Blog /

Labour Force Survey October 2024: Job Market Remains Under Pressure

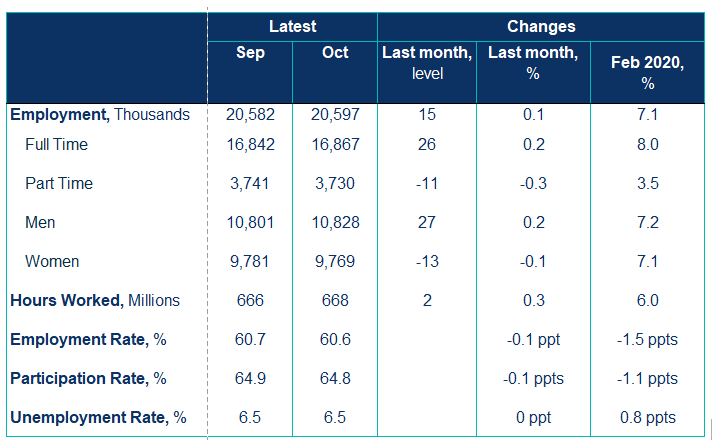

Canada saw modest job gains of 15,000 in October, falling short of market expectations of 27,000, while the unemployment rate held steady at 6.5%.

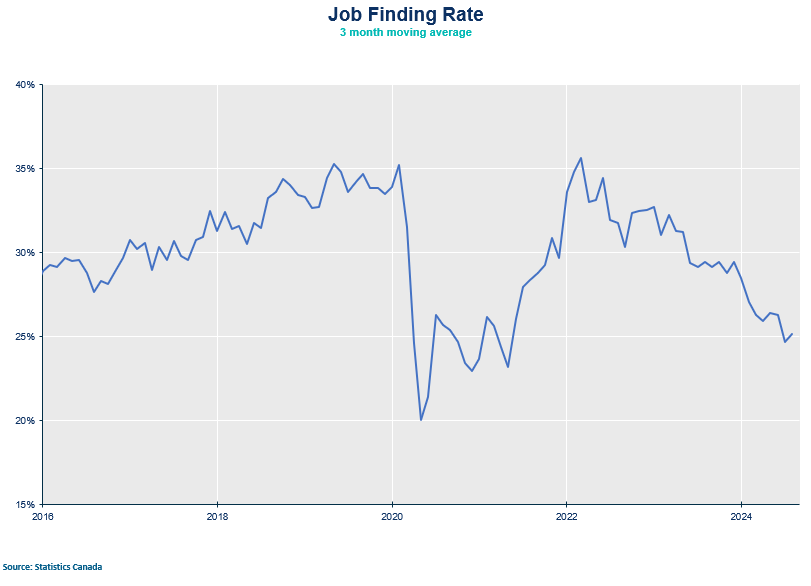

Canada saw modest job gains of 15,000 in October, falling short of market expectations of 27,000, while the unemployment rate held steady at 6.5%. As labour demand dwindles, workers are having a harder time finding jobs, even if layoffs have not surged. Notably, the participation rate fell to its lowest level since 1997, outside of the pandemic, which presents further challenges to future economic growth.

The main takeaway here is that Canada’s job market continues to soften, and the rising downside risks to growth increase the probability of the Bank of Canada delivering another 0.5% rate cut in December.

- Alissa Gorelova, Economist, Canadian Chamber of Commerce

KEY TAKEWAYS

- Canadian employment increased by 15K (+0.1%) in October, below market expectations of 27K. This was driven by increases for core youth employment aged 15 to 24 (+33K; 1.2%), with the youth employment rate rising 0.4 percentage points to 54.4% for the first time since April. However, youth continue to face difficulties finding jobs, as the youth employment rate is down 2.7 percentage points compared to last year.

- The unemployment rate holds steady at 6.5%. Youth unemployment rate fell 0.7 percentage points to 12.8% in October, declining from its recent peak of 14.5% in August.

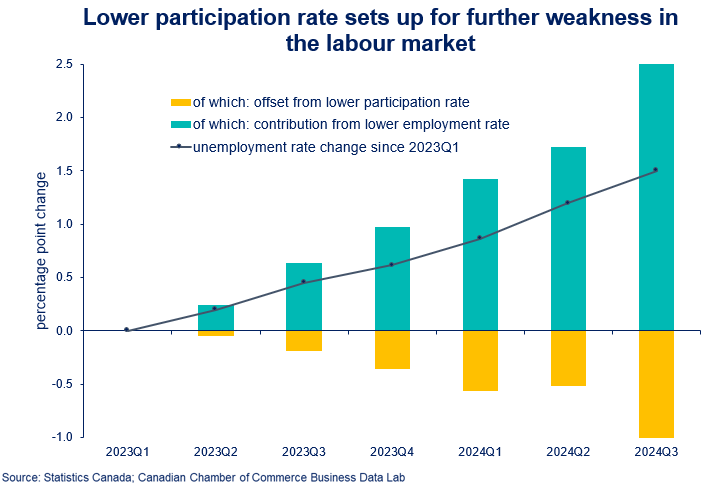

- Labour force participation fell 0.1 percentage points to 64.8% in October — the lowest since December 1997 (excluding the years 2020 and 2021, during the pandemic). Labour participation continues to edge down across most major demographic groups, but particularly for youth aged 15 to 24, highlighting further weakness in the labour market.

- Total hours worked rose 0.3% on the month and were up 1.6% on a year-over-year basis, alleviating concerns in September from weaker hours.

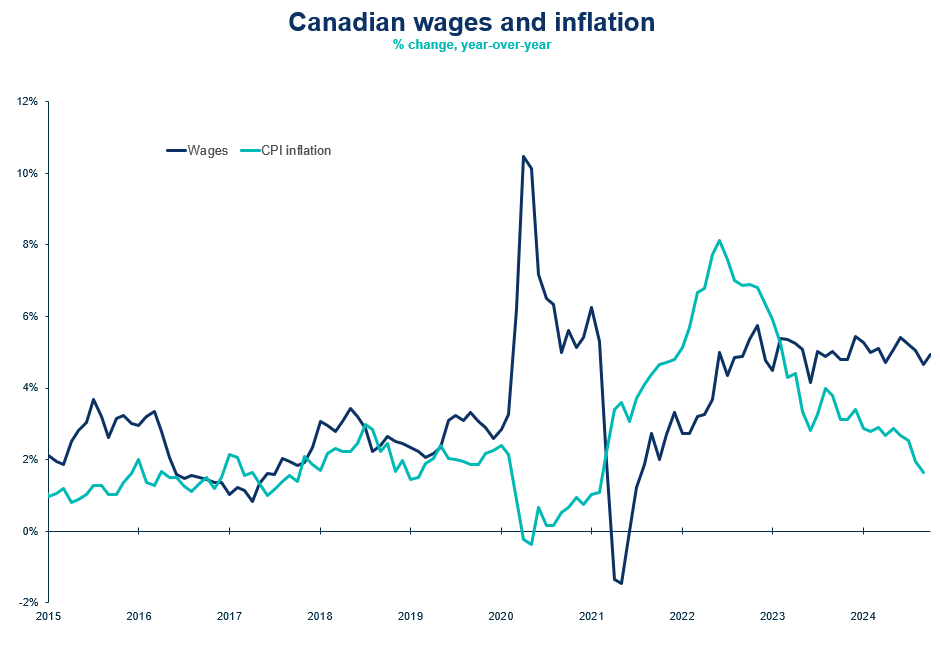

- Average hourly wages rose 4.9% on a year-over-year basis compared with 4.6% in September. The evolution of persistent wage pressures will remain a factor in the next policy rate decision.

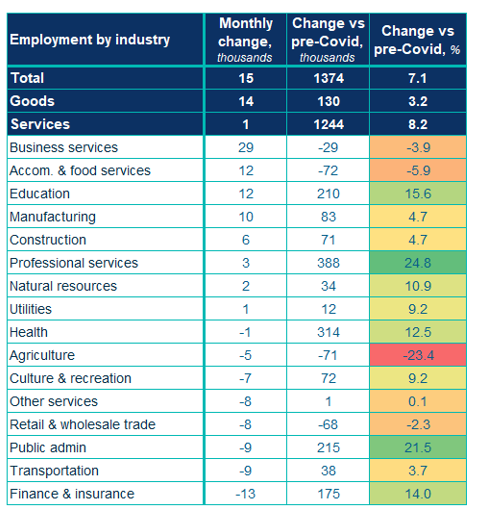

- Employment gains were concentrated in business, building and other support services industry, rising by 29K (+4.2%) in October, for the first time since May. Employment in finance, insurance, real estate fell by 13K (-0.9%) but continues to outpace employment growth across all industries (+1.5%). Public administration employment fell by 0.7% in October but has maintained a strong upward trend in the year until July 2024.

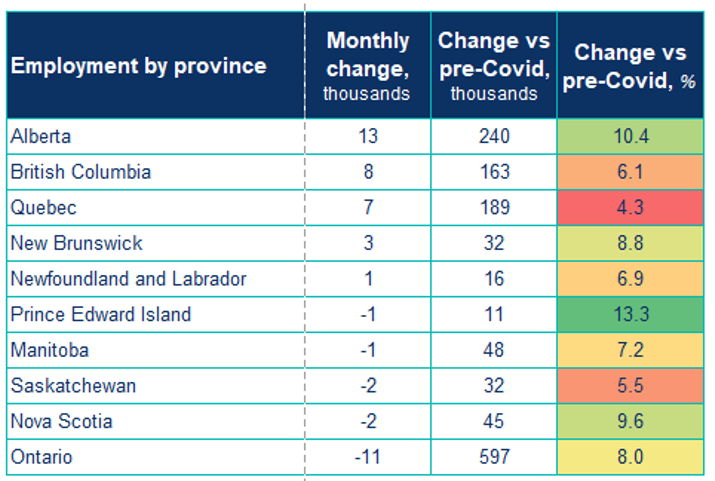

- Regionally, provincial employment increased in Alberta (+13K, +0.5%) and New Brunswick (+3.3K, +0.8%), while PEI saw declines (-1.1K, -1.2%) and Ontario and Quebec saw little overall employment change in October.

SUMMARY TABLES

CHARTS