Blog /

July 2023 CPI: Inflation got hotter in July, but it was mostly expected.

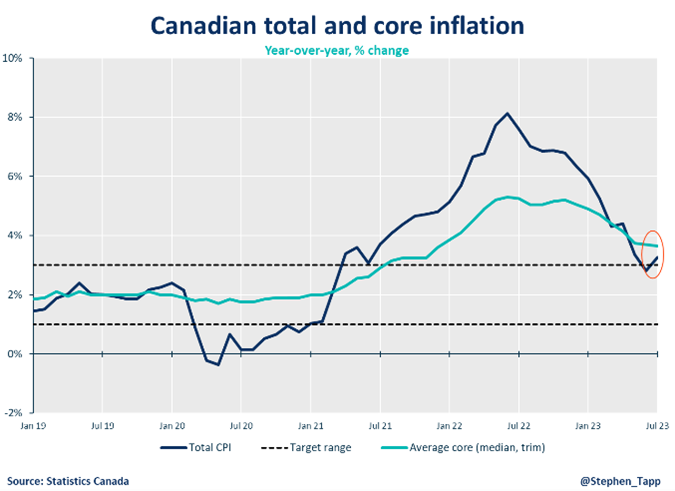

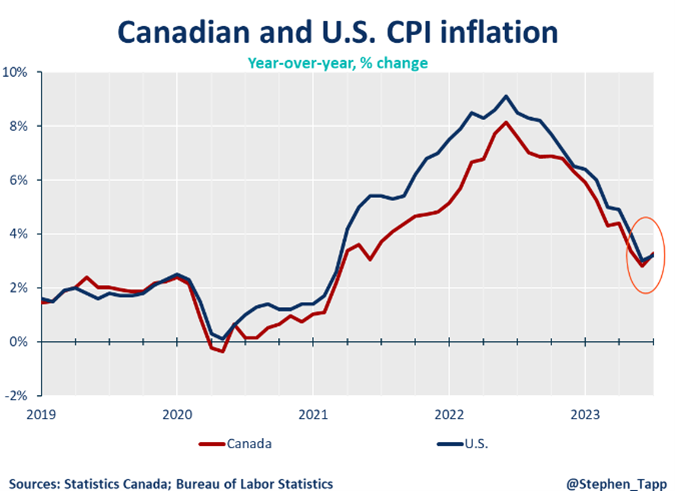

After a cooling streak, higher than expected Canada’s headline CPI inflation had an uptick in July to 3.3% (as compared to the anticipated 3.0%) on a year-over-year basis.

As frustrating as today’s headline inflation figure of 3.3% may be – given it was up from 2.8% in June and higher than market expectations – the change of trajectory from recent months was not entirely surprising. So much of the downward momentum and cooling that we’ve seen over the past few months has been overstated progress from soaring gas prices a year ago. While those effects have now peaked – and heftier grocery bills, mortgage interest rate costs and energy prices remaining a pain point for Canadian consumers – we’re now getting a chance to focus on the real work that remains ahead.

Does this signal another policy hike is in store for Canadians next month? With sluggish progress on the Bank of Canada’s core measures, it’s not entirely out of the question. We might need to see how June’s GDP data fares come on September 1. This will signal whether further tightening is necessary.

Marwa Abdou, Senior Research Director, Canadian Chamber of Commerce

KEY TAKEAWAYS

HEADLINE

- After a cooling streak, higher than expected Canada’s headline CPI inflation had an uptick in July to 3.3% (as compared to the anticipated 3.0%) on a year-over-year basis.

- After a recent steady cooling streak, Canada’s annual inflation rate dropped to a 27-month low of 2.8% in June led by lower energy prices from a year prior when Russia invaded Ukraine. As those effects have peaked, the real work has been making headway on the Bank of Canada’s core measures.

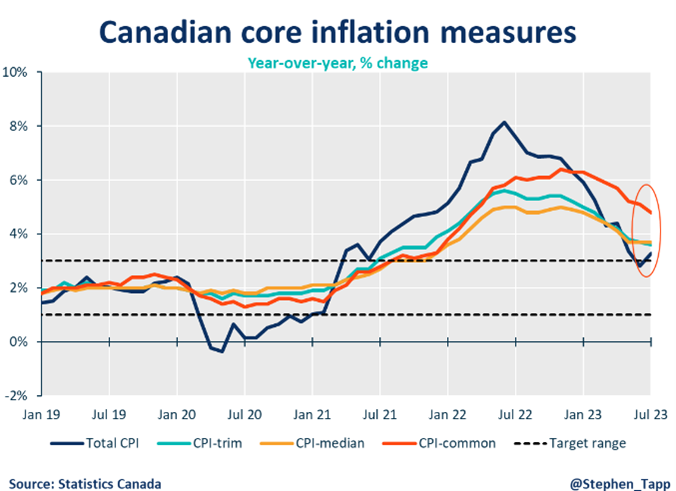

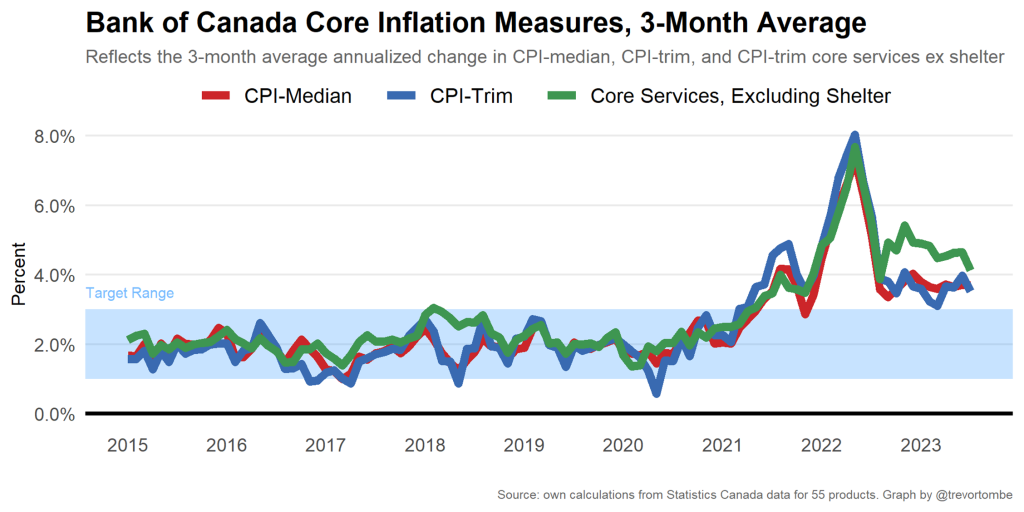

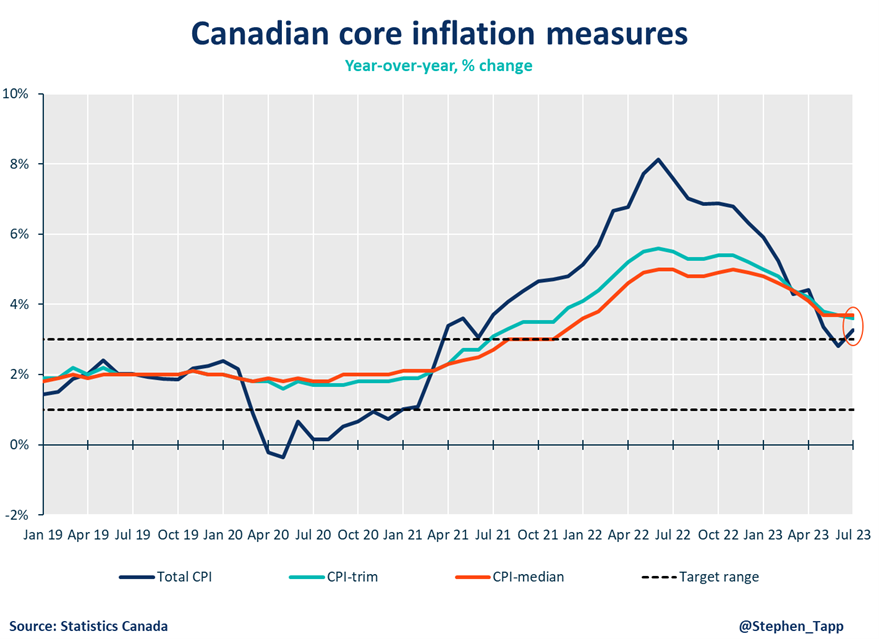

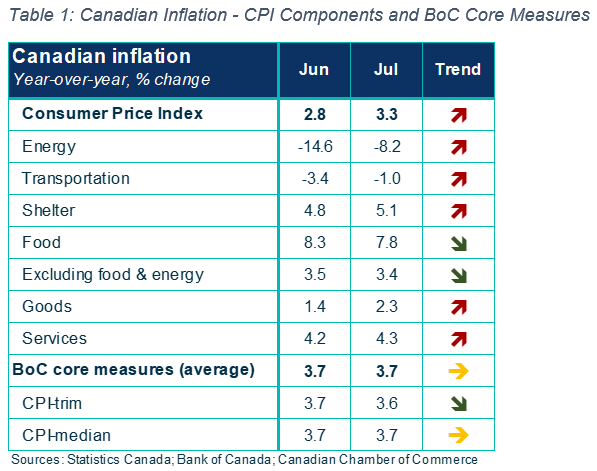

- Overall, there hasn’t been significant progress on core measures. While headline inflation accelerated, the average of two of the Bank of Canada’s core measures of underlying inflation, CPI-median and CPI-trim, came in at 3.7% (unchanged from June) and 3.6% (compared to 3.7%)

CPI COMPONENTS

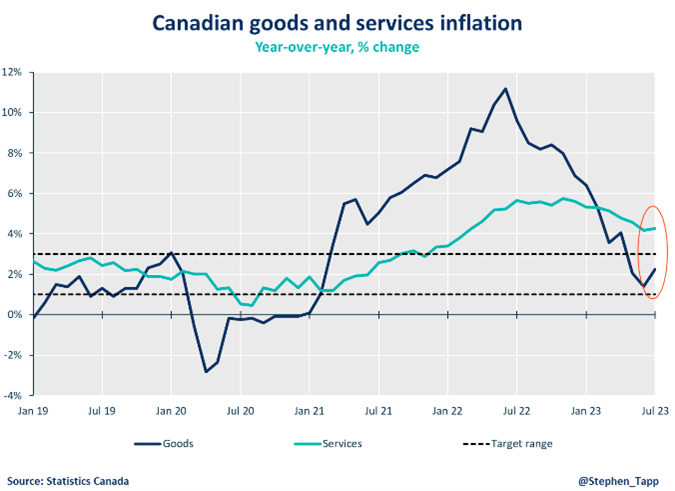

- Excluding food and energy, prices rose 4.1% compared with a 4.0% rise in June.

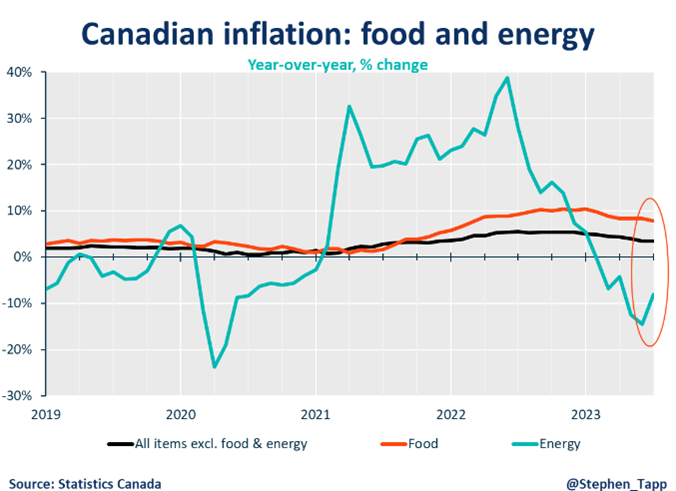

- Though gas prices were still below year-ago levels in July (-12.9%), the decline was smaller than in June (-21.6%). This is also a result of base-year effects and prices remaining nearly unchanged on a month-over-month basis in July.

- One bright spot in the data has been the cooling of prices for travel-related services as compared to last year when COVID restrictions had lifted, and demand peaked post-pandemic. Traveler accommodation prices continued to slow (4.2% vs. 12.9% in June). Prices for travel tours also slowed (1.2% vs. 6.8%). In addition, airfares were down 12.7% compared with last July, after falling by 3.5% in June.

- One major pain point for Canadian consumers has been grocery prices which had been consistently running hot. While prices remain elevated, another ray of light is that we’re seeing a slower pace of growth (8.5% vs 9.1% in June) by way of fresh fruit and, to a lesser extent, baked goods.

PROVINCIAL INFLATION & REGIONAL NOTES

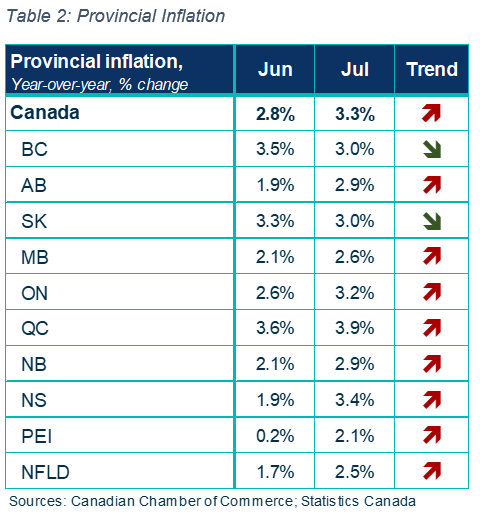

- On an annual basis, except for Saskatchewan and British Columbia, prices rose at a faster pace in July than in June. Price growth accelerated the most in Prince Edward Island, largely due to acceleration in prices for energy products.

- Another noteworthy highlight is that electricity prices rose significantly in Alberta (+127.8%!) in July.

SENTIMENT, OUTLOOK & IMPLICATIONS

BANK OF CANADA

- While there is glacial progress on the Bank of Canada’s core measures, and we’ve been surprised in the past, my sense is come September we might be still safe from another increase in policy rates. It will also have to factor in the strength of the Canadian economic backdrop – as we await June’s GDP data on September 1.

- We’ve seen signs that the economy is slowing, including the 3-month averages falling slightly. We also know that lagged effects of previous policy rate hikes will take time to continue working their way through the economy.

SUMMARY TABLES

CPI CHARTS