Blog /

November 2022: Labour Force Survey

Our Economist, Mahmoud Khairy, comments on Canada’s steady unemployment rate from today’s Labour Force Survey. He says, “Today’s labour force data demonstrated little change in Canada’s unemployment rate, which was 5.1% in November, down by only 0.1% from October.”

A steady hold for Canada’s unemployment as wage growth persists

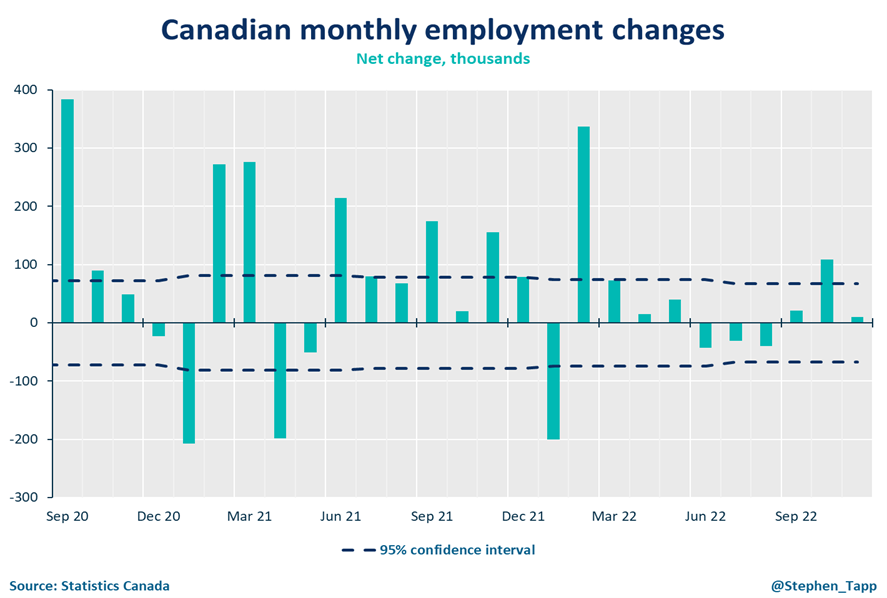

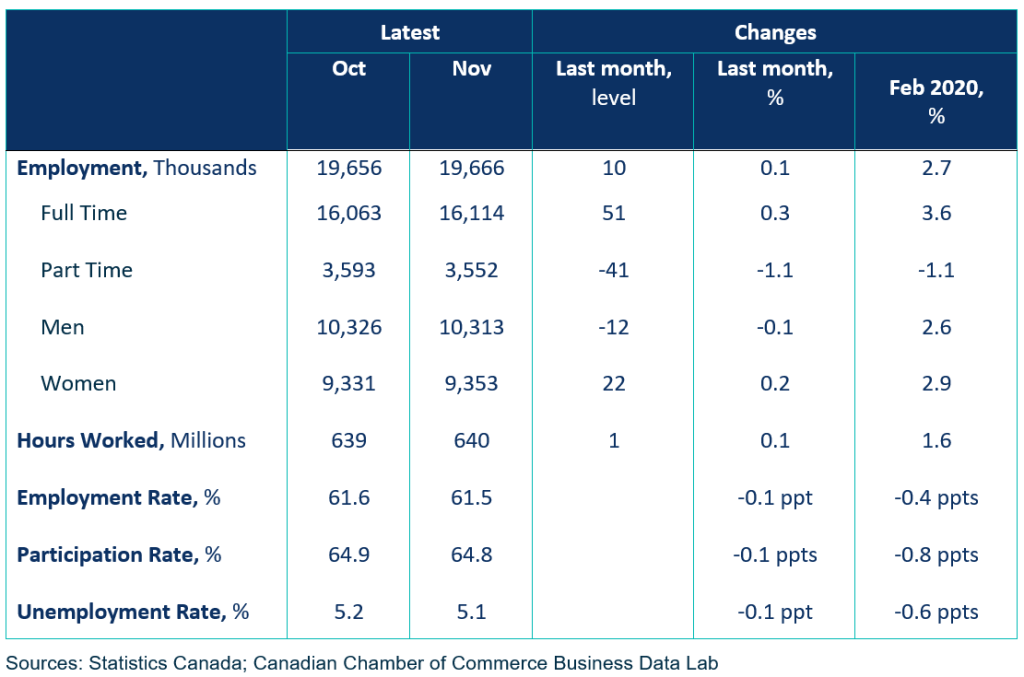

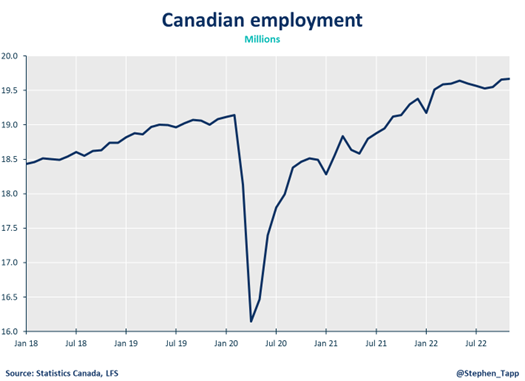

Today’s labour force data demonstrated little change in Canada’s unemployment rate, which was 5.1% in November, down by only 0.1% from October. After a very impressive headline gain in October, we had a very little increase of 10,000 net-new jobs in November.

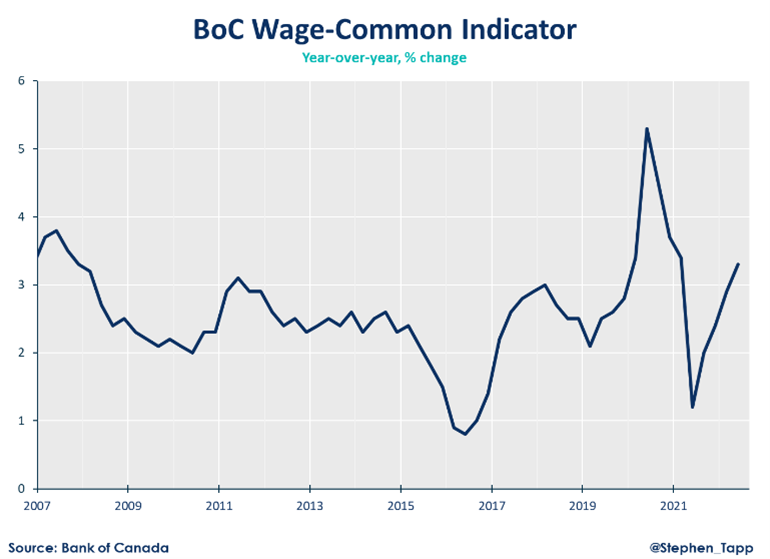

This gain was broad-based across sectors — by way of full-time core-aged female workers, in both private and public sectors. Hours worked settled and wage growth picked up to 5.6% y-o-y. It will mean keeping an eye out for further rate hikes ahead as the Bank of Canada continues to steadily slow inflation.

Mahmoud Khairy, Economist, Canadian Chamber of Commerce

Key Takeaways

- November’s monthly unemployment rate showed minimal change at 5.1%, which was a 0.1% decline from October’s figure.

- Canadian employment increased by only 10,000 jobs in November. This figure was in line with market expectations following a larger than expected gain in October of 108,000 jobs (+0.6%).

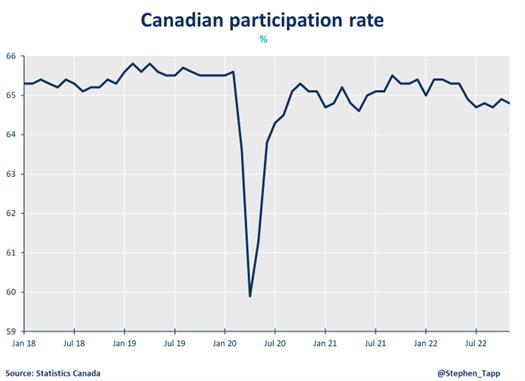

- Total hours worked were up by only 0.1%, after a 0.7% gain in October. Compared to the year prior, this is an increase of 1.8% year-over-year (y-o-y).

- Employment growth in the private and public sectors also stabilized, while having grown around 2% over the past 12 months.

- Full-time jobs rose (+51k) in November — up over 2.9% y-o-y, while part-time employment continues with its sixth consecutive month flat streak.

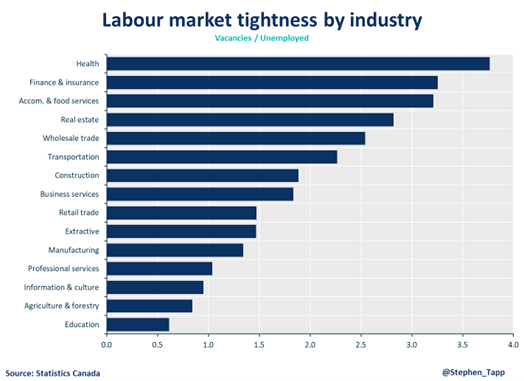

- Job gains occurred across most sectors including finance, insurance, real estate, rental and leasing (21k), manufacturing (19k), information, culture and recreation (16k). Jobs contracted in construction (-25k), wholesale and trade (-23k) and professional, scientific and technical services (-15K) sectors.

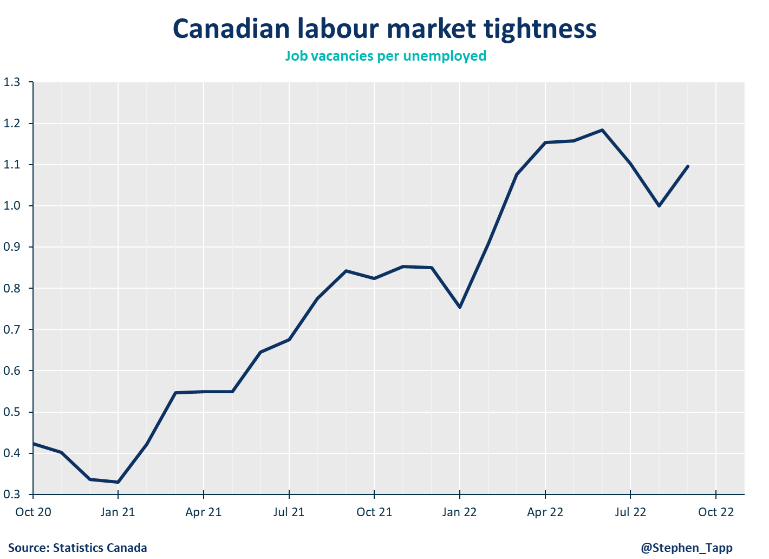

- As employers look to fill record-high job vacancies, wage growth is now showing signs of slowing down.This month marks the sixth straight month since June that y-o-y growth has exceeded 5%. This will surely raise flags for the Bank of Canada as it looks to reel inflation in with aggressive hikes.

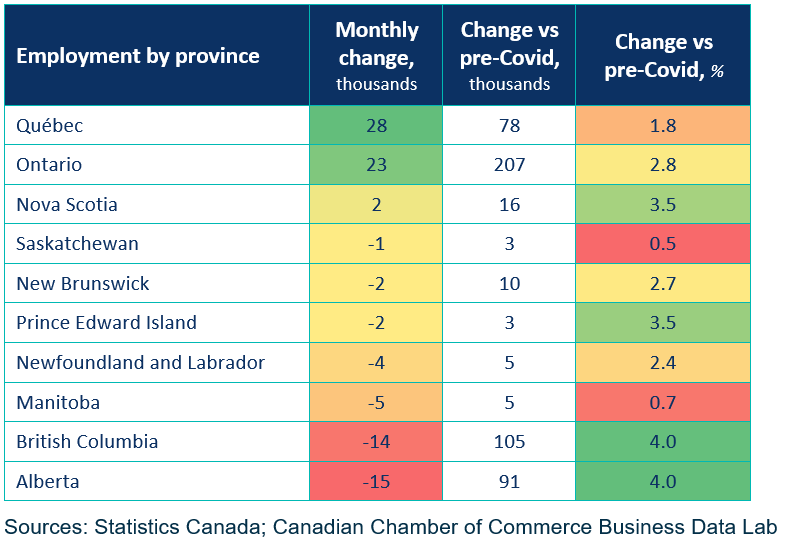

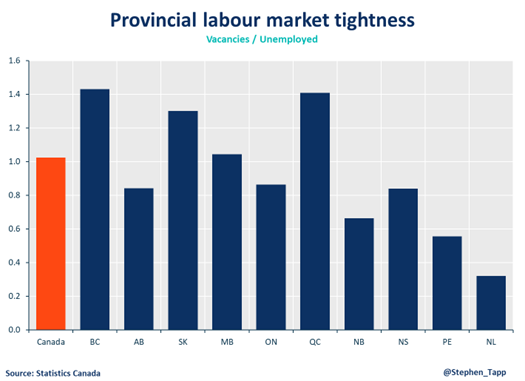

- The biggest provincial employment increase was in Quebec (+28K), while conversely, the largest contractions were in Alberta (-15K) and British Columbia (-14K).

Summary Tables

View More Labour Charts

For more great #cdnecon content, visit our Business Data Lab.