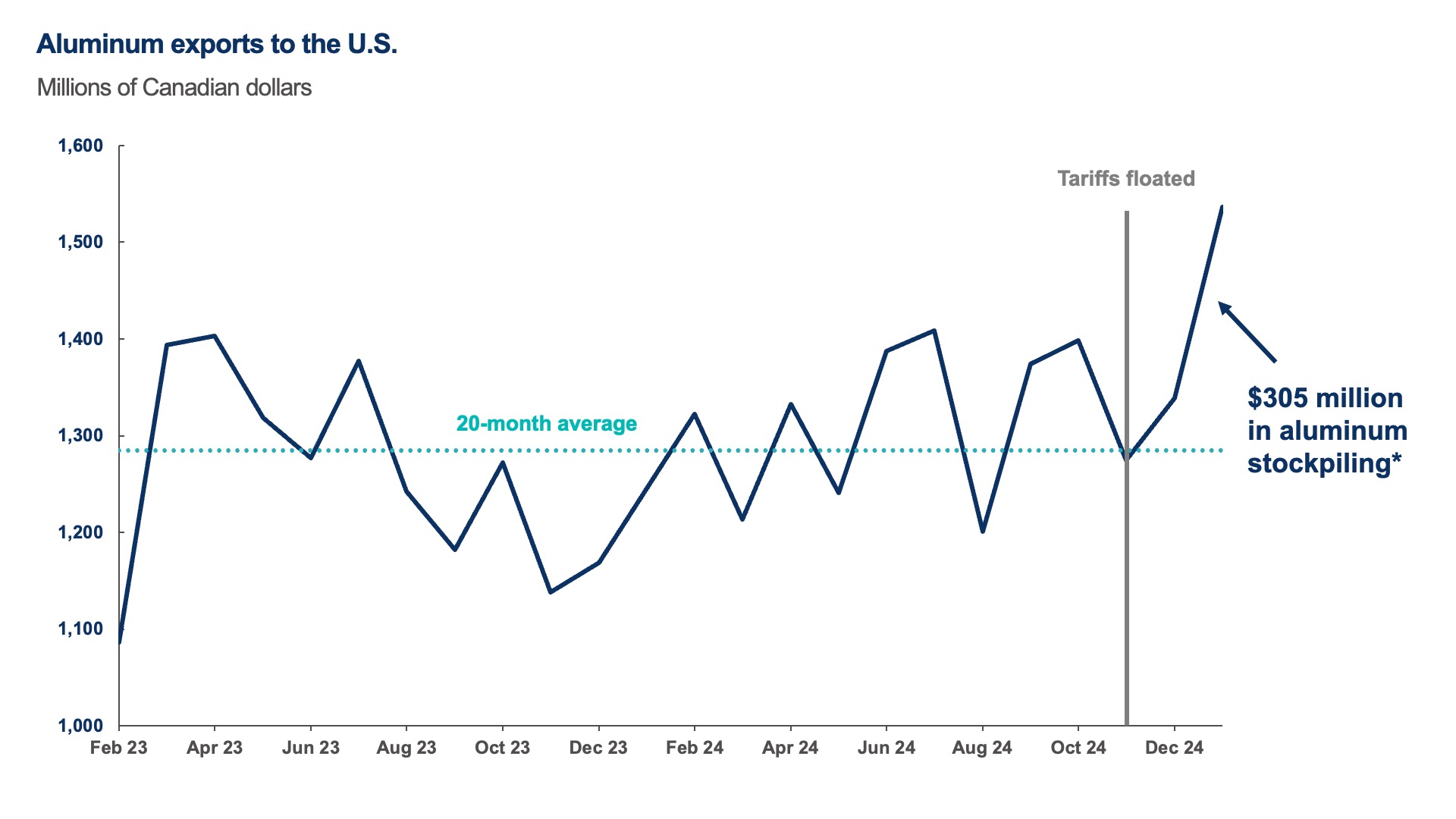

- Recognizing that tariffs were bad for business and disruptive to supply chains, Canadian aluminum exports to the U.S. spiked $305 million after the incoming U.S. administration rolled back aluminum tariffs in late 2024.

Aluminum Stockpiling Surges Ahead of U.S. Tariff Deadline

*Note: Based on recent above-average monthly export data

“Tariffs will help American workers.”

Reality:

- Aluminum is an input, not a finished product. The U.S. specializes in downstream aluminum fabrication (sheets and coils) that depends on steady and affordable access to Canadian raw aluminum.

- In 2023, U.S. firms imported $7.56 billion USD in Canadian aluminum. A 9% cost hike on that volume equals hundreds of millions in new input costs that will be passed along to auto buyers, homebuilders, and consumers.

- Cities like Detroit, Louisville, Kansas City, San Antonio, and Nashville — all manufacturing hubs — are among the most export-dependent on Canada. Tariffs in these communities won’t revive production, they’ll raise costs for U.S. manufacturers, shrink margins, and risk local jobs.

Tariffs on Canadian aluminum are a tax on U.S. industry, disguised as protectionism.They won’t bring smelters back online. Instead, they’ll raise prices, shrink margins, and pass costs down to U.S. consumers. Not only that, but they’ll also weaken America’s trade relationship with its closest and most stable partner — all while offering no viable path to self-sufficiency. If the goal is to reshore strategically, the U.S. needs policies that make its production more competitive, not punitive measures that tax American manufacturing in the name of nationalism.

Sources

Analysis by the Canadian Chamber of Commerce’s Business Data Lab (BDL), based on trade data, industry benchmarks, and sector-level impact estimates to assess the potential effects of U.S. tariffs on supply chains, consumer costs, and cross-border production.

- S. Aluminum Manufacturing: Industry Trends and Sustainability (2022)

- Century Aluminum Selected by U.S. Department of Energy to Receive $500 Million Investment to Build New Green Aluminum Smelter to Accelerate Industrial Decarbonization (2024)

- Which American Cities Are the Most Export-Dependent on Canada? (2025)