Blog /

Consumer Price Index (CPI) September 2024: Price stability is no longer a distant goal with inflation below the 2% target.

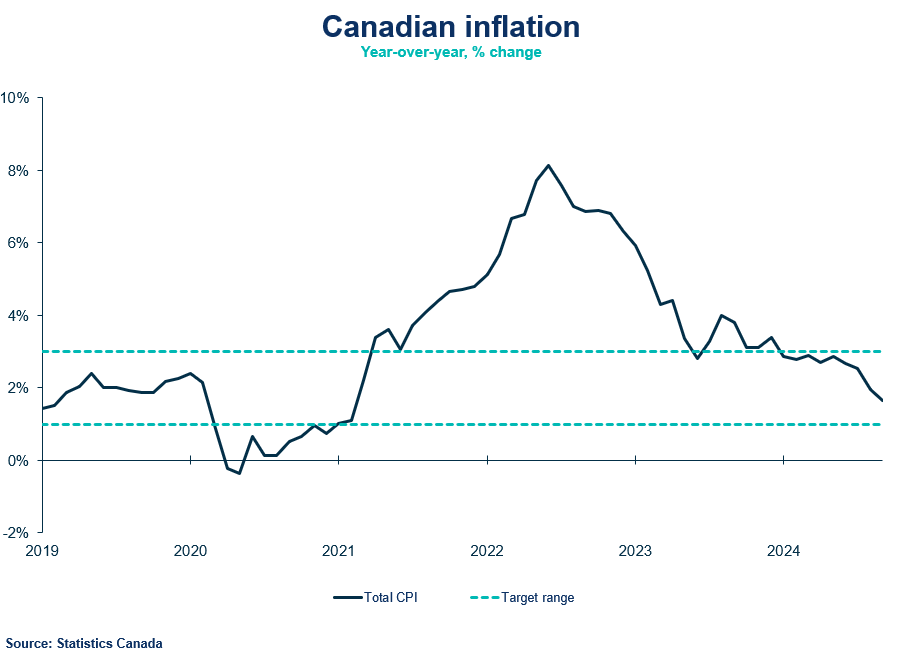

For the first time since early 2021, inflation has dropped below the Bank of Canada's 2% target, settling at 1.6% for September.

Price stability is no longer a distant goal, with inflation cooling faster than expected. We’ve hit another key milestone with inflation now below the 2% target. While falling gasoline prices continue to keep overall prices down, the broader economic slowdown is starting to make its mark on the inflation data. With inflation falling below the Bank of Canada’s forecast, it’s time for them to act boldly—a 50 basis point cut is warranted. This is the final signal they’ve been waiting for to shift their stance and recalibrate towards a lower policy rate.

- Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headline

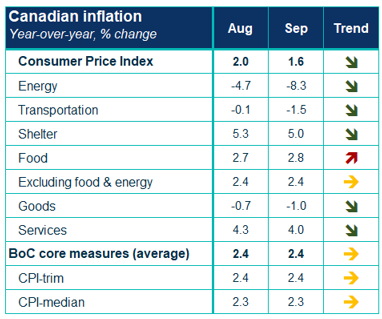

- Canada’s headline inflation decelerated to 1.6% in September, below consensus (1.8%) on a year-over-year basis. This is the slowest increase in prices since February 2021. Price levels remain elevated from 2021, but price stability is no longer a distant goal. Monthly seasonally adjusted prices were flat with gasoline prices bringing down overall inflation.

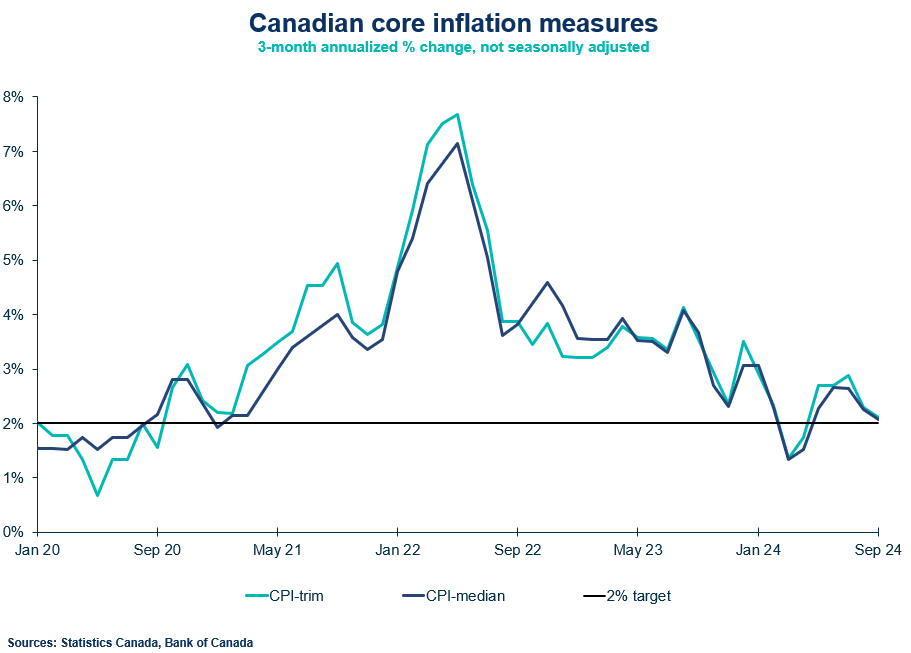

- The Bank of Canada’s core measures (Trim and Median) held steady at 2.4% year-over-year. Short-run core measures (3-month change annualized) increased 2.1%, slowing from 2.3% in August, adding another month of price momentum falling within the target range (1 to 3 percent).

CPI Components

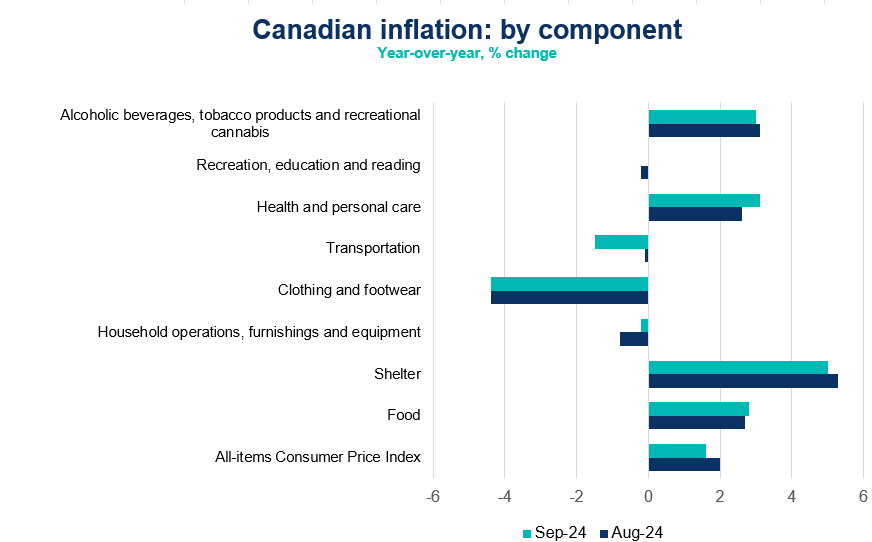

- Energy prices were the largest contributor to the decline in September CPI. Gasoline prices declined -10.7% on a year-over-year basis, a deeper contraction from last month’s 5.1% decline in prices.

- Shelter prices decelerated to 5% (previously 5.3%) from lower rent and mortgage interest costs. Rent prices grew 8.2%, down from a recent peak of 8.9%. This is still strong price growth but helped overall shelter prices decelerate. Mortgage interest costs also showed some reprieve, slowing to 16.7%, the slowest annual growth since December 2022.

- Goods inflation declined 1% in September, driven down by durable, semi-durable, and non-durable goods. Clothing and footwear prices were down for the ninth consecutive month, declining 4.4% in September. Back-to-school shopping also led to prices slowing monthly. Services inflation slowed to 4% in September, down from 4.3%, marking the slowest pace of services price growth since September 2023.

- Food price inflation edged up again in September, growing 2.8%. Grocery store prices continue to put pressure on prices, rising 2.4%. Meat, vegetables, and dairy products were the largest contributors to food inflation in September. Restaurant prices remained steady at 3.5%, with table service establishments the largest contributor. Fast-food restaurants were the fastest growing category (4.3%).

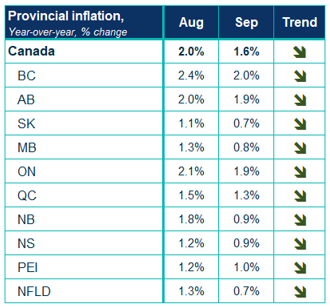

Provincial and regional inflation

Inflation slowed in all provinces in September on an annual basis with New Brunswick and Newfoundland and Labrador slowing the most.

SENTIMENT, OUTLOOK AND IMPLICATIONS

- September CPI undershooting the target continues the good news on the inflation battle, beating the inflation forecast in the Bank of Canada’s July Monetary Policy Report, which expected 2.2% year-over-year growth. They also anticipated negative contributions from energy prices. The past two inflation readings show a trend that inflation is slowing alongside a weak Canadian economy. GDP is tracking just over 1% growth in Q3. Updated forecasts from the Bank of Canada will be released at their next meeting. Core measures are holding steady, despite some easing in mortgage interest costs and rent.

- Markets are expecting rate cuts at each of the remaining meetings this year with odds of a 50bps cut increasing to 77% following this release. Governing Council is likely to alter their predetermined pace for a faster move to the neutral rate, at their October decision. Our view is that a larger cut is now in play with September’s downside surprise to inflation and a weaker third-quarter GDP. The Canadian economy has shown recent weakness, and incoming data is calling for swifter action, sooner than they expected. A proactive recalibration in policy is needed.

SUMMARY TABLES

CHARTS