Blog /

May 2023 CPI: Base effects overstate progress on slowing inflation

Headline inflation is finally looking better in Canada, down a full percentage point in May to 3.4% year-over-year. However, this...

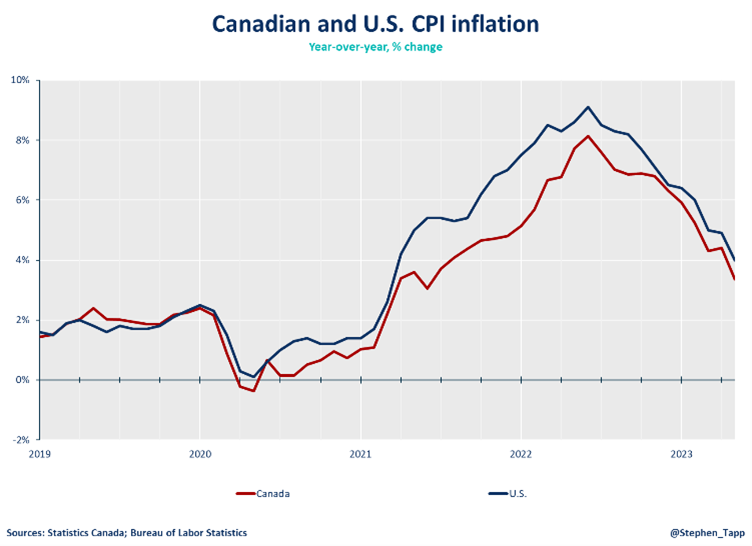

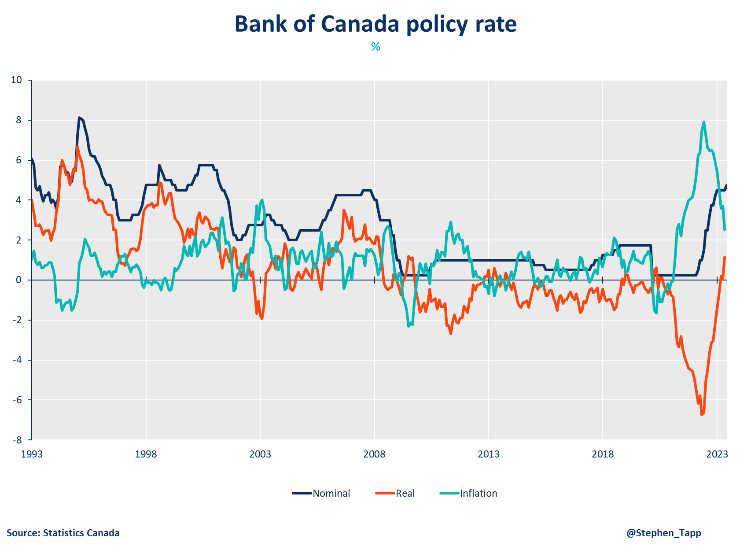

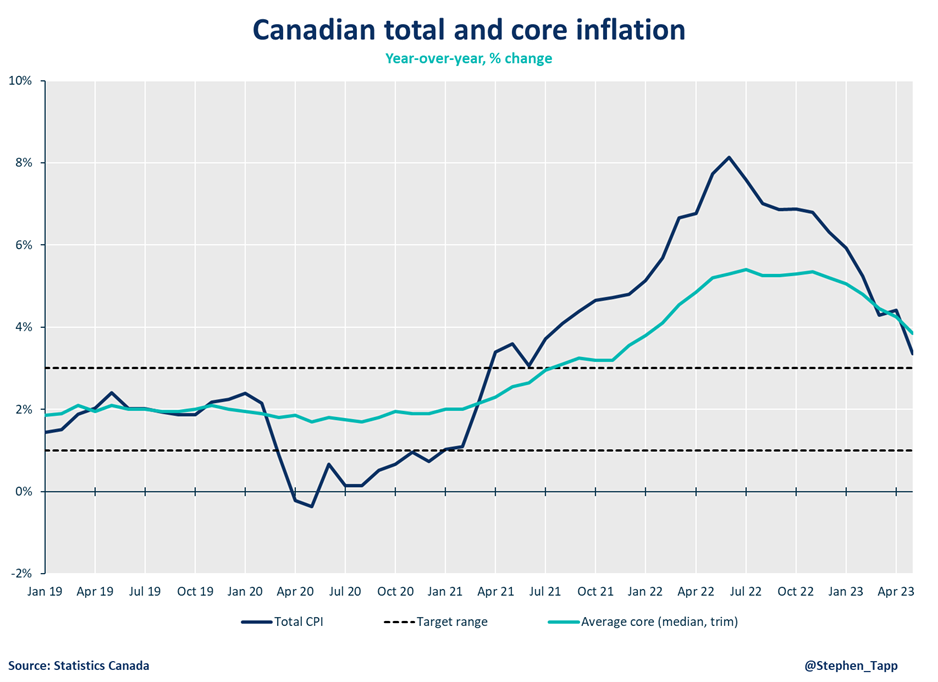

Headline inflation is finally looking better in Canada, down a full percentage point in May to 3.4% year-over-year. However, this progress is mostly a statistical mirage, because global commodity prices spiked last year when Russia invaded Ukraine. The Bank of Canada will not see enough in today’s release to feel confident that inflation will settle back down to 2% without more tightening. Therefore, I’m penciling in another 25 basis point hike in July, pending Friday’s GDP data and new BoC surveys.

Stephen Tapp, Chief Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headline

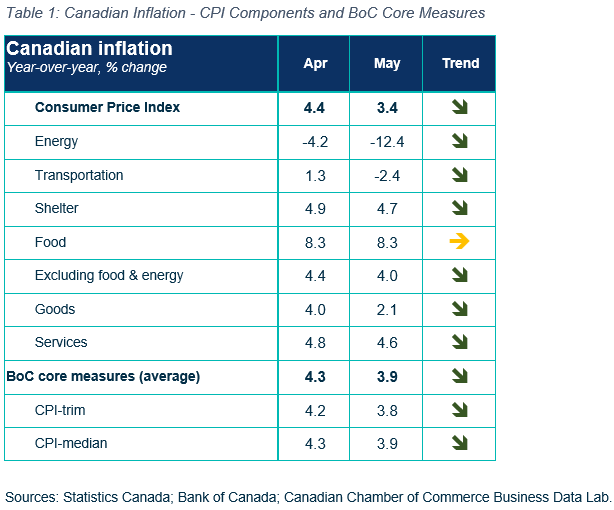

- As markets expected, Canada’s headline CPI inflation slowed by a full percentage point in May to 3.4% on a year-over-year basis. The deceleration largely reflects lower gas prices, as compared with elevated levels one year ago. While still above the Bank of Canada’s inflation control target range, this is the lowest inflation rate in nearly two years.

- On a month-over-month basis the CPI rose by 0.4%, pushed up by higher costs for mortgage interest and travel.

Key Drivers

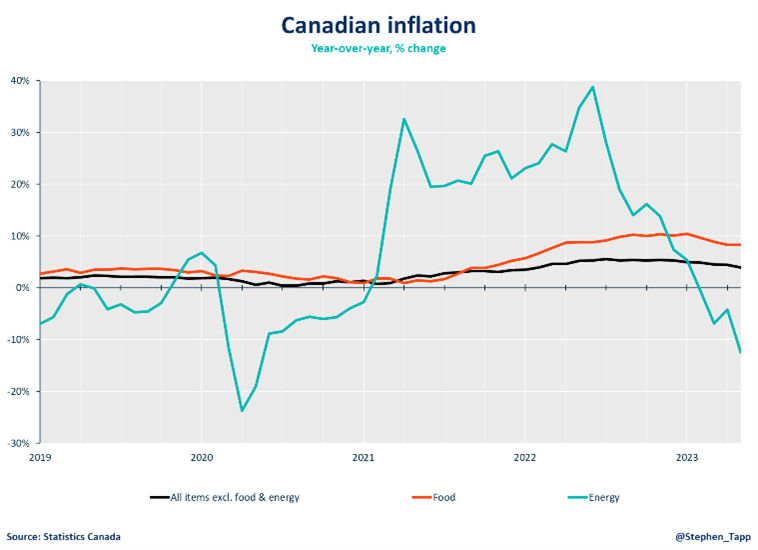

- Gas prices were a key driver of the slower headline inflation in May. They were 18% lower, compared with a year earlier when Russia’s invasion of Ukraine caused global price spikes for energy and other commodities.

- Food inflation remains high and problematic for consumers (at 8.3%, unchanged from last month). In this category, grocery prices are up 9%, and restaurant meals picked up further to 6.8%, amid labour shortage and higher costs.

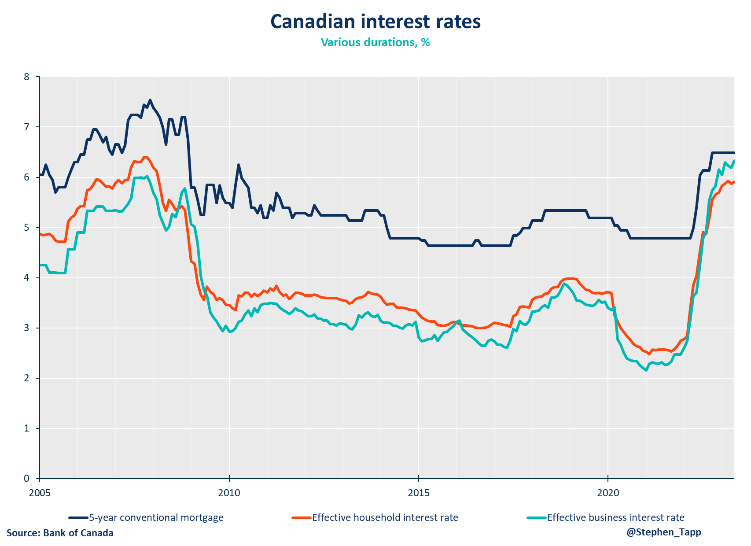

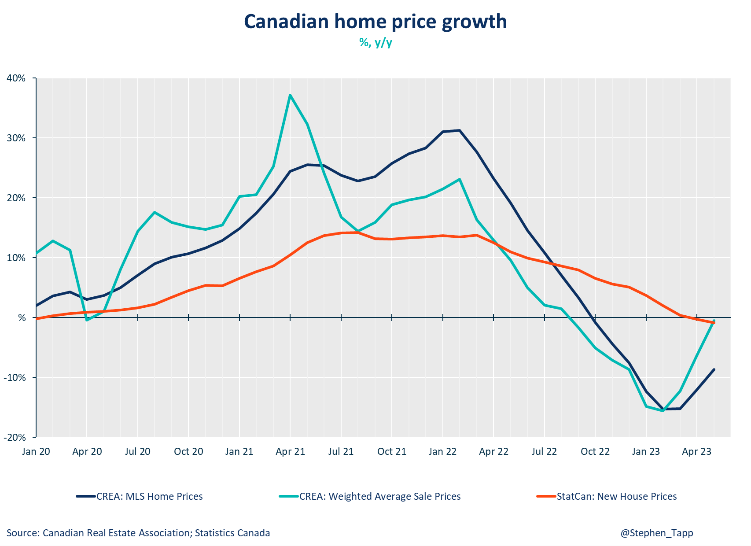

- Mortgage interest costs are up a record 30%, as the Bank of Canada raises rates to control inflation. That said, overall shelter costs decelerated slightly to 4.7%, even as home prices are once again on the rise as the housing market picks up steam.

- Services inflation slowed modestly to 4.6% (from 4.8% last month) but remains at worrying levels for the Bank of Canada. Goods inflation showed a bigger improvement slowing to 2.1% (from 4.0%), reflecting an easing of global supply chain problems since last year.

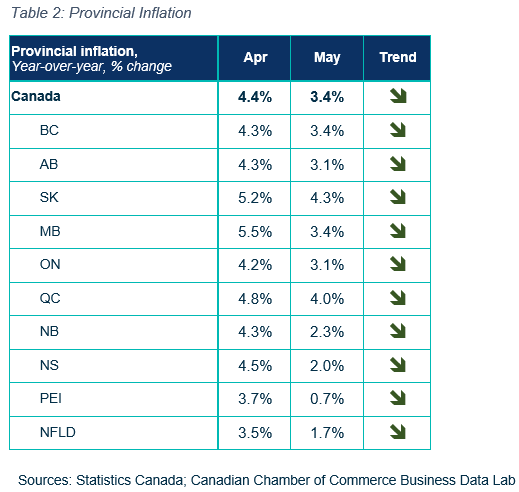

- Inflation slowed in all provinces, particularly in Atlantic provinces due to lower prices for heating fuels.

Bank of Canada Interest Rates

- The Bank of Canada’s two “core inflation” measures slowed to 3.9% year-over-year and continue to trend in the right direction.

- Unfortunately, and more consequentially, shorter-term (three-month annualized) core is holding steady around 3.5% or higher.

- This suggests the Bank of Canada will likely deliver another rate hike in July — although it’s too soon to place my bets, given that we will get an important Canadian GDP release and BoC surveys this Friday.

Taken together — and looking past the base-year effects that are overstating the actual progress on slowing down inflation pressures — the risks remain high that inflation will get stuck above the Bank’s target, without tighter monetary policy:

- Short-run core inflation is still too high;

- Wage pressures are sustained in a labour market with falling labour productivity that only started slowing in the last two months;

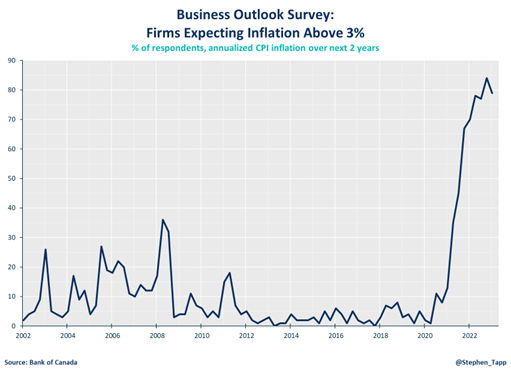

- There have only been modest improvements for services prices and inflation expectations;

- The housing market is bouncing back to life;

- All this while businesses face broad-based cost pressures, which are preventing pricing behaviour from normalizing

SUMMARY TABLES

INFLATION CHARTS