Blog /

Pulse Check: Persistent inflation remains biggest pain point for businesses in Q4 2022

Welcome to our Pulse Check blog series! A quarterly look at the top challenges and opportunities facing Canadian businesses from...

Welcome to our Pulse Check blog series! A quarterly look at the top challenges and opportunities facing Canadian businesses from coast to coast to coast based on our Business Data Lab’s (BDL) analysis of the quarterly Canadian Survey on Business Conditions (CSBC).

As we’ve seen in previous CSBC releases, rising costs associated with doing business remains the top near-term obstacle for more than half of Canadian businesses. Looking ahead, business expectations remain in check with the potentially recessionary conditions that await them in the new year. We have yet to see how businesses will continue to adapt, re-tool and strategize to get to the other side.

Read the top findings we learned about Canadian businesses from Statistics Canada’s Q4 CSBC below:

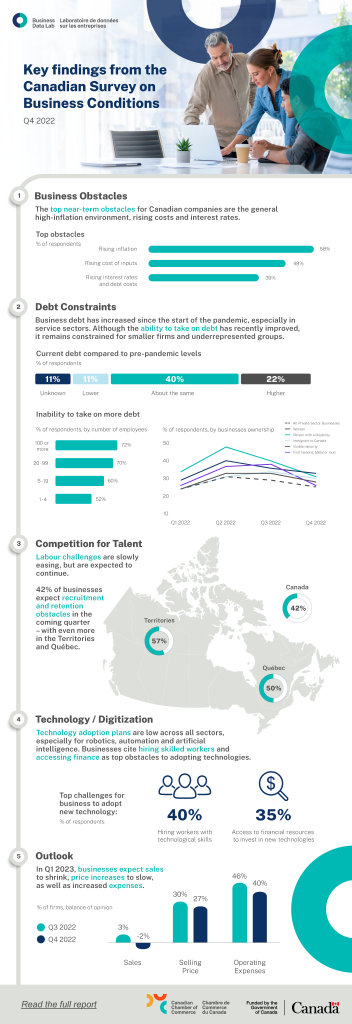

- Business obstacles: Top near-term obstacle for Canadian companies in 2023 are the rising costs of doing business. Persistent inflation is the biggest pain point, cited by well over half of all businesses (58%), followed by rising input costs (48%) and debt costs (39%).

- Inflationary pressures: With persistent inflation, about one-third of businesses plan to increase their selling prices in the next quarter to combat cost pressures — expected to be more prevalent in Northern, Central and Western Canada.

- Debt constraints: Businesses’ ability to take on debt has improved, although remains constrained, especially for smaller firms and underrepresented groups. Although 57% of businesses are able to take on more debt, 75% do not plan on taking out a loan mainly due to rising interest rates and uncertainty in the economy.

- Labour challenges: Recruiting and retaining employees remain major issues for businesses, despite improvements over the past year.

- Supply chain issues: Supply chain issues are improving, as difficulty acquiring inputs and maintaining inventory levels have steadily decreased as obstacles over the past year as more businesses report implementing management strategies.

- Tech/digital adoption: Planned adoption of emerging technologies, including automation (6%), Artificial Intelligence (6%) and robotics (1%), remains low across all businesses. The need to hire workers with technological skills (40%), have access to financial resources (35%) and ability to retain employees (26%) are cited as key obstacles to adoption.

- Growth outlook: Business optimism across industries has tempered over the course of this year. Firms in arts, entertainment and recreation, healthcare and wholesale trade are the most optimistic.

The Q4 CSBC 2022 was collected from October to November, 2022 and is based on responses from 17,363 Canadian businesses across the country.

Check out our full analysis here.

What exactly is the Canadian Survey on Business Conditions?

Early in the pandemic, Statistics Canada created the CSBC in partnership with the Canadian Chamber, to quickly develop an innovative survey to learn about the issues facing Canadian businesses across the country, providing critical insights for decision makers and businesses. This successful collaboration has continued through our BDL.

Business Data Lab (BDL)

Our Business Data Lab (BDL) provides future-focused, real-time data and insights for companies of all sizes, sectors and regions of the country. The BDL brings together data from a variety of sources to track evolving market conditions, providing Canadian businesses with critical information to help them make better decisions and improve their performance.