Blog /

Canada’s real GDP growth slowed down in the third quarter of 2024

Canada’s economy grew by 1.0% on an annualized basis in the third quarter.

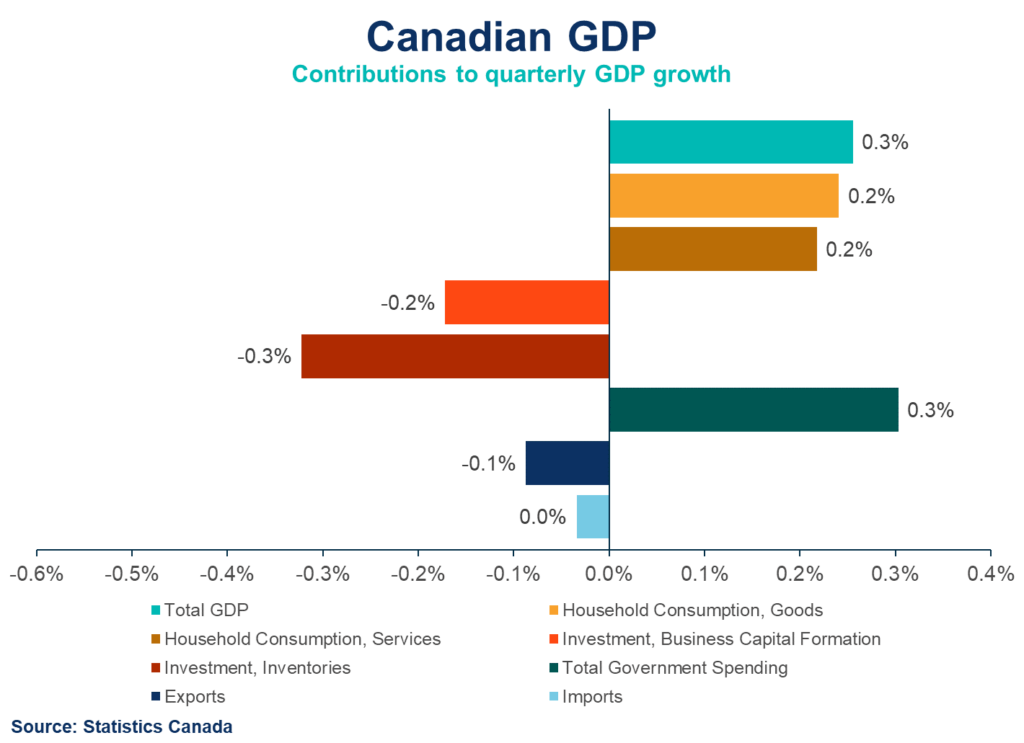

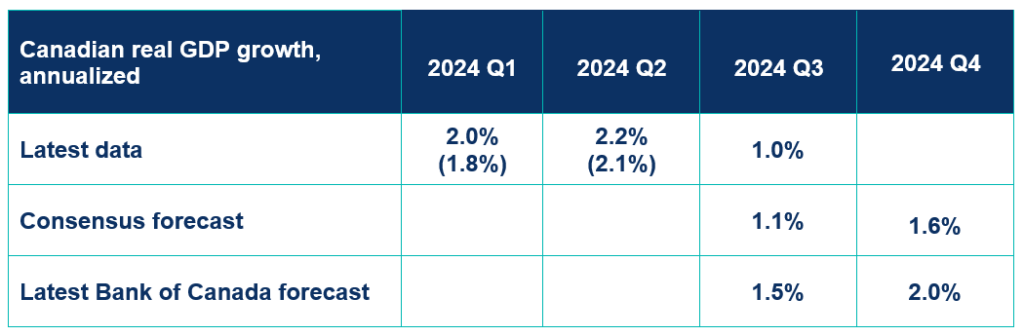

Canada’s economy grew by 1.0% on an annualized basis in the third quarter. This is close to the 1.1% expected by markets and slightly below the 1.5% expected by the Bank of Canada. Growth in government and consumer spending offset declines in business investment and international trade.

The big picture story is that Canada’s economy continues to underperform its peers and its own potential. Remarkably, real GDP per capita fell for the sixth straight quarter. Looking ahead to 2025, there are two big looming negative shocks, which if realized, would make things very challenging: 1) Trump’s new tariff threats; and 2) a significant slowdown in the government’s immigration targets. In this climate of heightened uncertainty, it’s hard to imagine business investment or international trade being strong contributors to Canada’s growth on a sustained basis over the coming year. As such, there continues to be a strong case for the Bank of Canada to deliver another 50-basis point cut in December. Interest rates should be supporting, not restraining economic activity at this time.

- Stephen Tapp, Chief Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

- Canada’s real gross domestic product (GDP) grew by 1.0% annualized in the third quarter, aligning closely with the 1.1% forecasted by markets and slightly below the 1.5% anticipated by the Bank of Canada.

- Real GDP per capita declined by 0.4% in Q3, marking its sixth consecutive quarterly decrease.

- Monthly GDP by industry showed a modest 0.1% growth in September, closing the quarter slightly below StatCan’s initial 0.3% flash estimate. The preliminary flash estimate for October is also 0.1%, suggesting continued positive momentum and a likely growth rate of around 1.5% for Q4.

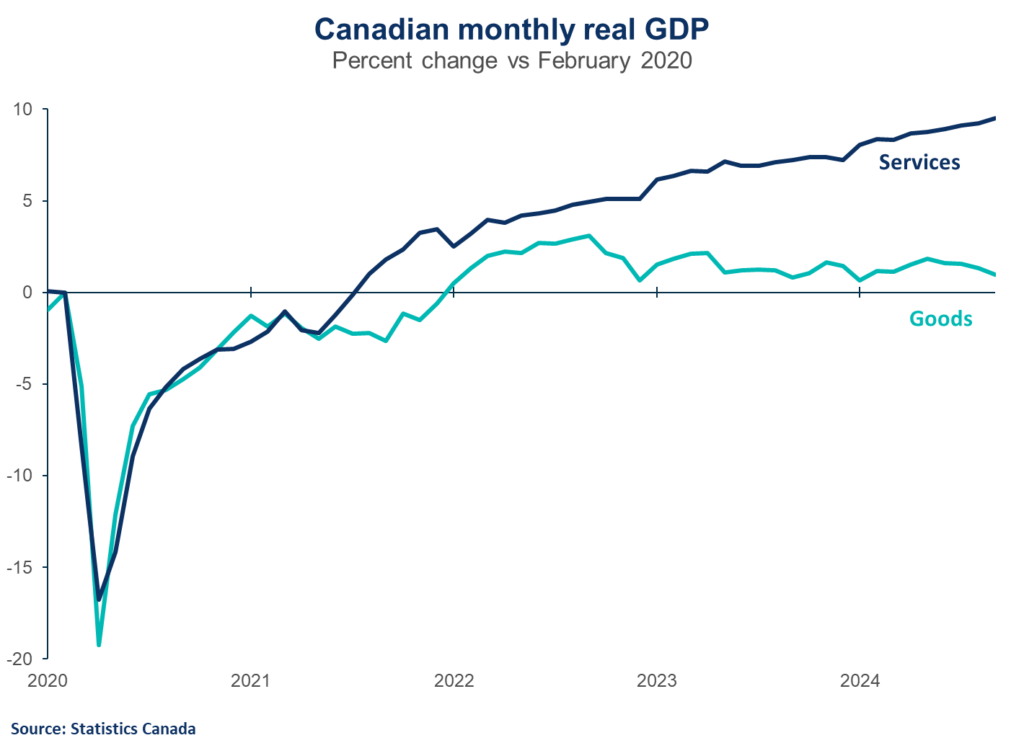

- Key contributors to growth in the third quarter were government spending (+4.5% annualized) and household spending (+3.5%). Employee compensation remained robust, despite Canada’s weak productivity performance. As a result, the household savings rate hit a three-year high at 7.1% in the third quarter, as households set aside some additional funds for mortgage renewals and rainy days.

- Business investment reversed course in Q3 (-3.6%) following a short-lived pick up in Q2 (+3.3%). There was a broad-based decline in corporate income on the quarter, outside of energy and financial companies.

- Exports of goods and services declined 1.1%, while imports edged down 0.4%.

- Final domestic demand grew by a decent 2.4% in Q3, slightly ahead of its previous quarter (2.3%).

OUTLOOKS AND IMPLICATIONS

The Canadian economy grew roughly as expected by market watchers during the quarter. This represents only a modest miss relative to the Bank of Canada’s previous expectations.

The bigger concern is the uneven composition of Canada’s growth, with government and households driving gains, while business investment and trade weigh on growth. Looking ahead, business investment will likely hesitate given heightened policy uncertainty south of the border, including tariff threats by Donald Trump. If realized (even with exemptions), these threats could dramatically disrupt bilateral trade flows.

The odds of another 50-basis-point cut from the Bank of Canada increased slightly this morning after the release. Markets are currently pricing this as roughly a toss-up (i.e., a 36-basis-point cut is priced in, implying a 43% chance of the larger move). Of course, this could change as we get closer to the Bank’s December 11 decision date, and upcoming labour data could prove pivotal.

If even a modest chance of a full-blown tariff war scenario materializes in 2025, Canadian policymakers would be wise to act preemptively and remove monetary policy restrictiveness with urgency.

SUMMARY TABLES

Note: Previous data shown in parenthesis.

Sources: Statistics Canada; Bank of Canada Monetary Policy Report, October 2024.